Trend strength indicators play a crucial role in helping traders assess whether a trend is strong enough to trade. The market needs to know not only whether it’s rising or falling, but also how sustainable that trend is. By using trend strength indicators, traders can filter out sideways phases, optimize entry points, and improve the effectiveness of trend-following trading.

- Average true range volatility: How traders adjust stop loss placement

- Moving average crossover and how traders identify trend changes

What is a trend strength indicator?

Trend strength indicators are a group of technical analysis indicators used to assess the strength or weakness of a price trend in the market. Instead of simply identifying the direction of price, these tools help determine whether the current trend has enough strength to continue or is weakening and reversing.

Trend strength indicators exist in various forms, such as numerical values, line graphs, or visual signals on price charts. Thanks to these tools, traders can assess the quality of the trend more clearly, thereby making informed entry and exit decisions and increasing the probability of successful trades.

Why trend strength indicators play a crucial role in trading?

Trend strength indicators not only tell traders the direction of price movement but also assess the strength or weakness of the trend. This allows traders to make more informed trading decisions and maintain consistency in their strategies.

- Identifying strong or weak trends: An uptrend or downtrend is only truly worth trading when it has sufficient strength. Indicators like ADX, MACD, or the slope of the Moving Average help traders assess whether the market is in a clear trend phase or just short-term fluctuations.

- Avoid trading in sideways markets: Sideways markets are the “enemy” of trend-following traders. Trend strength indicators act as filters, helping you avoid entering trades when the market lacks momentum, significantly reducing noise trades and unnecessary losses.

- Optimizing entry and exit points: By understanding the strength of the trend, traders can enter trades more confidently, hold trades longer when the trend is strong, and exit trades early when the trend weakens. This helps improve the risk/reward ratio and better control drawdowns.

- Applications in trend-following and breakouts: With trend-following strategies, trend strength indicators help traders “stay with the trend” instead of exiting early. In breakouts, they help confirm whether the breakout has sufficient force or is just a false breakout.

Comparison between trend strength indicators and trend confirmation indicators

In technical analysis, trend strength indicators and trend confirmation indicators are often used in conjunction but serve two different purposes. Understanding the difference will help traders choose the right tool and improve their trading success rate.

Similarities:

- Used to determine the effectiveness and reliability of market trends.

- Helping traders avoid entering trades against the main trend.

- Easily combined with price action and market structure analysis.

- Suitable for trend-following and swing trading strategies.

Differences:

| Trend strength indicators | Trend confirmation indicators | |

| Meaning | Measure the strength of the trend. |

Confirm whether a trend exists. |

|

Time of use |

After identifying the trend | Before or right when a trend is forming |

| Latency | Often more sensitive, it can warn of an early weakening trend. |

There is often a lag because the price needs to move for a while before confirmation. |

|

Trading signals |

The index exceeded the threshold. | A crossover, or price crossing above the baseline. |

| Popular indicators | ADX, MACD Histogram, MA slope, Bollinger Bandwidth |

Moving Average, MA crossover, Trendline, top-bottom structure |

When should each group of indicators be used?

Using the right set of indicators at the right time helps traders understand the market, avoid noise signals, and improve the effectiveness of trend-following trading.

Trend confirmation indicators should be used when:

- Helps identify whether the market is trending or sideways.

- Suitable for new traders who need intuitive, easy-to-observe, and easy-to-apply signals.

- Support in developing and implementing trend-following trading strategies.

- Used to analyze the dominant trend across larger timeframes.

Trend strength indicators should be used when:

- Assess whether the current trend is of sufficient quality to enter a trade.

- Minimize noise signals when the market is moving sideways or lacking momentum.

- Assists in making timely decisions on whether to continue holding or exit a trade.

- Suitable for breakout trading strategies and following strong trends.

Top 5 most effective trend strength indicators

Here are 5 trend strength indicators commonly used by traders:

Average Directional Index (ADX)

Among trend strength indicators, ADX is a crucial tool for traders to assess the quality of a trend. Developed by Welles Wilder, ADX measures the extent of price volatility to determine the strength of the current trend. This indicator does not indicate whether the trend is uptrending or downtrending, but only reflects the strength or weakness of the trend. Information about the trend direction is supplemented through the DMI+ and DMI– lines.

ADX is used to assess the strength of a trend through key price levels.

- When the ADX crosses above 25, the market is considered to be in a strong trend and is worth trading.

- Conversely, an ADX below 20 indicates that the market lacks a clear trend and is often moving sideways.

- If the ADX gradually declines from its highs, it could be a sign that the trend is weakening.

When the ADX remains low for an extended period and then rises back above 20, a new trend is likely to form.

Not only the ADX value, but also the direction of the ADX line clearly reflects the strength of the trend. As the ADX increases, the trend is consolidating and strengthening. Conversely, a decrease in ADX indicates that the trend momentum is weakening.

True Strength Index (TSI)

The True Strength Index (TSI) is a tool that measures trend momentum based on the difference between the average price increase and decrease over a given period. The TSI fluctuates around 0, where a positive value reflects an uptrend and a negative value indicates a downtrend.

Many traders use the TSI indicator in conjunction with technical tools and price patterns to analyze market trends more comprehensively. This combination helps identify trend momentum, detect overbought/oversold areas, and increase the accuracy of entry points.

Rate of change (ROC)

Rate of Change (ROC) is a momentum indicator that measures the strength of a trend and is classified as an effective trend strength indicator. By comparing current prices to past prices, ROC reflects the rate of increase or decrease in the market.

When ROC is above zero, upward momentum prevails; conversely, a negative value indicates a downward trend and the possibility of the market entering an oversold state.

ROC is an indicator that measures the rate of price change by comparing the current closing price to past prices. An increasing ROC indicates a trend gaining strength, while a decreasing ROC reflects a loss of momentum. Therefore, traders can use ROC to assess the likelihood of a trend continuing and to detect early signs of market reversals.

McGinley Dynamic (MD)

The McGinley Dynamic indicator is designed to automatically adapt to market fluctuations, minimizing lag and eliminating false signals. Thanks to its flexible smoothing capabilities, MD provides a clearer view of price movements, particularly effective during periods of high market volatility.

As one of the useful trend strength indicators, the MD line clearly reflects the relationship between price and trend. Price above the MD line indicates that upward momentum is dominant, while price below the MD line indicates a downward trend. Traders can utilize the MD line as a flexible support and resistance level to optimize entry and exit points in line with the trend.

Ichimoku Kinko Hyo

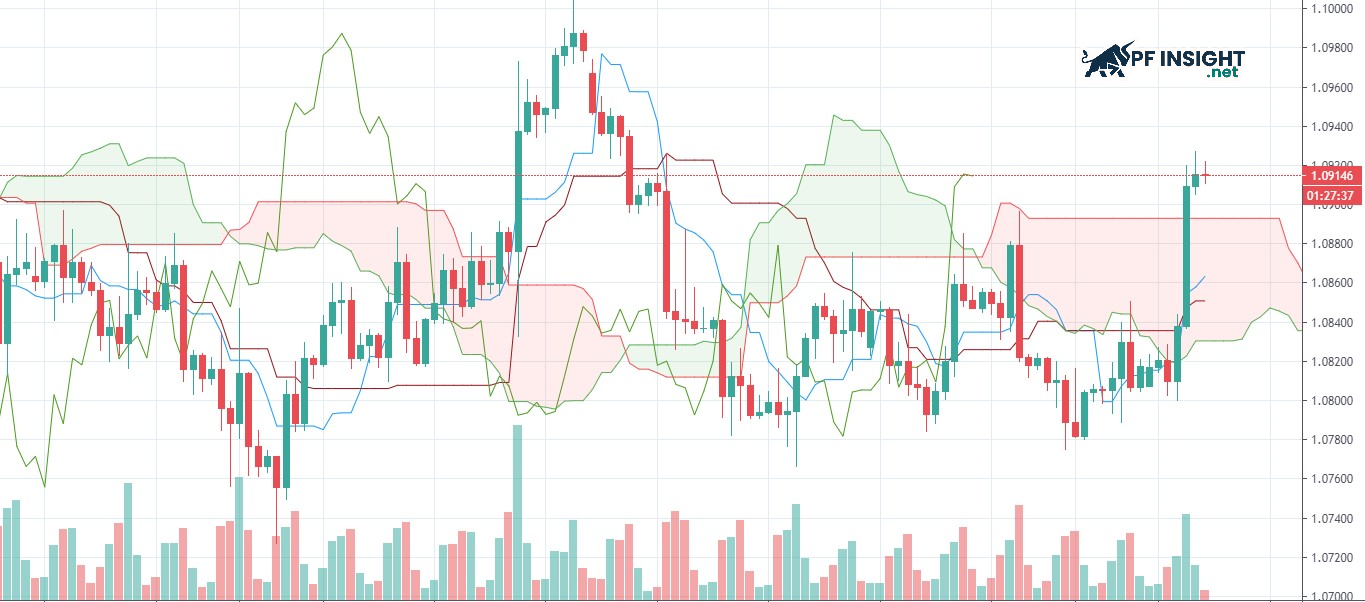

Ichimoku Kinko Hyo, often referred to as the Ichimoku cloud, is one of the most comprehensive trend strength indicators in technical analysis.

This indicator simultaneously provides information on trend direction, market momentum, and key support and resistance zones. The advantage of Ichimoku is its ability to give traders an overall view of the market on a single chart. This system comprises five main components, which combine to form a “cloud” that helps assess the strength and structure of the trend.

- Tenkan-sen (Conversion line): This is a moving average calculated by averaging the highest and lowest prices over a short period, usually 9 periods, to reflect short-term price fluctuations.

- Kijun-sen (Base line): Defined as the average of the highest and lowest levels over a longer period, commonly 26 periods, used to assess the medium-term trend of the market.

- Senkou Span A (Leading Span A): This is the average value of the Tenkan-sen and Kijun-sen, then shifted forward relative to the current price, usually by 26 periods, forming part of the Ichimoku cloud.

- Senkou Span B (Leading Span B): Calculated as the average of the highest and lowest prices over a longer period, usually 52 periods, then shifted forward by the same number of periods as Senkou Span A to create the Ichimoku cloud structure.

- Chikou Span (Lagging Span): This is the current closing price line moved back from the price chart, usually 26 periods, to compare the current price with past price movements.

The position of price relative to the Ichimoku cloud indicates the market trend status. Price above the cloud suggests an uptrend is dominant, while price below the cloud signals a downtrend. The remaining elements of Ichimoku help traders confirm trend strength and establish effective trades.

Advantages and disadvantages of trend strength indicators

Trend strength indicators help traders assess the strength of a trend more clearly, but they also have certain limitations that need to be understood before applying them to actual trading.

Advantage

- It helps traders and investors assess whether the current trend is strong or weak, thereby supporting a more informed trading decision-making process.

- It provides a visual overview of market trend developments, helping traders easily analyze price data and identify potential trading opportunities.

- Trend strength indicators help limit emotional or impulsive trading decisions by applying a systematic analytical method based on trend strength.

- When used in conjunction with other technical indicators, trend strength indicators help traders understand the market context more fully and accurately.

Disadvantages

- Trend strength indicators are susceptible to false signals, especially during periods of high market volatility or when used independently without additional confirmation tools.

- The effectiveness of trend strength indicators is not always consistent, as they may work well with one asset class but be less effective with another or under certain market conditions.

- In many cases, trend strength indicators do not provide clear enough signals, forcing traders to rely on personal experience and analytical skills to make accurate decisions.

- These indicators are often based solely on past price data and may overlook external factors such as economic or political news, or unexpected events that strongly influence market trends.

How to effectively combine trend strength indicators

Properly combining trend strength indicators helps traders not only identify trends but also assess their quality, thereby increasing the probability of successful trades and reducing noise signals. Below are some of the most common and effective combinations.

ADX combined with Moving Average

ADX combined with Moving Average is one of the simplest yet most effective ways to filter quality trends. Moving Average helps identify the market’s main direction, while ADX indicates whether that trend is strong enough to trade.

When the price remains above the moving average (MA) and the MA has a clear slope, the market is confirmed to be in an uptrend. If the ADX simultaneously crosses the 20-25 threshold, this indicates that the trend not only exists but also has enough strength to continue.

The combination of MA and ADX helps traders only enter the market when it is both in the right direction and has momentum, minimizing noise orders and avoiding trading during sideways phases lacking a trend.

ADX combined with RSI

ADX, combined with RSI, helps traders assess both the existence of a trend and the momentum within that trend. ADX determines whether the market is trending, while RSI reflects the strength of buying and selling pressure.

As the ADX gradually increases, this indicates that the trend is consolidating and becoming stronger. If the RSI simultaneously remains above 50 in an uptrend, or below 50 in a downtrend, the market momentum is considered to be in line with the main direction.

This combination is particularly effective in avoiding misinterpretation of RSI overbought/oversold signals, because in a strong trend, the RSI can remain in high or low areas for extended periods without necessarily indicating a reversal.

MACD combined with Bollinger Bands

MACD combined with Bollinger Bands is an effective tool for assessing the true strength of breakouts. Bollinger Bands reflect market volatility and show when prices begin to expand out of consolidation zones, while MACD measures momentum and the acceleration rate of the trend.

When the price breaks out of the Bollinger Bands and the MACD histogram simultaneously expands strongly in the same direction, this indicates a breakout supported by clear momentum and a high probability of continuing. Conversely, if the Bollinger Bands expand but the MACD reacts weakly or inconsistently, traders should be cautious as it could be a false breakout.

The combination of MACD and Bollinger Bands helps traders determine whether a breakout has enough strength to sustain the trend, thereby improving the quality of entry points and reducing trading risk.

Practical trading experience with trend strength indicators

To make the most of trend strength indicators, traders need to look beyond just indicator signals and combine them with analytical methods and trading discipline. Below are some advanced tips to help improve performance sustainably.

- Multi-Timeframe (MTF) analysis: Always start with a larger timeframe to assess the overall trend strength, then look for entry points on smaller timeframes. When a strong trend on H4 or D1 is confirmed by ADX, MACD, or MA slope, signals on lower timeframes will have a higher probability of success and less noise.

- Combine price action and market structure: Trend strength indicators show whether the trend is strong or weak, but price action gives you the right time to act. Combining candlestick patterns, support and resistance zones, and higher high and higher low structures helps avoid entering trades late or during a weakening trend.

- Record and backtest your strategy: No indicator set is absolutely effective without verification. Keep a record of winning and losing trades, trend strength conditions at the time of entry, and your trading emotions. Backtesting on past data helps you understand when trend strength indicators work best and when to stay out of the market.

- Maintain discipline and manage your emotions: Strong trends often last, but they can easily lead to greed or FOMO (fear of missing out). Stick to your plan, only trade when the trend is strong enough according to your criteria, and always manage risk tightly. Discipline and emotional control are key factors in helping traders survive and grow in the long term.

Conclude

In trading, not every trend is strong enough to justify entering a position. Trend strength indicators help traders filter out low-quality signals and confirm when the market is truly gaining momentum. According to pfinsight.net, whether you are a beginner or an experienced trader, using these indicators correctly can support more accurate decision-making, improve emotional control, and enhance trading performance over time.