Funding Pips has recently emerged as a phenomenon in the trading community, particularly within the Prop Firm sector. With standout marketing promises such as high and attractive profit-sharing ratios and low fees, Funding Pips has successfully drawn the attention of many traders. However, some traders claim that it is a scam used to misappropriate clients’ funds. So, what’s the truth? Is Funding Pips a scam or a legitimate firm? Should traders consider investing with Funding Pips? Let’s explore the facts in this Funding Pips Review by Pfinsight.net!

What is Funding Pips?

Established on August 25, 2022, Funding Pips is a proprietary trading firm legally registered as ANKH PROP-FZCO. It is managed and operated by Khaled Ayesh, with its headquarters located in Dubai, United Arab Emirates. As a leading liquidity provider, Funding Pips offers traders a choice between four funding programs: two two-step evaluation models, one one-step evaluation model, and an instant funding program.

Its headquarters are based in the IFZA Business Zone, Building No. 19448-001, Dubai, UAE.

Funding Pips Review – Funding Programs

Funding Pips provides traders with four distinct funding program options:

- Two-step Pro Evaluation

- Two-step Evaluation

- One-step Evaluation

- Zero Program

Two-step Pro Evaluation

Traders can access up to $100,000 in funding through Funding Pips’ Two-step Pro Evaluation program. The objective is to identify skilled traders capable of managing risk efficiently and generating profits over two evaluation stages. This program allows traders to use leverage of up to 1:100.

- In Phase One, traders must achieve a 6% profit target without exceeding a 3% maximum daily loss or a 6% overall loss. There is no time limit for this phase.

- In Phase Two, the requirements remain the same: a 6% profit target with 3% daily and 6% overall loss limits, again with no time restrictions.

After successfully completing both evaluation phases, traders receive a funded account with a minimum withdrawal requirement of 1% of the initial balance. The only rules to follow are the 3% daily loss and 6% overall loss limits. The first payout becomes available seven days after placing the first position on the funded account. Profit split is 80%.

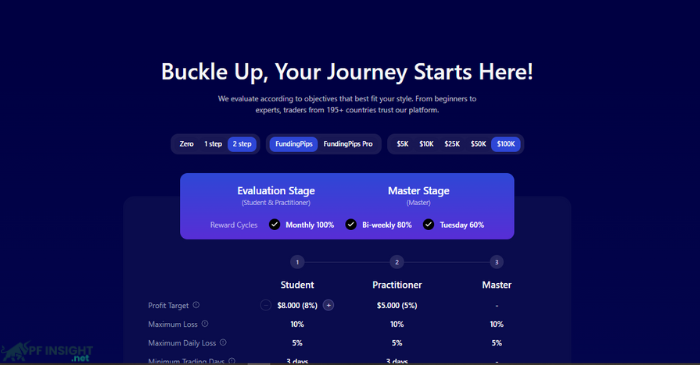

Two-step Evaluation

For traders looking to access funded accounts ranging from $5,000 to $100,000 with leverage up to 1:100, Funding Pips offers the Two-step Evaluation program. This program aims to identify competent and reliable traders capable of managing risk.

In Phase One, traders must achieve an 8% profit target without exceeding a 5% daily loss or a 10% overall loss. This phase can be completed at any pace but requires at least three trading days.

The same trading day requirement and loss limits apply in Phase Two, but the profit target is reduced to 5%.

Once both phases are passed, traders are awarded a funded account. At this stage, only the 5% daily and 10% overall loss limits must be observed. The first payout can be requested after generating a profit on the first Tuesday, with weekly payouts available thereafter.

The profit split depends on payout frequency:

- 60% for weekly payouts

- 80% for bi-weekly payouts

- 100% for monthly payouts

This flexible strategy ensures consistent results and a carefully structured withdrawal plan.

One-step Evaluation

For those seeking a quicker route to funding, Funding Pips offers the One-step Evaluation. Maximum leverage is 1:50, with account sizes from $5,000 to $100,000. The goal is to identify disciplined traders who can manage risk effectively within a single evaluation phase.

Traders must achieve a 10% profit target without exceeding a 4% daily or 6% total loss to pass the challenge. There is no time limit, but at least three trading days are required to qualify for a funded account.

After successful completion, traders receive a funded account with the same 4% daily and 6% total drawdown limits. Once a profit is made by the first Tuesday, the first payout can be requested; following payouts are available every Tuesday.

The profit split ranges from 80% to 100% depending on performance and payout frequency. This program offers a streamlined funding process with performance-based rewards.

Zero Program

The Zero Program is designed for traders who wish to skip the evaluation and start trading immediately on a funded account. It provides leverage up to 1:50 and account sizes ranging from $5,000 to $100,000.

The first 3% of profit generated acts as protection and cannot be withdrawn, even though traders receive a funded account immediately after purchasing the Zero Program. After that, traders may withdraw a minimum of 1% of the starting balance. Strict risk rules apply: 3% maximum daily loss and 5% overall trailing loss.

After 14 days, if traders have achieved at least 7 profitable trading days and maintain the required Consistency Score, they can request their first payout. Future withdrawals can be made on a bi-weekly basis if all conditions are met. The program offers a high profit split of 95%, allowing traders to retain nearly all of their earned profits.

Funding Pips Review – Trading Platforms

Match-Trader

Match-Trader combines powerful trading features with user-friendly design. It is ideal for both beginners and experienced traders. The platform offers access to various markets and smooth trade execution, along with superior performance and a wide range of analytical tools.

Its interface blends real-time data and charting functionality with intuitive use. Traders who prioritize speed, functionality, and accuracy will appreciate this platform.

cTrader

Known for its strong infrastructure and competitive edge in forex and CFD trading, cTrader is another platform offered by Funding Pips. It features advanced tools and a fully customizable interface, making it ideal for traders who rely on technical analysis and multiple timeframes.

With its cAlgo functionality, cTrader supports algorithmic trading, making it an excellent option for traders using automated strategies.

TradeLocker

TradeLocker is praised for its simplicity and accessibility. It is designed to help traders easily access the financial markets. This platform is perfect for those new to proprietary trading or those preferring a more basic platform with essential tools.

Despite its simplicity, TradeLocker does not compromise on performance. It offers real-time data and quick execution, helping traders take advantage of market opportunities.

Limitations When Trading with Funding Pips

Strict Discipline Requirements

Funding Pips enforces strict drawdown limits (e.g., 4% daily and 6-10% overall), which could lead to disqualification if traders fail to follow tight risk management—even though there’s no time limit on evaluations.

Relatively Low Leverage

The 1:50 maximum leverage for One-step and Zero Programs might be limiting for traders used to higher leverage offered by other Prop Firms, making it harder to fully implement their strategies.

Upfront Program Fees

Although Funding Pips is more affordable than some competitors, traders must still pay fees for each program, including the Zero Program—which does not require evaluation but still charges for account access.

Strict Initial Withdrawal Conditions (Zero Program)

To withdraw from the Zero Program, traders must have at least seven profitable days within the first 14 calendar days and meet a required Consistency Score—an especially challenging requirement for beginners.

Limited Long-Term Reputation

As a relatively young prop firm, Funding Pips lacks the long-term operational history necessary to evaluate its stability and trustworthiness compared to more established competitors.

Conclusion

The above details provide a comprehensive overview of the Funding Pips project. In general, all Prop Firm models offer appealing conditions, but they also carry risks that traders must carefully consider. We hope this Funding Pips Review has given you a broad perspective. Wishing all traders success in their trading journey!