The market does not move randomly, as many traders believe, but is driven by massive capital flows from large financial institutions. When you understand institutional order flow, you no longer just see price going up or down but begin to read the intention behind each movement. This is how smart money builds liquidity, creates trends,…

Stop hunting trading is a concept frequently mentioned when traders feel the market “sweeps their stop loss” and then quickly reverses. In reality, this is not random behavior but reflects how large amounts of money seek liquidity at key price levels. Understanding stop hunting trading helps traders avoid impulsive entry and better utilize liquidity sweeps…

The liquidity pool concept is a fundamental pillar in DeFi, enabling DEXs to swap tokens continuously without relying on a traditional order book. In trading, many traders also observe that price often gets “pulled” toward liquidity levels, where large clusters of pending orders and stop-losses are concentrated. Although these belong to different contexts, both revolve…

Liquidity sweep trading is not a mechanical entry strategy, but a way to read market intent through liquidity. When price quickly breaks above a recent high or below a recent low and then sharply reverses, it often signals a liquidity sweep. Understanding this behavior helps traders avoid FOMO, improve entry timing, and trade in alignment…

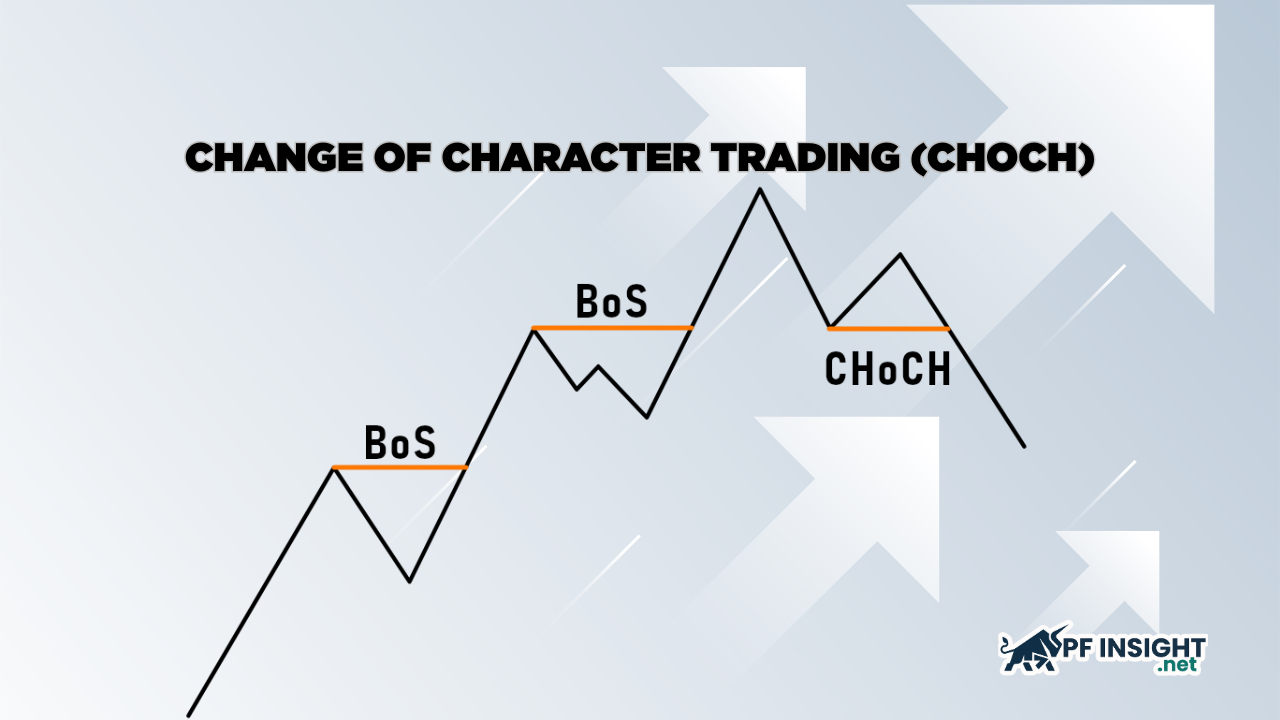

Change of character trading (CHOCH) is one of the most important concepts in market structure, helping traders recognize when the market starts to “change character” and may be preparing for a reversal. However, many traders still confuse CHOCH with Break of Structure (BOS) because both involve price breaking key structural levels. In this article, Pfinsight.net…

Many traders incur losses by trying to catch tops and bottoms while ignoring signs that the market structure has already changed. Break of structure trading addresses this issue by waiting for clear confirmation from price action before entering a trade. When the structure is broken, it often signals that either buyers or sellers have taken…

FundingTicks has announced it will begin winding down operations, describing the move as part of a “strategic plan” to refocus resources on areas that deliver long-term value to clients and partners. The decision follows backlash over new trading restrictions and profit-related changes introduced in late 2025. Importantly, the firm has published a detailed plan explaining…

When observing the market, what confuses traders most is not whether price is going up or down, but whether that trend is truly reliable or just temporary noise. Many traders enter based on gut feeling or a few strong candles, only to get “reversed” shortly after because they are trading against real directional pressure. This…

The ADX indicator (Average Directional Index) is an important tool that helps traders measure the strength of a trend rather than simply identifying price direction. In a constantly fluctuating market, understanding whether a trend is strong or weak allows traders to avoid emotional entries. The ADX indicator is especially useful for filtering market noise, reducing…

CME Group has fined Tanius Technology $150,000 for placing excessively large Treasury bond futures orders that far exceeded its immediate liquidity capacity. This behavior was deemed a violation of the exchange’s capital safety and risk management regulations. CME imposes a $150,000 fine on Tanius technology During the period of 2020-2022, Tanius Technology was found to…