The market does not move randomly, as many traders believe, but is driven by massive capital flows from large financial institutions. When you understand institutional order flow, you no longer just see price going up or down but begin to read the intention behind each movement. This is how smart money builds liquidity, creates trends, and controls market rhythm. Once you grasp this logic, trading shifts goes from guessing to making well-grounded decisions. Let’s walk through today’s article with PF Insight.

- Liquidity pool concept and why price is attracted to liquidity levels

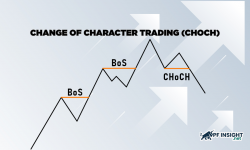

- Change of character trading (CHOCH): what it is and how it differs from BOS

- Break of structure trading and how it differs from simple breakout setups

What is institutional order flow in trading?

Institutional order flow refers to the buying and selling activity created by large financial institutions such as banks, hedge funds, and asset managers that trade in massive volume. Unlike retail traders who enter the market with relatively small positions, institutions execute orders large enough to influence price movement, liquidity, and overall market structure. In simple terms, institutional order flow is the footprint of smart money as it enters, builds, and exits positions in the market.

When a major institution places a large order, it cannot be filled instantly at a single price level. Instead, price is pushed through multiple levels of liquidity as those orders are absorbed, creating strong momentum, imbalances, and structural shifts. This is why institutional trades often appear as sharp moves, rapid expansions, or clean directional runs, very different from the choppy fluctuations caused by small retail orders.

More importantly, order flow reflects market intent rather than just visible price movement. A sudden displacement move after a liquidity sweep often signals aggressive institutional positioning. A series of controlled higher highs and higher lows suggests sustained accumulation by large players. By reading order flow, traders begin to understand not only where price is going, but also why it is moving and whether the move has real institutional backing behind it.

Smart money vs. retail traders: who really moves the market?

Financial markets are primarily driven by large institutions, commonly referred to as smart money, including:

- Central banks and major commercial banks

- Hedge funds

- Investment funds and asset management firms

- Pension funds and long-term financial institutions

- Market makers and professional liquidity providers

These institutions trade with extremely large capital, often reaching millions or even billions of dollars per position. Their objective is not short-term speculation like most retail traders, but rather building strategic positions to influence liquidity and shape market structure over the long term.

The key difference lies in capital size and execution mechanics. Retail traders typically place market or limit orders that are filled instantly with minimal impact on price. Institutions, however, must break large positions into smaller blocks and distribute them across liquidity pools to avoid excessive slippage. This process naturally pushes price through levels, creates momentum, forms imbalances, and engineers liquidity zones, the very patterns traders later see on their charts as trends, breakouts, and pullbacks.

Because of this imbalance in volume, retail trading activity simply does not have the power to move markets in a meaningful way. Thousands of small orders may create short-term noise, but sustained price movement requires institutional participation. Trends form, reversals occur, and volatility expands only when smart money commits significant capital. Once traders understand this reality, they stop trying to predict price based on indicators alone and begin aligning themselves with the real force behind market movement.

Institutional order flow vs trend direction

Traditional trend analysis focuses on identifying price structure through higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. This approach forms the foundation of most technical analysis methods and has proven effective for decades. Trading with the trend helps traders avoid fighting market momentum and capture major price movements.

However, trend direction only tells you where price is moving, not why it is moving. This is where institutional order flow adds a deeper layer of insight. By analyzing order flow, traders go beyond surface-level structure and evaluate the quality behind each move, whether a break in structure is supported by strong institutional momentum, liquidity shifts, and supply-demand imbalances.

In essence, trend direction reflects the outcome of market behavior, while institutional order flow reveals the cause and conviction behind that outcome. When combined, traders are no longer just following price; they are aligning with the actual forces driving the market.

Institutional order flow vs trend direction (comparison table)

| Aspect | Traditional trend direction | Institutional order flow |

| Main focus | Overall price movement | Quality and source of movement |

| Based on | Market highs and lows | Structure, displacement, and liquidity |

| Shows | Direction of the market | Strength and intent behind moves |

| Signal reliability | Strong in clear trends | Stronger when institutional activity confirms |

| Trading purpose | Identify bias | Validate momentum and sustainability |

Key signs that institutional order flow is driving the market

The activity of large institutions always leaves clear “footprints” in the market. Because of the enormous size of their orders, they cannot enter and exit positions quietly and instead naturally create distinctive price patterns. When traders learn to recognize these signs, they can distinguish between genuine smart money moves and short-term noise generated by retail flow.

Displacement when institutional flow reveals its true strength

There are times when the market moves sideways for a long period, seemingly lacking clear direction. Then suddenly, a series of large candles appears, and the price surges straight through key levels within minutes or just a few bars. This is displacement, a sign that large institutions are entering aggressively and absorbing all the liquidity in their path. Explosive moves like this rarely come from retail traders and are usually the beginning of a deliberate, large-scale move.

Fair value gap areas are the market often revisits before continuing the trend

When you closely observe strong price moves, you will notice zones where price barely “spends time” trading in balance. Instead, the market moves through them very quickly, leaving behind trading voids on the chart known as fair value gaps. In real market behavior, price often tends to return to these areas to rebalance supply and demand before continuing in the main trend. This is why many smart money traders view FVGs as high-quality price reaction zones.

Liquidity sweeps the familiar move before every major price push

The market rarely makes a strong move up or down without first “clearing the path.” Very often, price will reach obvious highs or lows where most traders place their stop losses. The moment those stops are triggered is also when liquidity surges, allowing large institutions to build sizable positions at optimal cost. Only after that does the market truly move in the direction they intend.

A clean market structure reflects smart money control

Not every trend is chaotic or unpredictable. When institutional flow is in control, price often moves in a very orderly manner, breaking structure cleanly, pulling back shallowly, and continuing to expand in the same direction.

These pullbacks rarely violate key levels, showing that large positions are being strongly defended. When this behavior appears together with displacement and liquidity sweeps, it is usually a sign of sustained institutional order flow.

How traders can apply institutional order flow step by step

Instead of trying to catch every small fluctuation, institutional order flow works best when used as a high-probability filtering system. The goal is not to predict price, but to align your trades with the institutional flow that is controlling the market.

Step 1: Identify market bias on higher timeframes

Start with H4 or H1 to define the overall structure. Observe whether the market is forming higher highs and higher lows, or lower highs and lower lows, while also marking key liquidity zones.

Higher timeframes help you avoid trading against smart money and focus on the direction with the highest probability.

Step 2: Confirm with order flow signals

Once the main bias is clear, look for signs that institutions are actively participating:

- Strong displacement in the direction of the trend

- Fair value gaps forming after impulsive moves

- Liquidity sweeps before each expansion phase

When these elements align, it strongly suggests the market is being supported by smart money.

Step 3: Refine entries on lower timeframes

Drop down to M15, M5, or M1 to fine-tune entries. Traders typically wait for the price to retrace into a fair value gap, order block, or recently swept liquidity zone.

Lower-timeframe entries allow for tighter stop losses while still trading in the direction of the institutional trend.

Step 4: Trade during high-liquidity sessions

Institutional activity is usually most active during the London and New York sessions, especially around session opens or major economic releases.

Trading during these periods makes order flow signals clearer, reduces noise, and increases the probability of clean market moves.

Common mistakes when reading institutional order flow

Many traders study order flow diligently yet still struggle with consistency. The issue usually lies not in the tools themselves, but in using them out of context or overcomplicating the chart.

Applying order flow without market structure context

One of the biggest mistakes is searching for displacement or fair value gaps without considering whether the broader trend is bullish or bearish.

Order flow only becomes truly effective when placed within a clear market structure framework. Without higher-timeframe bias, traders easily end up trading against smart money and getting caught in short-term noise.

Ignoring timing and trading sessions

Many setups look technically perfect but occur during low-liquidity periods, such as the Asian session or the quiet hours between major sessions.

Institutional activity is usually concentrated during the London and New York sessions. When timing is ignored, traders often mistake small retail-driven moves for genuine smart money flow.

Overcomplicating the chart

Drawing too many zones, indicators, and order flow signals at once removes clarity and weakens decision-making.

In practice, focusing on a few core elements such as market structure, displacement, and liquidity is more than enough to read institutional intent. The simpler the chart, the clearer and more disciplined the trading decisions become.

Conclusion

Institutional order flow helps traders not only see price movement, but also understand the real forces behind each trend. When market structure is combined with institutional flow, trading becomes clearer, more disciplined, and higher probability. To further develop your analysis skills, you can explore more in-depth articles in our Technical Analysis section.