Funding for trading is becoming a prominent trend among traders today, providing opportunities for skilled but capital-poor people to participate in the financial market. Through prop firms or investors, traders can receive capital to trade, share profits and develop their professional careers. This is a smart solution to optimize profit potential without having to invest…

PipFarm’s recent withdrawal from Prop Firm Match has raised questions about potential conflicts between some proprietary trading companies and the rating platform. According to Prop Firm Match, PipFarm’s removal was the result of a “rigorous review process.” Meanwhile, PipFarm CEO James Glyde said the rating platform had made “unreasonable” demands that were unacceptable. Addressing compliance…

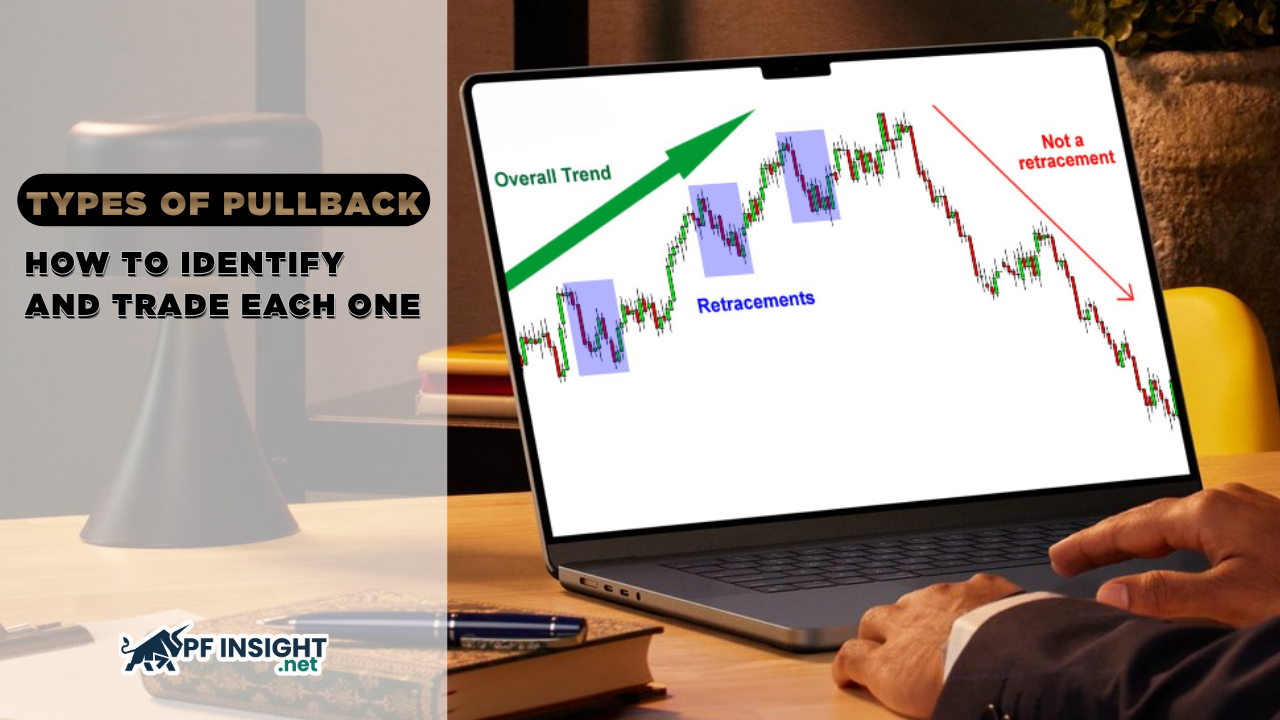

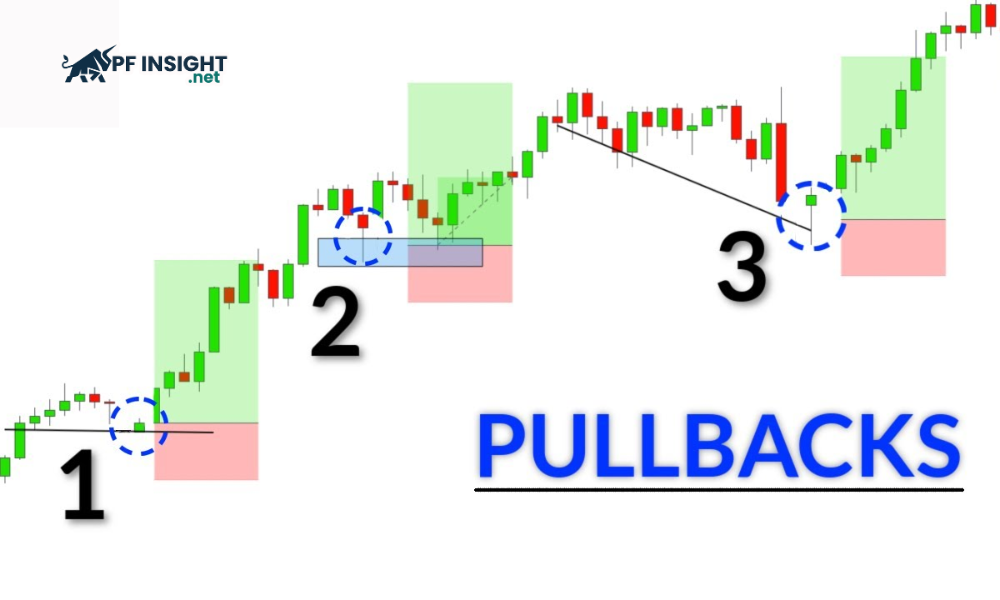

In trend trading, understanding and identifying pullbacks is a key factor that helps traders determine optimal entry points while minimizing risk. A pullback allows traders to join an existing trend during temporary price retracements, rather than chasing breakouts or trying to catch tops and bottoms. Knowing the types of pullback helps traders distinguish between a…

Momentum indicators are technical tools that help traders assess the strength and speed of price changes, thereby determining the momentum of the current trend. Understanding and applying these indicators correctly helps traders grasp favorable entry points and avoid noise signals. This article will analyze what momentum indicators are, how to use them and trading strategies….

For traders using MetaTrader 5, technical indicators are an important “weapon” to support analysis and trend identification. However, not everyone knows how to install indicators on MT5 properly. The following article by PF Insight will guide you step by step to install, activate and use indicators to maximize the power of the MT5 platform. What…

Prop firm risk is one of the most overlooked yet crucial aspects of modern trading. Prop firm trading, which enables traders to grow up by using company-funded money rather than their own, has become a significant trend in today’s financial markets. This strategy eases financial strain and provides access to more opportunities, but it also…

Execution speed and spread costs are two of the most critical factors in Forex trading; they can directly determine a trader’s profitability. That’s why more and more professional traders are turning to ECN brokers, platforms that connect directly to the interbank market, offering low spreads, ultra-fast execution, and maximum transparency. Unlike market maker brokers, an…

In the financial market, prices never move in a straight line but always fluctuate continuously. This fluctuation creates both opportunities and challenges for traders when finding appropriate entry and exit points. In particular, pullback is a common phenomenon, representing a temporary adjustment in the main trend. So what is a pullback? Let’s pfinsight.net find out…

In an era where trading systems dominate the markets, many believe that sitting in front of a screen and making manual decisions has become obsolete. However, in practice, manual trading – a strategy in which traders personally assess, carry out, and control risk remains essential, particularly for those who wish to fully comprehend the fundamentals…

In the volatile Forex market, smart account management is the foundation for traders to maintain efficiency and limit risks. MT4 account management not only provides comprehensive monitoring of trading activities but also supports profit optimization and tight capital management. The following article will help you understand the concept, forms of account management and how to…