When starting forex trading, most traders tend to focus on entry points, indicators, or leverage while overlooking a foundational factor that determines an account’s survival trade volume. Understanding the different lot types in forex is not about trading larger positions but about controlling risk and structuring positions appropriately. This article by PF Insight clearly explains what forex lot types are and how to choose the right position size for your account size.

- What is a pip in Forex trading and why it matters for beginners

- What is leverage in forex and how does it actually work in trading

- Drawdown control methods that help traders protect their trading capital

What is a lot in forex trading

In forex, a lot is a unit of measurement for trade volume, used to determine how many units of a currency pair you are buying or selling. Because price movements in forex are measured in pips, which are very small changes in decimal places, trading individual currency units is impractical. Lots were introduced to group currency units into standardized blocks, allowing traders to trade these small price movements efficiently.

A lot is directly linked to pips and price movement. Each time the price moves by one pip, the profit or loss of a trade changes based on the lot size the trader uses. The larger the lot, the higher the value of each pip, which means profits or losses increase more quickly for the same level of market movement.

For this reason, the concept of a lot is the foundation of position size. Position size is not simply the number of lots you trade but the way you quantify risk for each trade. Without understanding what a lot is and how it affects pip value, traders will find it very difficult to control risk, even if their trading strategy has a high win rate.

Why forex lot types exist

Forex lot types exist to create a clearly structured trading system that helps traders understand the exact size of their positions and manage risk consistently. Because the forex market operates on very small price movements measured in pips, standardizing trade volume through lots is essential to make trading practical and transparent.

Specifically, forex lot types are designed to serve the following three core purposes:

- Standardizing trade volume: Lots clearly define how many units of a currency pair a trader is buying or selling. As a result, all trades are based on the same reference framework, eliminating ambiguity about position size.

- Controlling risk exposure: The availability of multiple lot types allows traders to flexibly adjust trade volume according to account size and risk tolerance. The smaller the lot, the lower the impact of each price movement on the account, which is especially important for beginners.

- Creating a controlled link with margin and leverage: Lot size determines the required margin and the degree to which risk is amplified when leverage is used. Although leverage is often emphasized, lot size is the factor that directly controls the actual risk of each trade.

Thanks to the forex lot type system, traders can not only trade more conveniently but also build a rational position sizing framework, rather than trading based on emotion or short-term profit expectations.

Forex lot types explained

In forex, lots are divided into different types to give traders greater flexibility in controlling trade volume and risk. Each lot type represents a specific number of currency units, which in turn determines the value of each pip and the level of impact that price movements have on the account.

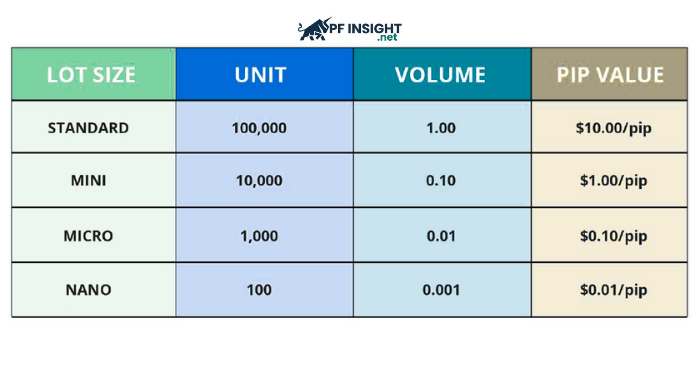

Common forex lot types include:

- Standard lot: A standard lot is the basic lot type in forex, equivalent to 100,000 units of the base currency. With a standard lot, each pip movement usually carries a relatively high value, making this lot type more suitable for traders with larger accounts or solid risk management experience.

- Mini lot: A mini lot is one-tenth of a standard lot, equal to 10,000 currency units. The pip value is significantly lower than that of a standard lot, allowing traders to reduce risk pressure while still maintaining a realistic trading experience.

- Micro lot: A micro lot represents 1,000 currency units, which is one-tenth of a mini lot. This lot type is very popular among beginners because the pip value is small, helping traders become familiar with the market, trading psychology, and position sizing without incurring large losses.

- Nano lot: A nano lot is the smallest lot type, equivalent to 100 currency units. This lot type is commonly used for learning purposes, strategy testing, or demo environments, where the primary goal is to understand market mechanics rather than maximize profit.

How lot size affects your position size

Position size is not simply the number of lots you trade but the actual level of risk you are placing into the market. Lot size directly determines position size because it defines the value of each pip and the amount of profit or loss when price moves.

When lot size increases, the value of each pip increases as well. This means that for the same price movement, the account will be affected more strongly if a trader uses a larger lot. Conversely, a smaller lot size limits the loss per pip, allowing traders to control risk more effectively, especially during the early stages of learning to trade.

To better understand this relationship, consider a simple example using the EUR/USD pair. Suppose you enter a trade with a 20-pip stop loss. If you use a micro lot, each pip has a very small value, so the total risk of the trade remains within a safe range. However, if you place the same trade using a standard lot, the potential loss increases many times over, even though the strategy and entry point remain exactly the same.

The key point to remember is that strategy determines the probability of winning, while lot size determines the level of risk. A proper position size allows traders to survive long enough for a strategy to show its effectiveness, whereas an excessively large lot size can cause serious account damage after just a few losing trades.

How to choose the right lot size for your account

Choosing the appropriate lot size is a foundational decision in forex trading because it directly affects risk levels and account stability. Rather than starting from profit expectations, traders should base this decision on account size, risk tolerance, and their current stage of trading.

To select a suitable lot size, traders need to understand and follow several core principles:

Lot size must match account size: The smaller the account, the more limited the lot size should be. Micro lots or nano lots reduce the value of each pip, thereby limiting losses when the market moves against expectations.

Lot size directly influences trading psychology: When trade volume is too large, traders tend to feel pressured by even small price fluctuations. An appropriate lot size helps traders remain calm and adhere to their trading plan.

Lot size is a risk management tool, not a profit maximization tool: The goal of choosing a lot size is not to make quick money but to control drawdown and protect the account over the long term.

Avoid the emotional mistake of choosing an oversized lot: Increasing lot size to recover losses or to capitalize on a “sure win” often leads to uncontrolled position sizing and a breakdown of trading discipline.

Key takeaways for beginner traders

For new traders, the biggest mistake does not lie in the strategy itself but in how trade volume is used. Lot size is the silent factor that determines the speed at which an account grows or declines, even when trade entries are correct.

Lot size reflects discipline, not skill: Trading large lots does not prove that a trader is more skilled. It only indicates a higher level of risk being accepted.

Controlling lot size means controlling the account: When lot size is kept within reasonable limits, a short series of losses will not destroy overall trading results.

Position size is the foundation of consistency: Consistency in trading does not come from being right repeatedly, but from maintaining stable position sizes across trades.

In the early stage, prioritize learning how to survive: Trading with small volumes gives traders time to observe the market, adjust their mindset, and refine their system without excessive financial pressure.

Conclusion

Forex lot types are not merely technical knowledge but a foundation that helps traders quantify risk and build position sizes appropriate to their accounts. Understanding what a lot is, how different lot types work, and how they affect pip value helps beginners avoid common mistakes from the very beginning. To further strengthen your foundational knowledge, you can read more related articles in the Trading Basics section.