In financial trading, markets don’t move randomly but always follow recurring patterns over time. Understanding market cycles in trading helps traders identify whether the market is in an accumulation, growth, distribution, or recession phase. By grasping market cycles, traders can choose appropriate strategies, avoid emotional trading, and improve long-term investment efficiency.

- Market structure trading: How traders identify trend and market direction

- Volatility trading concepts that help traders adapt to changing market conditions

- The trendline breakout strategy explained with clear entry and confirmation rules

What are market cycles?

Market cycles reflect recurring patterns of price fluctuations in financial markets over time. In the stock market, cycles are typically defined by the distance between two consecutive peaks or troughs of representative indices such as the S&P 500.

Market cycles in trading reflect the combined impact of recurring economic factors and the psychology of market participants. Even assets less susceptible to cyclical changes, such as certain defensive stocks, can still be affected by investor trading behavior.

Market cycles are composed of various phases and events. Among these, price bubbles and crashes often attract the most attention. However, alongside these periods of significant volatility, the market also experiences more stable phases, acting as a balance for the entire cycle.

How do market cycles in trading work?

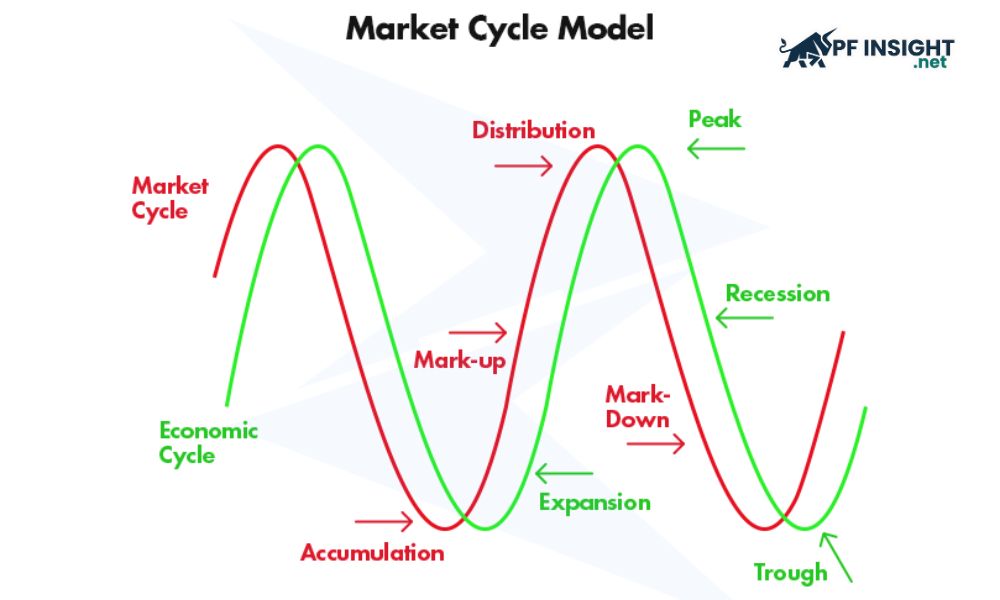

Market cycles in trading consist of four basic phases, which help traders identify current trends and predict future price movements.

Like cycles in nature, market cycles include periods of growth and decline. The biggest challenge is accurately identifying when one phase ends and a new one begins, as these cycles can last from several months to several years, requiring traders to observe and analyze carefully.

Market cycles in trading are primarily formed by price fluctuations around an equilibrium point, where supply and demand are balanced. The equilibrium price constantly changes according to market conditions, and traders take advantage of the difference between the current price and the equilibrium price to buy or sell assets, thereby creating phases of increases, decreases, and corrections in the market cycle.

Market cycles in trading function like a pendulum swinging above and below an equilibrium price, as traders seek profits from price fluctuations. This cycle reflects the overall trend of market sentiment, showing the shift between upward and downward phases.

The basic phases of a market cycle

A market cycle is divided into four phases, from the bull phase to the bear phase. Understanding each phase helps traders predict trends and develop appropriate strategies.

Accumulation phase

During the accumulation phase, pioneering traders begin to return to the market after prices bottom out. They accumulate assets, preparing for a recovery. This phase marks the end of the downtrend and opens up opportunities for growth in the next market cycle.

Depending on the type of market, the accumulation phase may be indicated by rising profits of stock companies, increased demand for the national currency in the Forex market, or higher demand for a specific commodity, suggesting a solid foundation before the market enters a growth phase.

Mark-up phase

Market cycles in trading indicate an upward price movement following a consolidation phase, when market momentum is strengthened. The market moves steadily upwards, creating higher highs and troughs, reflecting an expanding trend and the characteristics of a bull market.

Bullish phases are often accompanied by mixed reactions from experts and the media, as uncertainty remains about whether the market has bottomed out. Some negative indicators, such as the unemployment rate, may still rise, but greed gradually outweighs fear as traders return and begin buying.

The price surge phase ends when the majority of investors agree on a positive outlook. Everyone holds long positions, causing the market to fluctuate above the equilibrium price and prepare for the next phase of stabilization or correction.

Distribution phase

During the distribution phase, market growth slows down as early investors gradually close their positions. The market still lacks a unified view on whether prices are overinflated, creating a temporary equilibrium between supply and demand before the next trend forms.

In market cycles in trading, the distribution phase often sees prices fluctuating within a narrow range before reversing. Technical analysts can identify patterns such as double tops, triple tops, or head and shoulders, which help predict the likelihood of a short-term correction or decline in an asset.

During the distribution phase, the market is vulnerable to fluctuations. Negative information can cause asset prices to fall sharply in a short period of time.

Mark-down phase

A downtrend, or bearish phase, is the most challenging time for traders holding long-term long positions. During this phase, asset prices correct, eliminating accumulated profits that have exceeded their intrinsic value.

In market cycles in trading, when an uptrend ends, traders holding long positions are prone to panic selling, causing prices to fall further below equilibrium. Short rallies may occur as buyers take advantage, but selling pressure remains dominant, pushing prices down further.

Eventually, the market will bottom out, where most traders will stubbornly hold onto their positions and not sell. This phase can last for months or even years before a new accumulation cycle emerges. Typically, only breakthrough news or significant events will stimulate renewed buying demand.

The relationship between market cycles and investor behavior

Market cycles are always closely linked to investor sentiment. By understanding this relationship, traders can better comprehend price fluctuations. The following common scenarios will illustrate how market cycles directly impact market sentiment and investor behavior.

|

Scenario |

Market Sentiment | Investor Psychology |

| The stock price maintained a steady upward trend throughout the growth period. | Positive, high expectations |

Investors are increasingly confident and willing to accept higher risks in order to maximize returns. |

|

Assets consistently reach new highs as the market enters its peak phase. |

Overly excited and confident. | The fear of missing out fuels chasing buying behavior, despite signs of a reversal. |

| Economic indicators reflect a slowdown in growth, signaling an entry into a recession. | Cautious, still hesitant |

Investors may begin withdrawing capital from high-risk assets, shifting to safer investments, or holding cash. |

|

The market began to plummet sharply, leading to a significant drop in prices. |

Panic, pessimism | As risk increases, investors prioritize capital preservation by shifting to safe assets. |

| The central bank implemented an accommodative policy, cutting interest rates to stimulate the economy. | Expectations for recovery, gradually regaining confidence. |

Confidence in the recovery is prompting investors to proactively seek buying opportunities. |

|

Asset prices bottomed out as the economy gradually stabilized. |

Selective optimism | Experienced investors are quietly accumulating undervalued assets, anticipating profits when a recovery trend forms. |

| The market has begun a recovery process after a prolonged period of decline. | Be proactive and ready to seize opportunities. |

After weathering the recession, investors gradually regained confidence and returned to the market. |

Factors influencing market cycles in trading

Market cycles in trading are formed from the interaction between economic conditions and investor behavior. The following key indicators play a crucial role in determining each phase of the cycle.

Monetary policy management

Monetary policy is a key factor influencing market cycles. Through adjusting interest rates and the money supply, central banks guide inflation, stabilize the labor market, and promote economic growth.

For example, following the economic shock of the COVID-19 pandemic in 2020, many major central banks, such as the Fed and the ECB, quickly lowered interest rates to record lows and implemented large-scale fiscal and monetary stimulus packages. This policy helped bring money back into the market, fueling a strong recovery in global stocks during 2020–2021. However, as inflationary pressures increased in 2022–2023, central banks were forced to tighten policy, contributing to slower growth and a reversal of the market cycle.

Fiscal policy

Market cycles in trading are heavily influenced by fiscal policy when the government changes spending levels or tax rates. These measures can either stimulate economic activity or slow down market growth.

For example, following the 1997 Asian financial crisis, the South Korean government implemented fiscal stimulus programs and corporate reforms to restore market confidence. Increased public spending and support for key industries helped the economy recover more quickly, boosting growth and leading to an improvement in the stock market in subsequent years. Conversely, when some countries drastically cut public spending to reduce budget deficits, economic activity weakened, prolonging the market cycle in a state of stagnation.

Global events

In market cycles in trading, global events such as conflicts, natural disasters, or pandemics can disrupt market dynamics. They increase instability, disrupt supply chains, and cause rapid changes in consumer behavior.

For example, trade confrontations between the US and China since 2018, along with recent restrictions on semiconductor chip exports, have caused fragmentation in the global technology supply chain, leading to major disruptions in the electronics manufacturing and investment cycles.

New technology development

New technologies act as catalysts for growth, helping businesses operate more efficiently, expanding industries, and improving overall productivity.

For example, the explosion of artificial intelligence and cloud computing in the 2010s strongly fueled many new growth cycles in the financial markets. Companies like Microsoft, NVIDIA, and Alphabet benefited greatly from this wave of innovation, driving up their stock prices. However, when growth expectations were pushed too high and the cost of capital increased, the market also faced corrections to rebalance the cycle.

Consumer confidence

Market cycles in trading clearly reflect the role of consumer sentiment. When people are confident in the economic outlook, spending increases and fuels growth. However, a weakening in consumer confidence often leads to a slowdown in economic activity.

For example, the Business Confidence Index (BCI) plummeted sharply during the early stages of the COVID-19 pandemic in 2020, reflecting the uncertainty and pessimism of businesses regarding global supply chains and market demand. As confidence hit rock bottom, companies postponed expansion plans and cut capital investments, deepening the economic stagnation. Conversely, the strong recovery of business confidence in 2021, driven by fiscal stimulus packages and vaccine rollout, stimulated a wave of reinvestment and hiring, paving the way for a rapid economic recovery.

Corporate earnings

Improved revenue and profits fuel market growth, but when business performance declines, the risk of recession increases.

For example, in 2023–2024, technology giants like NVIDIA, Microsoft, and Alphabet announced earnings far exceeding expectations thanks to the boom in artificial intelligence (AI). These impressive financial reports not only boosted the stock prices of these companies but also created euphoric sentiment, leading the S&P 500 and Nasdaq to repeatedly reach new highs. Conversely, during the Dot-com bubble burst in 2000, a host of technology companies reported heavy losses and were no longer able to sustain cash flow, leading to a widespread sell-off and a prolonged decline in global stock markets.

Conclude

Understanding market cycles in trading helps traders identify each phase of the market and adjust their strategies accordingly. According to PF Insight, instead of reacting emotionally, traders can make decisions based on the cyclical context, thereby managing risk better and taking advantage of opportunities more effectively in the long term.