The liquidity pool concept is a fundamental pillar in DeFi, enabling DEXs to swap tokens continuously without relying on a traditional order book. In trading, many traders also observe that price often gets “pulled” toward liquidity levels, where large clusters of pending orders and stop-losses are concentrated. Although these belong to different contexts, both revolve around the same core idea: markets gravitate toward areas with enough liquidity to execute orders efficiently. Once you understand the liquidity pool concept, you will start viewing liquidity zones not just as “technical levels,” but as convergence points of order flow.

- Change of character trading (CHOCH): what it is and how it differs from BOS

- Break of structure trading and how it differs from simple breakout setups

- Directional movement index and the role of positive and negative directional movement

What is a liquidity pool? (concept & definition)

A liquidity pool is a “pool” of assets locked inside a smart contract to facilitate trading on decentralized exchanges (DEXs). Instead of requiring buyers and sellers to place orders and wait for matching, a liquidity pool allows anyone to swap tokens instantly, as long as the pool has sufficient liquidity.

Simply put, a liquidity pool is an always-available source of liquidity that enables the market to operate 24/7 without relying on traditional-style market makers. This is why liquidity pools have become the “backbone” of DeFi and the foundation for many products such as swaps, lending, and yield farming.

Liquidity pool vs order book (why it matters for price)

In traditional markets (and most CEXs), price is formed through an order book, a list of buy and sell orders stacked at different price levels:

- When buy orders push upward, price rises through the ask levels.

- When sell orders push downward, price falls through the bid levels.

- Liquidity sits across multiple “price layers,” which is why traders often see price react around zones with heavy resting orders.

In contrast, on DEXs that use liquidity pools, trades do not match against a specific counterparty inside an order book. Instead, they interact directly with the pool. Price is determined by the asset ratio inside the pool (e.g., ETH/USDC) through an AMM mechanism.

The key takeaway for traders is

- In an order book, price moves mainly because buying or selling pressure “consumes” layers of orders.

- In a liquidity pool, price changes because swaps alter the token ratio in the pool, forcing a “reprice” based on the AMM formula.

- The thinner the liquidity, the larger the slippage, meaning price can jump significantly from a relatively large swap.

In other words, an order book represents liquidity as “resting orders,” while a liquidity pool represents liquidity as “reserve assets.” This difference affects how price reacts, and why “pulls toward liquidity levels” can look different in a DeFi environment.

The role of smart contracts in decentralized liquidity

Smart contracts are what make liquidity pools possible and truly “trustless.” Instead of relying on an intermediary to hold assets and coordinate order matching, smart contracts:

-

Hold pool assets transparently: Assets deposited by LPs are not controlled by an exchange or a third party but are locked directly inside the contract.

-

Automatically price and execute trades: Every swap triggers the smart contract to calculate pricing using the AMM model, then update the pool’s asset ratios accordingly.

-

Distribute trading fees to LPs: A portion of swap fees is allocated to Liquidity Providers (LPs) based on their share of the pool.

-

Reduce human dependence, but increase technical risk: Since everything depends on code, if the smart contract contains bugs or vulnerabilities (bugs/exploits), the pool can be attacked and assets can be lost.

From a market perspective, smart contracts are not just operational technology; they are also the “rules of the game” that determine how price moves when liquidity changes and why certain liquidity zones become magnets for order flow.

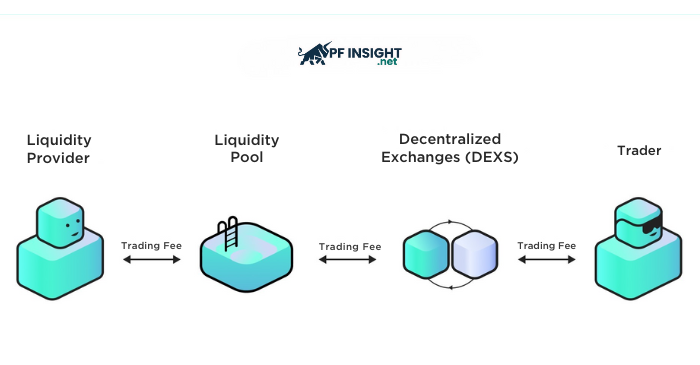

How liquidity pools work (LPs, AMMs, and price discovery)

A liquidity pool can function thanks to three core components: Liquidity Providers (LPs) supply assets to the pool, the AMM uses a formula to price and execute swaps, and the fee and rebalancing mechanism help the pool maintain liquidity. Unlike an order book, pricing on a DEX is driven by the supply-demand ratio inside the pool, meaning user trading activity directly “pulls” price to adjust in real time.

Liquidity providers (LPs): what they deposit and why

Liquidity Providers (LPs) are participants who supply liquidity to a pool by depositing assets into a smart contract. Typically, LPs deposit assets in token pairs of equal value, for example:

- ETH/USDC pool: Deposit an amount of ETH and USDC with the same USD value.

- BTC/ETH pool: Deposit BTC and ETH in balanced value at the time of deposit.

LPs participate mainly to:

- Earn trading fees: Each time a swap occurs, the pool collects a fee and distributes it to LPs.

- Receive platform incentives: Some projects provide additional token rewards through liquidity mining or yield farming to attract liquidity.

- Provide liquidity for the ecosystem: Many DeFi projects need initial liquidity so their tokens can trade smoothly. LPs are the key force that gives the pool depth.

In short, LPs contribute capital to the pool and effectively become decentralized “market makers.” However, profit always comes with risk, especially impermanent loss (which will be covered in the Risks section).

AMMs explained simply (x*y = k)

An AMM (Automated Market Maker) is the mechanism that allows DEXs to price assets without an order book. One of the most well-known models is the constant product formula:

x * y = k

Where:

x = the amount of token A in the pool (e.g., ETH)

y = the amount of token B in the pool (e.g., USDC)

k = a constant value

Key point: When someone swaps, they change x or y → the smart contract adjusts the other side so that k remains nearly constant → the price automatically shifts based on the new ratio.

A simple example: If many people buy ETH using USDC in an ETH/USDC pool

→ USDC in the pool increases, while ETH decreases

→ ETH becomes “scarcer” inside the pool

→ the pool-implied ETH price rises

So in an AMM:

- Price does not move because traders “eat through the order book”

- Price moves because swaps change the token ratio inside the pool

This is also why traders often observe that:

- When liquidity is thin, a single large trade can cause sharp slippage

- When liquidity is deep, price moves more smoothly and is harder to distort with small orders

Fees, rewards, and rebalancing dynamics

Fees (trading fees)

Each swap pays a fee (for example, 0.3% in some Uniswap v2 pools). This fee is

- Kept inside the pool

- Then distributed to LPs based on their share of the pool

→ The higher the trading volume, the more LPs earn.

Rewards / incentives

Many projects distribute rewards in their own tokens to attract liquidity. This is why liquidity sometimes “flows into” a specific pool during certain periods, creating very visible liquidity concentration zones.

Rebalancing and its impact on LPs

One interesting feature of AMMs is that LPs do not keep their original token amounts fixed. When price moves:

- The pool automatically adjusts token ratios

- LPs gradually end up holding more of the weaker token and less of the stronger token

This is the mechanism behind impermanent loss – because compared to simply holding the tokens in a wallet, LPs can underperform if one token significantly outperforms the other.

In short:

- Traders swap → the pool rebalances → price shifts

- LPs earn fees but accept structural risk

Pool models that matter (stable pools + concentrated liquidity)

Not all liquidity pools are the same. There are two main models you should understand, because they directly affect liquidity depth, slippage, and where price is likely to react.

Stable pools (e.g., Curve)

Stable pools are designed for assets with closely aligned prices, such as USDC/USDT and DAI/USDC.

Key characteristics:

- Low slippage

- Liquidity is evenly distributed around the 1:1 price area

- Well-suited for large swaps with minimal price impact

From a trader’s perspective, stable pools often feel like the price is being “held” near equilibrium because the pool is optimized for stability.

Concentrated liquidity (e.g., Uniswap v3)

This is a major upgrade: LPs no longer need to provide liquidity across the entire price range. Instead, they can choose a specific price range to supply liquidity.

For example, an LP may provide liquidity for ETH/USDC only within 2,800 – 3,200

As a result:

- It creates zones with dense liquidity (liquidity-concentrated zones).

- Price often reacts strongly around these zones.

- If the price moves outside the range, liquidity becomes “thin” immediately → slippage increases.

This is exactly where liquidity pools intersect with liquidity levels:

- Liquidity is not evenly spread out.

- It becomes concentrated at specific “levels,” → which helps explain why price tends to get drawn toward those zones.

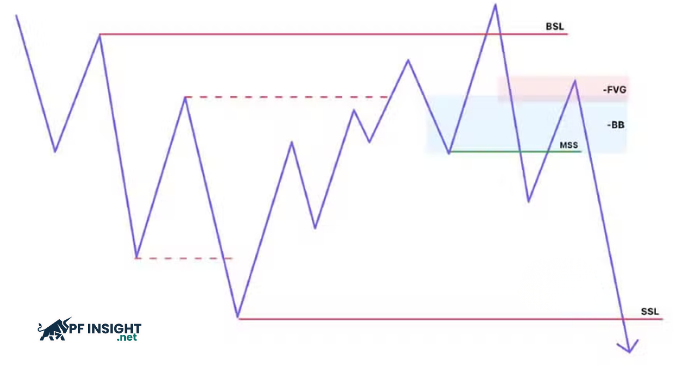

What are liquidity levels? (trader perspective)

In trading, liquidity levels are price zones where there is a high “order density,” especially clusters of stop-loss orders and pending orders from the majority of traders. When the market needs to execute large orders, price often tends to move toward areas with sufficient liquidity, allowing that volume to be filled faster and with less slippage. Therefore, liquidity levels are not just technical lines on a chart, but convergence points of order flow where price is likely to react sharply or produce sweep moves.

Liquidity levels are commonly viewed from two sides: buy-side liquidity and sell-side liquidity. Buy-side liquidity sits above highs, because that is where many buy stops and stop-losses from short sellers are concentrated. In contrast, sell-side liquidity sits below lows, where sell stops and stop-losses from long traders tend to cluster. From a Smart Money perspective, these areas act as “order pools” that the market often seeks before establishing its next directional move.

In short:

- Buy-side liquidity (BSL): Often located above swing highs or equal highs.

- Sell-side liquidity (SSL): Often located below swing lows or equal lows.

A common misunderstanding is treating liquidity levels as the same thing as support and resistance. In reality, support and resistance focus on areas where price reacted in the past, while liquidity levels focus on areas where many resting orders are concentrated. Because markets prioritize liquidity for efficient execution, price may sometimes push through support or resistance, sweep stops at a liquidity level, and then reverse, creating the impression of a “fake” S/R break.

Liquidity tends to build up in places where the crowd repeatedly places stops in similar ways. Some of the most common forms on a chart include:

- Equal highs / equal lows (double tops, double bottoms): Stop-loss orders cluster clearly in these zones.

- Swing highs / swing lows: Where traders place structure-based stops.

- Range edges (upper/lower boundaries of consolidation): Many range orders plus breakout orders stack together.

- Overly obvious patterns (trendline breaks, clean chart patterns): These often attract large liquidity clusters.

Why price is attracted to liquidity levels (the real mechanism)

Price is often “pulled” toward liquidity levels for one simple reason: large orders require liquidity to execute. Whether it’s crypto, FX, indices, or DeFi markets, meaningful size cannot be filled efficiently in thin areas. Liquidity levels where stop-loss clusters and resting orders concentrate create the conditions for the market to transact volume with lower friction. That is why these areas repeatedly act as magnets before major repricing events.

In practice, liquidity levels represent where the market can do business. A large participant entering or exiting needs two things: sufficient opposite-side flow and manageable slippage. Stop-loss zones provide both. When price approaches a well-defined high or low, stops convert into market orders, instantly injecting activity and enabling size to be absorbed. This is less about “hunting retail” and more about the mechanics of execution.

Liquidity levels typically attract price because they contain:

- Dense stop-loss clusters (forced market orders)

- Breakout orders waiting to trigger

- Liquidity pockets where spreads and slippage compress temporarily

Liquidity grabs and “stop hunts” (what they actually are)

Many traders describe the move into liquidity as a stop hunt. But mechanically, it is often a liquidity sweep a short-term expansion into an area rich in orders, followed by a reaction once that liquidity is consumed. The sweep itself is not the signal; the signal is what the market does after liquidity is taken.

A sweep tends to produce two common outcomes. The first is a quick raid above a high (or below a low) followed by a snap back into the range, usually because the liquidity served its purpose and price returns to fair value. The second is a raid that transitions into displacement, where price drives strongly away and breaks structure, suggesting a real shift in positioning.

To interpret these situations professionally, focus on order-flow behavior rather than labels.

Key clues that liquidity has been “used” (not just touched):

- A clean sweep of a defined high/low (equal highs/lows or structure points)

- A strong displacement move away from the sweep zone

- Failure to reclaim the swept level on retest (or immediate rejection after mitigation)

AMM liquidity (DeFi) vs liquidity levels (trading): avoid the common confusion

Because this article links the liquidity pool concept with liquidity levels, it’s important to separate terminology. In AMM-based DeFi markets, liquidity refers to token reserves inside a smart contract pool, which affects slippage and price impact. In trading structure narratives, liquidity refers to clusters of executable orders around obvious highs and lows.

These concepts overlap at the principle level markets move toward areas where execution is easiest—but the liquidity is “stored” differently.

In AMMs (liquidity pools):

- Liquidity is pooled reserves (e.g., ETH/USDC held in the contract)

- Price moves as pool ratios change

- Thin liquidity creates larger price impact and slippage

- Concentrated liquidity (Uniswap v3) creates zones where reactions become sharp

In trading liquidity levels:

- Liquidity is order clustering (stops, pending orders)

- Price moves to capture executable flow

- The sweep often precedes reversal or continuation

When you keep that distinction clear, the narrative becomes consistent: price tends to migrate toward liquidity because liquidity makes execution possible, regardless of whether liquidity is represented by orders (order-flow markets) or reserves (AMMs).

Liquidity pool risks (what traders must understand)

Liquidity pools make decentralized trading possible, but the risk profile is different from order-book markets. Instead of relying on an exchange to manage execution and security, DeFi shifts those responsibilities to smart contracts and protocol design. The result is that traders face not only price risk, but also mechanical and security risks that can impact execution or capital directly.

Impermanent loss (LP risk)

Risk (what it is): Impermanent loss happens when the price relationship between two pooled assets changes, causing the AMM to rebalance your holdings in a way that can underperform simple holding.

Why it happens: AMMs maintain pricing by adjusting token quantities inside the pool. When one asset appreciates faster than the other, the pool naturally ends up holding more of the weaker asset and less of the stronger asset. This isn’t an accident it’s the built-in trade-off of AMM market making.

What it looks like in practice: LPs often notice that after a strong trend, they withdraw liquidity and receive less of the outperforming token than expected, even though they earned fees along the way.

What to do (practical actions):

- Prefer stable pools (stablecoin pairs) when your goal is low-variance yield.

- Avoid pairs with high divergence risk unless fees are clearly compensating.

- Treat LP positions as strategy exposure, not “risk-free passive income.”

Smart contract vulnerabilities

Risk (what it is): If a liquidity pool contract is exploited, funds can be drained instantly with no recovery mechanism.

Why it happens: Liquidity pools are code-driven. Bugs, edge cases, or flawed assumptions (especially around pricing, permissions, and integrations) can be exploited. Even audited protocols can fail because composability increases attack surfaces across DeFi.

What it looks like in practice: Pools suddenly lose liquidity, swaps fail, token prices destabilize, and LP tokens can become effectively worthless within minutes.

What to do (practical actions):

- Stick to battle-tested protocols with strong audit history and meaningful TVL.

- Avoid newly launched forks with low usage, even if APR looks attractive.

- Use separate wallets: trading wallet vs storage wallet.

Flash loan attacks and oracle manipulation

Risk (what it is): Flash loans can be used to manipulate price inputs and extract value from pools or connected protocols.

Why it happens: Flash loans allow attackers to temporarily access massive liquidity. If a pool or protocol relies on weak or manipulable price references, attackers can distort price, trigger flawed logic, and profit immediately then repay the loan in the same transaction.

What it looks like in practice: Sudden abnormal wicks, inconsistent pool pricing, and rapid draining behavior often happening too fast for manual intervention.

What to do (practical actions):

- Prefer protocols using robust oracle design (e.g., TWAP, multi-source feeds).

- Avoid pools connected to complex lending/derivative mechanics unless mature.

- Be cautious with low-liquidity pools where manipulation is easier.

Rug pulls and malicious token mechanics\

Risk (what it is): Some pools are built around tokens designed to trap traders or enable liquidity removal without warning.

Why it happens: Anyone can deploy a token and create a pool. Scammers often use liquidity as credibility, then exploit token contract controls (sell restrictions, adjustable taxes) or remove liquidity once enough capital flows in.

What it looks like in practice: Price pumps with rising volume, then sells fail or taxes spike, followed by liquidity removal and total collapse.

What to do (practical actions):

- Check whether liquidity is locked, for how long, and by whom.

- Inspect token mechanics: transfer rules, sell restrictions, tax functions.

- Avoid tokens with anonymous contracts and no credible ecosystem footprint.

Approval risk (wallet permissions)

Risk (what it is): Token allowances (“approvals”) can expose your wallet if a contract becomes malicious or compromised.

Why it happens: Many DApps request unlimited approvals to reduce friction. If you approve the wrong contract or a trusted contract gets exploited, attackers can pull tokens later without needing another signature.

What it looks like in practice: Funds disappear from the wallet even though the trader didn’t execute new trades.

What to do (practical actions):

- Use limited approvals whenever possible.

- Revoke unused approvals periodically, especially for high-value tokens.

- Never connect your main wallet to random DApps or unfamiliar front-ends.

Conclusion

Understanding the liquidity pool concept helps traders see how liquidity is created in DeFi and how price discovery works without an order book. From that perspective, it becomes easier to understand why price is often attracted to liquidity levels, where orders and stop-loss clusters concentrate. Liquidity pools and liquidity levels come from different contexts, but they share the same core logic: markets move toward liquidity to execute efficiently. Once you recognize this, liquidity levels stop being “random lines” and become actionable areas where price is likely to react. On PF Insight, we publish practical trading research and education to help traders improve execution, risk control, and long-term consistency.