Among popular trading styles, the counter trend trading strategy is considered one of the most challenging yet alluring. Entering trades against the main trend can yield high profits if the reversal point is correctly predicted. However, this strategy also carries significant risks due to going against the primary price momentum. In this article, PF Insight will analyze the complexities of counter-trend trading and share tips to help you apply this strategy more effectively.

- Trend continuation strategy explained: how it works in strong trends

- Range trading strategy with clear entry and exit rules

- How to define a dealing range in trading markets with real examples

What is a counter trend trading strategy?

Counter trend trading strategy is a trading approach in which traders deliberately place orders against the prevailing market trend. This strategy is based on the assumption that after a strong upward or downward move, prices will eventually enter a correction phase or reverse direction. By entering trades early, before the trend clearly changes, traders can take advantage of larger profit margins from short-term market reversals.

While potentially profitable, counter-trend trading isn’t suitable for everyone. This method demonstrates a distinctly critical thinking approach, as traders actively go against the general market behavior. Instead of following the emerging trend, traders seek opportunities when the market is overvalued and herd mentality is strongly dominant.

Top counter trend trading strategies today

Counter trend trading strategy focuses on identifying trading opportunities that go against the current market trend. There are various methods that help traders recognize signals of an upcoming market reversal. By relying on technical analysis tools and price action, these strategies assist traders in determining optimal entry points for their trades.

Here are six common strategies:

Reversal patterns

In technical analysis, reversal patterns are used to identify the end of a trend and the potential formation of a new trend in the opposite direction. Structures such as the head and shoulders pattern, double tops, or double bottoms often appear at key price levels. When these patterns form, they indicate that the market is preparing for a reversal phase.

When the market forms a double top pattern in the context of a prolonged uptrend, the likelihood of a bearish reversal becomes more apparent. This is the point at which many traders choose to enter short positions to capitalize on the change in price direction.

By analyzing and forecasting key reversal points, traders can prepare strategies in advance to effectively take advantage of newly emerging counter-trend movements.

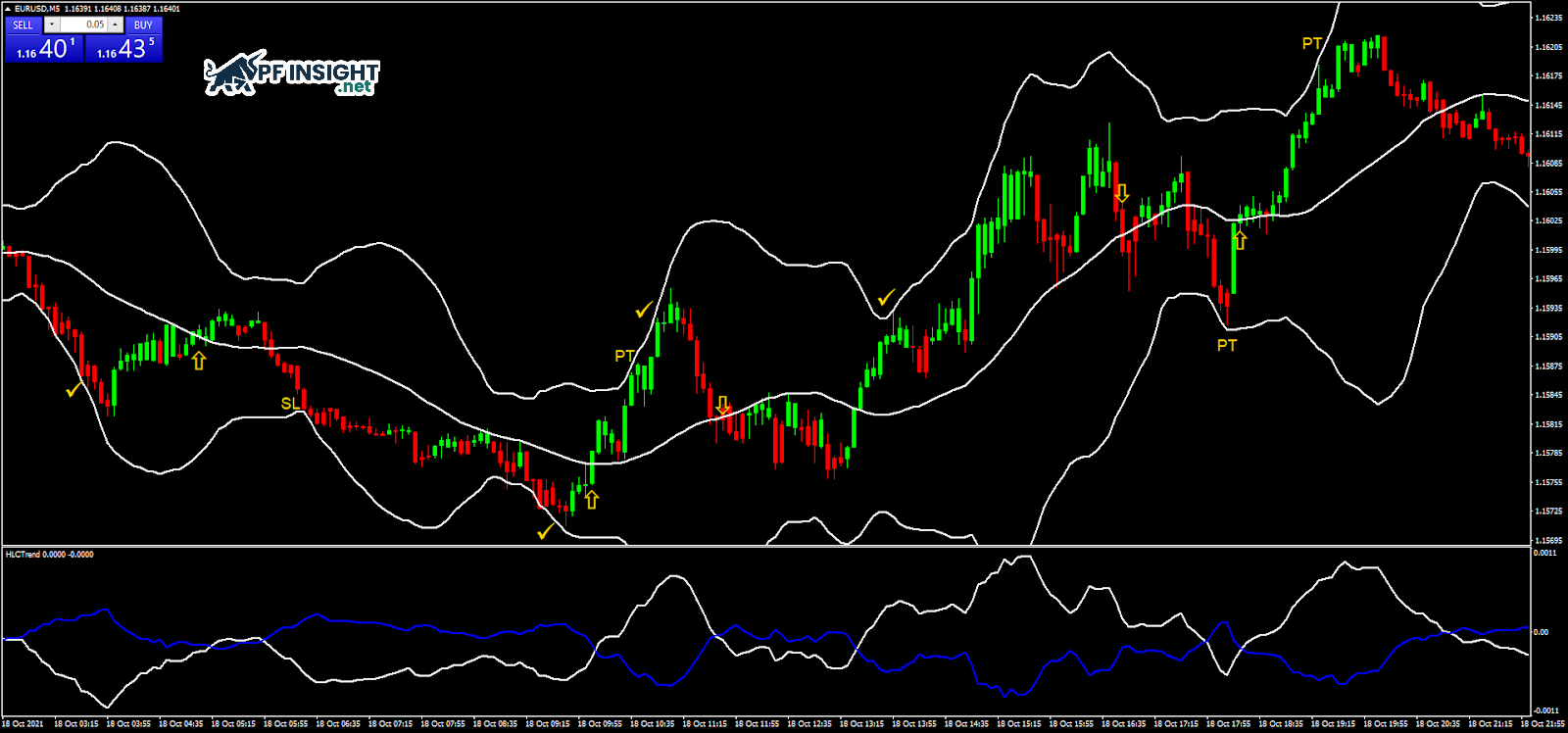

Using Bollinger Bands to trade price corrections

Bollinger Bands are considered an important tool in technical analysis and are frequently incorporated into the trading systems of many professional traders. Although primarily used for trend-following strategies, this indicator can also be applied effectively in counter-trend trading strategies, especially when exploiting short-term price corrections in the market.

By observing the illustrative image, it can be seen that Bollinger Bands are a familiar tool for counter-trend traders in identifying price pullbacks. When price breaks above the upper band or below the lower band, it is often interpreted as a warning signal that price has moved too far from its equilibrium level and may soon reverse or correct.

The middle moving average of the Bollinger Bands is commonly used to identify the prevailing trend and the strength of price volatility. Meanwhile, the upper and lower bands can be viewed as dynamic support and resistance levels, helping traders determine more precise entry and exit points.

When the market is in an uptrend, counter-trend traders often look for selling opportunities as price approaches the upper Bollinger Band. This strategy is typically applied to short- to medium-term trades and requires strict risk management. Rather than expecting a strong reversal, traders usually take profit at the middle band of the Bollinger Bands and continuously adjust their stop-loss levels according to price movement.

Stochastic RSI & MACD strategy for trading reversals

In counter trend trading, reversal prediction is often carried out using technical oscillators. These indicators provide signals related to momentum and overbought or oversold market conditions. To reduce false signals, traders commonly apply multiple oscillators simultaneously, allowing them to confirm potential trend reversals and select more accurate entry points.

By observing the chart above, it can be seen that the combination of Stochastic RSI and MACD helps traders identify early signs of a possible trend reversal. When the Stochastic RSI is in the overbought zone, it indicates that buying pressure is weakening. At this point, counter-trend traders often look for opportunities to sell the asset in anticipation of a price correction.

To increase signal reliability, traders typically wait for a MACD crossover to occur near potential reversal zones. Stop-loss orders are placed a few pips above the most recent swing high to protect capital. Once the trade is triggered, traders follow the new trend until the Stochastic RSI signals an oversold condition, while profit targets can be set at the origin point of the trend prior to the reversal.

Mean reversion trading strategy

In a mean reversion strategy, market momentum is evaluated based on the price’s tendency to return to its historical average. When prices rise or fall too sharply within a short period, traders assume that such movements are unlikely to be sustained over the long term.

Based on this assumption, traders identify overvalued or undervalued price levels and place trades with the expectation that the market will correct, allowing them to profit from pullbacks or declines back toward the average price zone.

Through a counter-trend trading strategy, traders can identify movements that go against the prevailing trend or excessive price fluctuations, enabling them to capitalize on short-term market corrections.

For example, when the price of a currency pair rises or falls excessively relative to a moving average, this is often considered a sign that the market is becoming imbalanced.

In such circumstances, traders may consider executing counter-trend trades with the expectation that price will soon revert to its mean. If price falls significantly below the average, traders may open long positions in anticipation of a bullish reversal, and conversely when price rises excessively above the average.

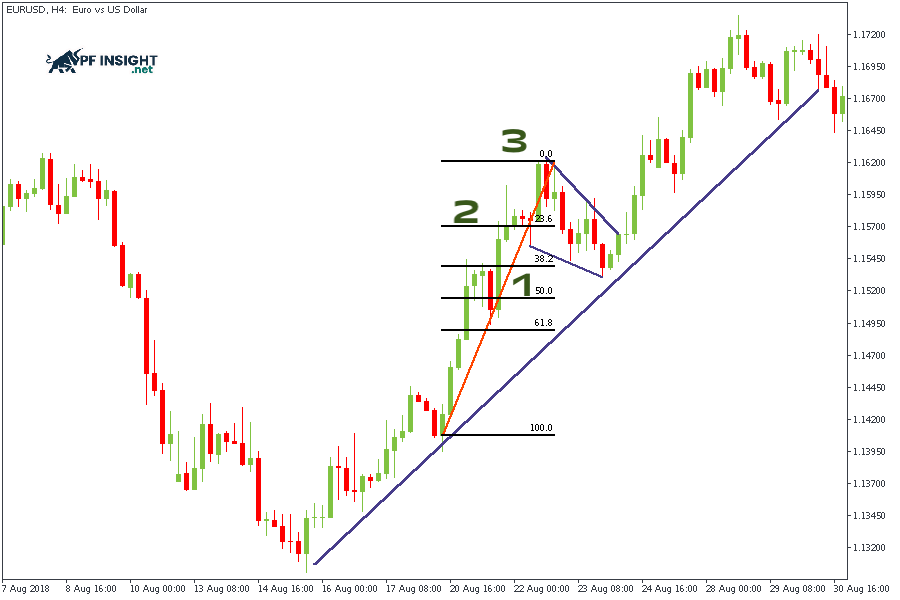

Trendline break trading strategy

Trendlines are diagonal lines drawn on price charts by connecting significant swing highs or swing lows, helping to reflect the market’s primary direction. Through trendlines, traders can identify whether an uptrend or downtrend is dominant. When price breaks a trendline, it often signals that the current trend is weakening and that a potential reversal may occur.

In a counter trend trading strategy, trendline breakout techniques are used to identify moments when price moves beyond trendlines from above or below. By monitoring appropriate timeframes, traders can look for opportunities to trade against the prevailing market trend.

A break of an ascending trendline is commonly viewed as an important warning signal that the current bullish trend may be coming to an end. When this happens, many traders choose to enter short positions in anticipation of the next bearish move.

Conversely, if price breaks through a descending trendline in a clear upward direction, it may indicate weakening bearish momentum. In this scenario, traders often consider opening long positions, expecting the market to reverse into an uptrend.

Overbought and oversold levels strategy

The overbought and oversold zones strategy is based on identifying excessively high or low price levels through momentum indicators. RSI and Stochastic are commonly used tools to measure overbought and oversold conditions in the market. When these indicators show that price is in extreme zones, it suggests that the current trend may be nearing its end and that a price reversal is likely to occur.

By observing key indicator thresholds, traders can determine whether price is in an overbought or oversold state. For example, an RSI reading above 70 typically indicates an overbought market, while an RSI reading below 30 reflects an oversold condition.

Under overbought conditions, traders often look for short-selling opportunities in anticipation of a price pullback, whereas oversold zones may present buying opportunities.

Major mistakes to avoid in counter trend trading

Unlike other trading styles, a counter trend trading strategy requires specific psychological traits such as patience and strong emotional control. Without proper preparation in these areas, traders are highly susceptible to psychological mistakes during the trading process. Below are some of the common psychological errors that often occur when applying counter trend trading strategies.

Underestimating the strength of market trends

When the market is moving with strong momentum and is supported by high trading volume, attempting to pick tops or bottoms often leads to rapid losses. In such cases, trends can persist far longer than expected, causing counter-trend positions to be repeatedly stopped out and significantly reducing overall trading performance.

Executing too many trades in a short period of time

Overtrading is a common mistake in counter trend trading strategies, especially when traders try to capture every market pullback. Forcing trades when signals are unclear often results in emotional decision-making and unnecessary losses. Instead of trading excessively, traders should remain patient and wait for high-quality setups that fully meet their predefined criteria, thereby improving the probability of success and maintaining better risk control.

Overlooking important economic news and data

While technical indicators and price patterns provide useful signals, fundamental factors such as economic data releases, monetary policy decisions, or major news events can still have a strong impact on the market. Ignoring these elements may cause traders to misinterpret the broader market context and make ineffective or poorly timed trading decisions.

Lack of patience when waiting for trading signals

Lack of patience is a key reason why many traders fail when using counter trend trading strategies. Counter-trend trade setups often require time for clear confirmation, including signals from technical indicators, price patterns, and overall market behavior.

Entering a trade too early while the primary trend remains strong can quickly cause the trade to move against expectations. Therefore, traders need to cultivate patience and only enter positions when all conditions are clearly identified and confirmed.

Making trading decisions based on emotions

Emotion driven trading often causes traders to deviate from their trading plans and ignore established risk management rules. When fear of loss or greed dominates decision-making, trades tend to become impulsive, inconsistent, and poorly timed.

To avoid this mistake, traders must strictly adhere to their predefined strategies, maintain discipline in every trade, and evaluate market conditions objectively rather than reacting to short-term emotional impulses.

By identifying and avoiding these common mistakes, traders can significantly improve their psychological control when applying counter trend trading strategies. A combination of discipline, patience, and sound risk management will enhance overall trading performance and increase the likelihood of achieving consistent and sustainable profits.

Which traders should use counter trend trading strategies?

Although counter trend trading strategies can offer attractive profit potential, they are not suitable for every trader. This trading style requires strong analytical skills, a high level of emotional control, and considerable patience, making it more appropriate for traders with a certain level of experience.

- Experienced traders: Traders who have accumulated substantial hands-on experience, possess a solid understanding of technical analysis, and have a deep knowledge of market behavior tend to have a significant advantage when applying counter-trend trading strategies. Their ability to recognize reversal signals and manage risk effectively allows them to trade more confidently and efficiently.

- Risk-tolerant individuals: Counter trend trading is only effective when traders strictly adhere to their predefined trading plans, including entry points, exit strategies, and capital management. A lack of discipline can amplify risk and significantly reduce overall trading performance.

- Highly disciplined traders: Counter trend trading is only effective when traders strictly follow their predefined trading plans, including entry and exit rules as well as capital management. A lack of discipline can amplify risk and substantially reduce overall trading performance.

- Traders with fast decision-making abilities: During market reversal phases, price movements often occur very quickly. As a result, traders must assess situations promptly and make decisive decisions to avoid missing opportunities or being caught off guard by sudden market fluctuations.

- Mentally resilient traders: Using counter trend trading strategies often involves significant psychological pressure, especially when price temporarily moves against initial expectations. Therefore, traders need to remain calm, maintain strong emotional control, and evaluate market conditions objectively to avoid making impulsive or emotionally driven decisions.

How to manage risk in counter trend trading

Due to its high volatility, the counter trend trading strategy requires traders to pay special attention to risk management. This is a core element in minimizing losses, preserving capital, and laying the foundation for long-term profit growth.

- Position size management: Determining a reasonable trade volume is a crucial part of risk management, helping traders control the amount of capital at risk for each trade. As a safety principle, traders should only use a small percentage of their capital, usually not exceeding 1–2% of their total account, for each trade.

- Use stop-loss orders: Stop-loss orders are set to automatically close a position when the price moves to a predetermined level. This tool helps traders limit their maximum losses, prevent prolonged unfavorable trades, and protect their accounts from serious losses.

- Adhering to a trading plan: Traders need to develop and stick to a clear trading plan that specifically defines entry and exit points, stop-loss levels, and profit targets. Adhering to the plan helps maintain trading discipline and limits emotional decisions during trading.

- Accept market uncertainty: Counter trend trading strategies inherently involve higher risk because they require trading against the prevailing market trend. Therefore, traders must be mentally prepared to face uncertainty and understand that not every trade will unfold as initially expected.

- Cultivating patience: Patience plays a crucial role in counter-trend trading strategies. Instead of rushing into trades out of fear of missing opportunities, traders need to wait for appropriate entry and exit points that have been clearly confirmed. Simultaneously, maintaining an objective mindset and evaluating data neutrally will help traders avoid bias and make more accurate decisions.

Conclude

While not suitable for everyone, the counter trend trading strategy remains a worthwhile option for experienced and patient traders. Understanding the market context, waiting for confirmation signals, and adhering to the trading plan will help minimize risk. Ultimately, success in counter trend trading depends heavily on discipline and emotional management.