Day trading has become one of the most popular trading styles among those who prefer a fast pace and the potential for same-day profits. Instead of holding positions overnight, day traders focus on intraday price movements, the small, frequent fluctuations that occur throughout the trading session. By understanding how the market moves minute by minute…

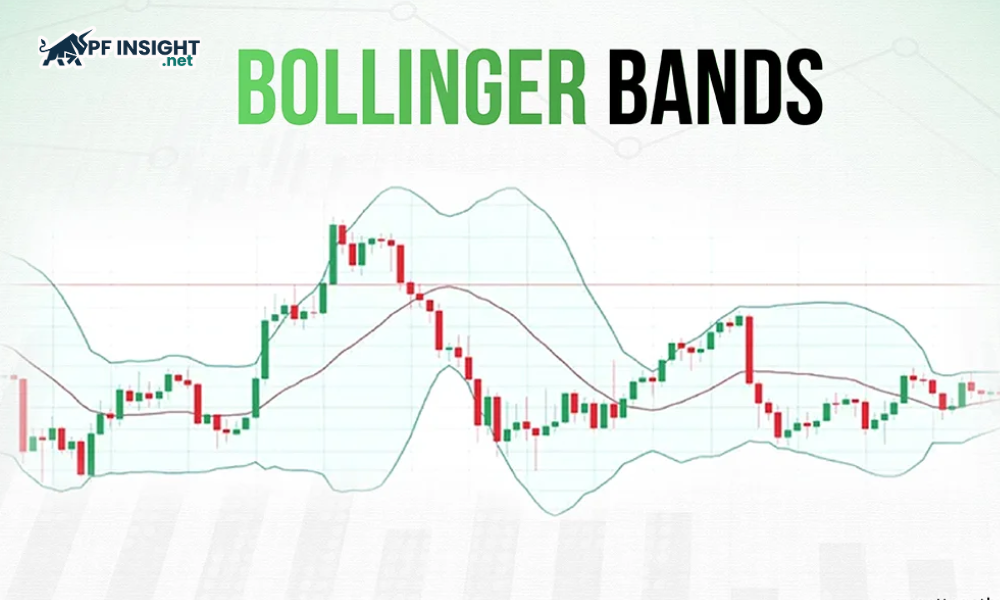

Bollinger Bands is a famous technical indicator that helps traders visually identify trends and market volatility. This tool, developed by John Bollinger, helps assess risks and find potential trading opportunities. So how do Bollinger Bands work and how can they be applied effectively? Let’s pfinsight.net explore the details in this article. Automated trading system benefits…

FundedNext has officially introduced cTrader to the U.S. market, giving traders access to a more modern, faster, and more transparent trading platform. This update is considered a strategic move aimed at enhancing the user experience and strengthening the firm’s competitive position in the United States. FundedNext rolls out cTrader access for U.S. traders FundedNext has…

As markets move faster and price data becomes increasingly complex for traders to process manually, an automated trading system helps execute trades with greater accuracy, discipline and consistency. By automating the decision-making process, traders can minimize emotional influence and maintain strict adherence to their strategy across all market conditions. From basic algorithmic rules to more…

The year 2026 marks a booming rise in proprietary trading firms, making it more crucial than ever to choose the right one. Based on key criteria such as business models, trading platforms, and profit-sharing ratios, this article highlights the 10 best Prop Firms 2026 that are currently the most reputable. Regardless of your experience level,…

About 10 months after reaching an acquisition agreement with private equity firm CVC, Czech proprietary brokerage FTMO completed its acquisition of OANDA yesterday, Monday. To make the transaction official, the proprietary brokerage giant had to go through a rigorous regulatory process and receive the necessary approvals from five different regulatory bodies. A bold move or…

In trading, most traders do not lose because their analysis is wrong but because they take on too much risk for too little potential reward. Asymmetric trading introduces a completely different mindset. It is an approach where the potential reward is always significantly greater than the amount of risk you take, allowing you to protect…

The rapid expansion of the prop trading market has made traders increasingly interested in prop firm regulations – an important factor in assessing the transparency of a funding fund. These regulations play a role in protecting traders, helping them understand how prop firms are monitored, the risks involved, and the criteria for assessing reputation. Equipping…

Arbitrage forex is widely regarded as one of the most attractive strategies in currency trading because it is based on exploiting price differences across markets to generate almost risk-free profit. Although the concept sounds simple, executing arbitrage in the forex market requires speed, sophisticated technology, and a deep understanding of how the foreign exchange market…

Anti Martingale strategy is a trading method applied by many traders to increase profits when the market is favorable. The operating principle is quite simple: increase the volume after winning and reduce it immediately after losing to limit risks. This article will analyze the benefits, limitations and how to effectively apply the Anti-Martingale strategy in…