Change of character trading (CHOCH) is one of the most important concepts in market structure, helping traders recognize when the market starts to “change character” and may be preparing for a reversal. However, many traders still confuse CHOCH with Break of Structure (BOS) because both involve price breaking key structural levels. In this article, Pfinsight.net will clearly explain what CHOCH is and how it works on a chart. You will also understand the difference between CHOCH and BOS, as well as when to prioritize each signal for more effective trading.

- How institutional trading activity influences price movement

- Directional movement index and the role of positive and negative directional movement

- ADX indicator and why it does not show trend direction

What is change of character (CHOCH) in trading?

CHOCH meaning in market structure

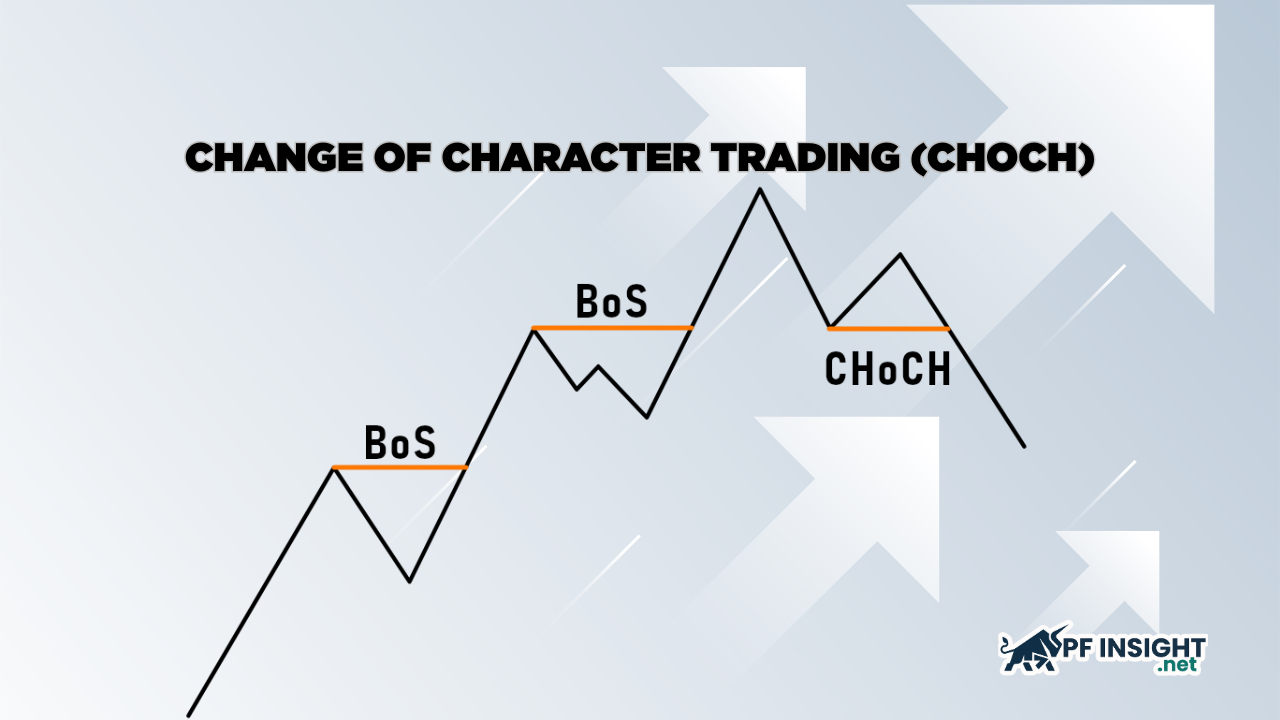

Change of Character (CHOCH) is a signal that the nature of price movement has changed, often shifting from “trend continuation” to “weakening momentum with potential reversal.” If BOS focuses on confirming that price is continuing in the current direction, CHOCH focuses on detecting a phase shift within market structure. Simply put, CHOCH means the market is no longer behaving the way it did before.

Definition of CHOCH

In market structure, a CHOCH appears when the current trend begins to lose control, and the price breaks a key swing level in the opposite direction, signaling a potential reversal.

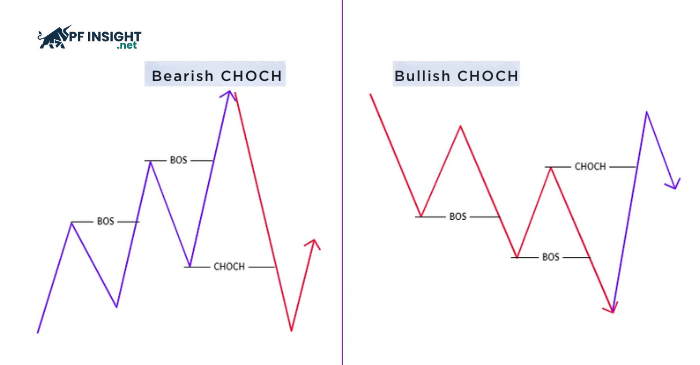

Examples:

- The market is in an uptrend (HH – HL): → price breaks below a key higher low (HL) → this is a bearish CHOCH

- The market is in a downtrend (LL – LH): → price breaks above a key lower high (LH) → this is a bullish CHOCH

What does “character” mean in price behavior?

In a trading context, “character” refers to the market’s behavior over time, meaning how the market moves and reacts. It includes:

- Trend strength or weakness (momentum)

- How swings form (HH/HL vs LL/LH)

- Breakout behavior: strong breakouts or just wick sweeps

- Pullback behavior: deep pullbacks or shallow pullbacks

When the market’s “character” changes, you will often see:

- Price no longer forms the same structure as before

- Trend impulses become weaker

- Volatility shifts more clearly

- Breakouts start failing more frequently

How does CHOCH confirm a change in “flow”?

“Flow” here refers to the trend flow or order flow. CHOCH confirms a change in flow by:

- Breaking a key swing level

- Disrupting the old structure

- Creating conditions for a new structure to form

To put it another way, CHOCH is the first indication that buyers may be losing control to sellers (or vice versa).

Why CHOCH matters (trend shift & reversal confirmation)

CHOCH matters because it often appears early, right when market structure begins to shift direction, before a full trend reversal is confirmed. In other words, instead of waiting for price to complete a “clear” reversal pattern, traders can use CHOCH as an early warning signal to shift from trend-following mode to monitoring a potential reversal. However, CHOCH is only reliable when it breaks a key swing level in the structure, not when it is just a wick sweep or a minor break inside a noisy range. High-quality CHOCH signals usually come with the right context: the current trend is already weakening, momentum is fading, and the break is confirmed by a strong candle close (not just a wick). Most importantly, CHOCH must be distinguished from random breaks, which often occur due to noise and stop hunts, fail to change the overall structure, and lack follow-through. A valid CHOCH typically shifts structural behavior (for example, from HH/HL to LH/LL or vice versa), showing that order flow is changing and the market may be entering a new phase.

How CHOCH forms on a chart (step-by-step)

CHOCH is not just any break. It appears when a structure that has been moving in the current trend direction starts to break in the opposite direction, creating the first sign of a potential reversal. To identify CHOCH correctly, traders need to follow the logic: trend → swing points → key level → confirmed break.

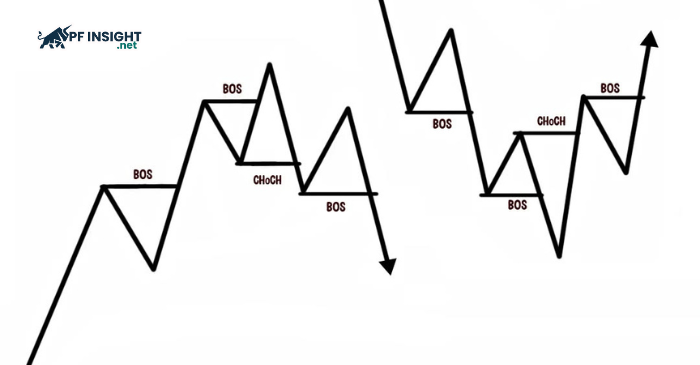

Bullish CHOCH (downtrend → potential reversal)

Market conditions

Bullish CHOCH typically appears in a market that is clearly in a downtrend (LL – LH). Before CHOCH occurs, you will often see:

- Price continues making lower lows, but bearish momentum starts to weaken.

- The pullbacks become “stronger than usual” or deeper than previous pullbacks.

- Signs that the market is no longer trending down smoothly (loss of rhythm).

Which break is considered valid?

In a downtrend, the key structural points are the lower highs (LH). Therefore, a bullish CHOCH is valid when price:

- Breaks above the most recent key lower high (an important LH).

- Ideally, it closes clearly above that LH level (not just a wick).

Note: If the break only pokes above the LH and immediately reverses, it is more likely a liquidity sweep or a false break than a true CHOCH.

How to mark swing points correctly

To mark swing points correctly in a downtrend:

- Only use clear pullback highs that form LHs (highs that are followed by a bearish reaction).

- Prioritize swings that are clearly visible on your trading timeframe.

- If the swings are too small and noisy, you will get “fake CHOCH” signals repeatedly.

Bearish CHOCH (uptrend → potential reversal)

Market conditions

Bearish CHOCH typically appears when the market is in a clear uptrend (HH – HL). Common “warning signs” before CHOCH include:

- Price continues making higher highs, but bullish momentum weakens.

- Pullbacks become deeper than usual.

- Some breakouts above HH start to fail or become slow and hesitant.

Which break is considered valid?

In an uptrend, the structure is held by the higher lows (HL). Therefore, a bearish CHOCH is valid when price:

- Breaks below the most recent key higher low (an important HL).

- Ideally closes below the HL, creating the sense that “structure has broken.”

You should avoid calling it CHOCH when:

- Price only wicks below the HL but still closes above it.

- The break happens inside a tight range and shows no follow-through.

How to avoid “mislabeling CHOCH”

Bearish CHOCH is most commonly misread in situations where:

- You mark an HL too close to the price (internal noise) instead of a true swing HL.

- You trade against the higher-timeframe trend (HTF is still strongly bullish).

- The market is simply pulling back normally, without a real structural shift yet.

The most common mistakes when marking CHOCH

- Confusing internal vs. external structure: Marking CHOCH on small LTF structure without considering the HTF context creates noisy signals and increases the risk of getting stopped out.

- Using wicks instead of confirmation: Wicks are often just liquidity sweeps; CHOCH is more reliable when you have a clear candle close beyond the swing level or strong displacement.

- Ignoring higher timeframe bias: A CHOCH on the LTF may only be a pullback if the HTF trend is still strong; always define the HTF bias before trading.

- Overtrading due to small swings: Using swings that are too minor will make you “see CHOCH everywhere”; only mark clear swings and key levels, and wait for confirmation.

CHOCH vs BOS: What’s the difference?

In market structure trading, BOS (Break of Structure) and CHOCH (Change of Character) both involve price breaking key structural levels, but their meanings are completely different. While BOS is typically used to confirm that the current trend is still continuing, CHOCH acts as a signal that the market is starting to shift state and may be changing direction.

A BOS occurs when price breaks a swing level in the same direction as the ongoing trend. For example, in an uptrend, price continues breaking above a previous high, or in a downtrend, price breaks below a prior low. Therefore, BOS is often seen as a sign that control remains with the dominant side, and the trend may continue developing.

In contrast, a CHOCH appears when price breaks a key swing level in the opposite direction. For example, in an uptrend, price breaks below a higher low (HL), or in a downtrend, price breaks above a lower high (LH). This is often the first sign that the old structure is weakening and price behavior is starting to change, opening the possibility that the market is moving into a new phase.

Quick comparison table

| Factor |

BOS |

CHOCH |

| Meaning | Confirms the current trend is continuing | Signals a potential shift in market direction |

| Best use case | Trend continuation setups | Early reversal detection and trend-shift confirmation |

| Typical market context | Strong trend with clear momentum | Trend weakening, loss of momentum, possible reversal zone |

| Strength on HTF/LTF | Strongest on higher timeframes; noisier on lower timeframes | More reliable on higher timeframes; useful on lower timeframes for timing entries |

| Confirmation needed | Usually less confirmation required | Often needs stronger confirmation (close beyond level, displacement, context) |

| Common trap | Chasing breakouts during exhaustion or reversal areas | Mistaking a simple pullback/noise as a true CHOCH |

| Best entry timing | After BOS or BOS + retest | After CHOCH + confirmation (break/retest/shift) |

How to trade CHOCH (entry rules, SL, TP)

One of the most common mistakes when learning CHOCH is treating it as an “immediate entry signal.” In reality, CHOCH sometimes only serves as a warning that market structure is beginning to shift, and for it to become a tradable setup, it still needs clear context and confirmation. Therefore, the best way to trade CHOCH is to follow a structured market logic: Entry → Risk → Reward.

Entry logic (when CHOCH becomes tradable)

Not every CHOCH is worth trading. Some CHOCH signals are only a brief “loss of rhythm” within a larger trend, or short-term noise that slightly breaks structure and then quickly returns. That is why you need to distinguish between:

- CHOCH as a warning: It shows the market is losing momentum and may reverse, but it is not yet a valid entry.

- Tradable CHOCH: The break creates clear evidence that trend flow has shifted and the market is ready to move in the new direction.

To treat a CHOCH as tradable, you should prioritize at least one of the following confirmation types:

- A clear candle close beyond the level: The market does not just sweep the swing level, but actually closes beyond the structural level. This is a key difference between a real break and a wick/stop-hunt break.

- Displacement (a strong impulse) after the break: Displacement often signals that momentum has truly shifted. If the break happens but price moves weakly, hesitates, or immediately pulls back deeply, the CHOCH is usually lower quality.

- Retest failure / rejection after the break: After CHOCH forms, price returns to retest the broken zone but fails to reclaim the old structure (gets rejected). This is the market “re-confirming” that the shift is real.

Risk logic (where the idea is invalid)

The strength of CHOCH trading is that you can define risk based on structural logic, instead of placing a stop loss emotionally using a fixed number of pips. When you trade CHOCH, the key question is not “How many pips is my stop?”, but: If the market returns to this level, the CHOCH idea is invalid.

Therefore, the stop loss should be placed at the structure’s invalidation point, usually at the nearest opposing swing:

- For a bullish CHOCH, invalidation is typically below the most recent swing low (the structural low).

- For a bearish CHOCH, invalidation is typically above the most recent swing high (the structural high).

Placing the stop this way gives the trade clear meaning: you exit not because “price is fluctuating,” but because the market has violated the structural condition that made the setup valid in the first place.

Reward logic (where price is likely to run)

After a CHOCH, price often tends to move toward areas where the market has a “reason” to run. In practice, the two most common targets are:

- Swing targets (key swing levels ahead): Price often moves toward prior swing highs or swing lows, because these zones triggered strong reactions in the past and naturally become potential destinations for the next move.

- Liquidity pools (liquidity zones): Areas such as equal highs/equal lows, obvious highs/lows, and zones packed with stop orders are often where price gets pulled. A clean CHOCH often comes with the logic that the market shifts direction to take liquidity on the opposite side.

For take-profit management, the most consistent approach is:

- Take the nearer target first (TP1 at the nearest swing/liquidity zone).

- Hold the remaining portion for a farther target (TP2), letting it run based on structure rather than exiting too early.

This helps you both protect profits and capture strong continuation moves after the market has truly shifted.

How to filter false CHOCH signals

False CHOCH signals often appear when traders focus on only one timeframe or enter too early without strong confirmation. To filter noise more effectively, you can apply two simple rule sets: a context filter (multi-timeframe) and an execution filter (liquidity + displacement).

Multi-timeframe alignment

Rule 1: Identify HTF bias

Before looking for CHOCH on the LTF, define the trend and context on the HTF (e.g., H4/D1). The HTF tells you whether the market is favoring continuation or entering a zone where reversals are more likely.

Rule 2: Only take LTF CHOCH near HTF key zones

LTF CHOCH signals are most reliable when they form near major HTF zones such as swing highs/lows, key support/resistance levels, or previous structure zones. If CHOCH forms in the middle of a noisy area, the probability that it is just a pullback is much higher.

Rule 3: Ignore CHOCH against strong HTF momentum

If the HTF trend is still strong and structure has not weakened, an LTF CHOCH is often only a corrective move. In that case, CHOCH should be treated as a warning to monitor, not a reversal signal to trade immediately.

Liquidity sweep + displacement confirmation

Rule 1: Look for a clear liquidity sweep first

Prioritize CHOCH setups that show signs of liquidity being swept beforehand (taking a swing high/swing low, or equal highs/equal lows). A sweep suggests the market has just “trapped” one side and has a reason to reverse.

Rule 2: Wait for displacement after the sweep

After the sweep, you need clear displacement in the opposite direction to confirm a true shift in momentum. If price only turns slightly, moves weakly, or hesitates, the setup is more likely to be a fake shift.

Rule 3: Trade only after CHOCH is confirmed with a close/retest

Do not enter just because a wick breaks the level. CHOCH becomes more tradable when there is a clear candle close beyond the level or a failed retest (price retests but cannot return to the old structure). This helps you avoid getting caught in fakeouts.

Conclusion

To apply Change of Character trading effectively, you should backtest at least 20 – 50 cases using a fixed checklist: define the HTF bias → wait for clear confirmation → set the stop loss at the invalidation level → take profits at swing targets or liquidity zones. With a large enough sample size, you will find it easier to refine entries, reduce noisy signals, and trade more consistently. Prioritize risk management first, because no setup is 100% accurate. Wishing you successful trading and stronger confidence in your system over time. Do not forget to explore more articles in the Knowledge Hub to continue upgrading your strategy.