In Forex trading, understanding price measurement units is essential for every investor. One of the fundamental yet crucial concepts is the pip. So, what is a pip, and why does it directly affect profits, losses, and capital management? Mastering this concept will help traders read charts more accurately and calculate risks effectively from the very beginning.

- Drawdown control methods that help traders protect their trading capital

- Risk reward ratio explained and why it matters more than win rate

What is a pip?

Pip stands for Percentage in Point, representing the smallest change in the exchange rate of currency pairs. It’s an important metric that helps traders compare price fluctuations, assess risk levels, and accurately calculate profits or losses when participating in the Forex market.

In the Forex market, a pip is considered the smallest change in the exchange rate. Each pip is equivalent to one percent of 1%, or 0.0001 for most currency pairs, allowing traders to accurately measure price fluctuations.

Most currency pairs in Forex are quoted with four decimal places, so a pip is located at the fourth decimal place, equivalent to 1/10,000. For example, when the USD/CAD exchange rate changes by 0.0001, this is counted as a one-pip fluctuation.

Pip has a similar meaning to bps (basis points) in the interest rate market, as both represent 1/100th of 1%, equivalent to a 0.01% change in financial value.

How do pips affect Forex trading?

In Forex, pips are fundamental to all trading calculations. When traders understand what a pip is, they can better control risk, determine appropriate volume, and avoid making impulsive decisions in volatile markets.

Analyzing market movements

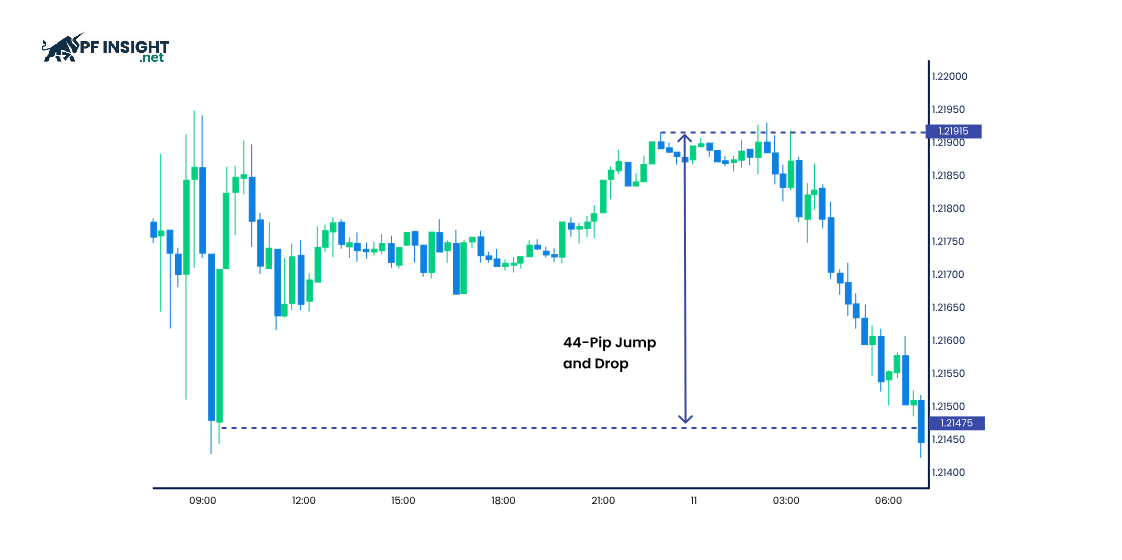

Pips serve as a benchmark for price volatility in Forex. Based on the number of pips increasing or decreasing, traders can easily identify the level of market volatility and manage risk better. For example, a currency pair with large and continuous pip fluctuations often reflects a highly volatile market. Based on this characteristic, traders can adjust their strategies accordingly, choosing to take advantage of the price range to seek profits or applying risk management measures to limit unwanted losses.

Methods for calculating profits and losses

In Forex, pips are the basis for estimating the profit and loss of each trade. When traders understand what a pip is, they can accurately calculate the value of each price movement, thereby anticipating potential profits or losses.

Suppose a trader opens a buy order for the GBP/USD pair at 1.3000 and closes it when the price rises to 1.3050. This trade yields a spread of 50 pips. The actual profit will depend on the value of each pip, which is determined by the lot size the trader used.

Risk management in trading

Pips play a crucial role in managing trading risk. Based on the maximum pip tolerance, traders will set appropriate stop-loss points to limit losses and maintain trading discipline.

Suppose a trader places a buy order for the USD/JPY pair at 150.50 and sets a stop loss at 150.30. This means a risk of 20 pips for the trade. If each pip is worth $9, then the maximum loss the trader can accept would be $180. This calculation helps traders effectively control risk before placing an order.

How calculate pip value

In Forex, the pip value is determined by the currency pair being traded and the role of each currency within that pair. Clearly distinguishing between the base currency and the counter currency helps traders calculate pips more accurately.

Case 1: USD is the quote currency

Pip value = Value traded × Quote currency pip

Let’s assume your trading account uses USD as its currency and you trade the GBP/USD pair, where USD is the quoted currency. With a four-decimal place structure, one pip is equivalent to 0.0001. If the trading volume is 10,000 British pounds, the value of each pip would be 1 USD. If you buy GBP/USD at 1.2500 and close the order at 1.2510, this trade yields 10 pips, equivalent to a profit of 10 USD.

Case 2: USD is the base currency

In cases where the USD is the base currency, such as in the USD/CAD pair, calculating the pip value becomes more complex due to the exchange rate. A common formula is to divide the standard pip value by the current exchange rate and then multiply by the trading volume.

Pip value = Trade value (Pip size ÷ Exchange rate)

Let’s say you’re trading the USD/CHF pair, where USD is the base currency, with the current exchange rate at 0.9100. The value of one pip is calculated by dividing 0.0001 by 0.9100 and then multiplying by the trading volume of $100,000, resulting in approximately $10.99 per pip. If you buy $100,000/CHF at 0.9100 and sell at 0.9101, this trade yields a profit of 1 pip, equivalent to approximately $10.99.

Case 3: Calculating profit and loss

Profits and losses in Forex depend directly on the pip value and trade size. When traders use larger volumes, the level of risk increases, but at the same time, the opportunity for profit is also higher.

For profit

Let’s say you trade the USD/JPY pair with a volume of 300,000 units and close the position at an exchange rate of 150.00 after the price increased by 40 pips. First, the value of each pip is calculated by dividing 0.01 by the exchange rate of 150.00 and then multiplying by 300,000, resulting in approximately 20 USD per pip. Therefore, the total profit of the trade would be 40 pips × 20 USD, equivalent to 800 USD.

For losses

Suppose you open a USD/GBP position with a volume of 200,000 units and close the order at 1.2500 after the price moves in the opposite direction by 60 pips. The value of each pip is calculated by dividing 0.0001 by 1.2500 and then multiplying by 200,000, resulting in approximately 16 USD per pip. Therefore, the total loss for the trade would be 60 pips × 16 USD = 960 USD.

Exception case: USD/JPY

USD/JPY is a unique currency pair in the forex market when it comes to pip calculation. For pairs involving the Japanese Yen, pips are determined at the second decimal place instead of the fourth. This difference stems from the Yen’s smaller denomination, forcing the market to adjust how exchange rates are displayed to reflect reasonable fluctuations.

Let’s say you place an order for the USD/JPY pair with a volume of 10,000 units. In this case, each pip corresponds to a fluctuation of 0.01 yen per unit of currency. Therefore, when the price moves 1 pip, the total value change of the trade will be 100 yen for the entire volume placed in the order.

3 tools that help calculate pips in Forex

In the constantly fluctuating Forex market, modern technological tools help traders calculate pips faster and more accurately. By understanding what a pip is, traders can leverage these tools to simplify the process, save time, and minimize errors.

- Basic pip calculator: With online pip calculators, traders only need to provide information about the currency pair, price level, and lot size to receive an accurate pip value immediately.

- Advanced trading platforms: Most modern Forex trading platforms integrate pip calculators, allowing traders to track and calculate pip values in real time, reflecting the ever-changing market.

- Mobile apps: Forex trading apps on mobile phones are developed specifically for traders, allowing for instant pip calculations and providing many additional essential tools, making trading more convenient and proactive.

Factors affecting pip value

In forex trading, each currency pair reflects its own pip value. This difference arises from the exchange rate, volatility, and trading characteristics of each pair. Understanding this allows traders to make more informed decisions, from choosing which currency pair to trade to adjusting volume and stop-loss levels, thereby minimizing risk.

- Exchange rate: The exchange rate plays a crucial role in determining the pip value. Understanding what a pip is helps traders grasp the relationship between exchange rates and Forex market fluctuations, thereby adjusting their strategies accordingly.

- Currency pairs: In Forex, all price movements are measured in pips; however, the value of a pip varies between currency pairs. This difference stems from the specific exchange rate of each pair. Therefore, major currency pairs like EUR/USD or GBP/USD often have different pip values compared to minor or exotic pairs like USD/ZAR or EUR/TRY, where exchange rates and volatility are usually higher.

- Leverage: Leverage allows traders to open positions much larger than their actual capital by borrowing additional funds from the broker. However, the higher the leverage, the greater the risk. When high leverage is combined with large pip values, even a small pip fluctuation can cause significant losses. This happens because the larger the trade size, the higher the value per pip, making it possible for the account to be depleted quickly if the market moves against expectations.

- Trading volume: Trading volume reflects the size of positions opened in the Forex market over a specific period. This trading size directly impacts the pip value, because the larger the volume, the higher the profit or loss generated by each pip movement.

Effective pip trading strategies in Forex

50 pips a day trading strategy

In the 50 pip/day trading strategy, investors primarily seek short-term profits through numerous quick trades throughout the day. Understanding what a pip is helps traders accurately measure their targets and stop-loss levels. This method is particularly suitable for day trading, aiming to capitalize on small but recurring price fluctuations, targeting approximately 50% of the daily price range of a currency pair.

After a candle closes during a trading session, traders should quickly set up pending orders. Specifically, place a buy order about 2 pips above the closing price and a sell order about 2 pips below. This strategy allows you to catch price movements in any direction the market chooses.

When the price starts to fluctuate, one of the two pending orders will be triggered. At this point, the trader can cancel the other order and focus on exploiting the market’s price swings for profit.

- The take-profit order is set at a target profit level of approximately 50 pips.

- A stop-loss order is used to control risk and can be placed approximately 10 pips higher or lower than the lowest price or entry point, depending on the trading direction.

In the 50 pip per day trading strategy, if the price reaches the profit target, you can close the trade immediately. Otherwise, traders should move the order to the break-even point or stop loss before closing the session. Each successful trade yields at least 50 pips, equivalent to $0.005, and with a volume of 100,000 units, the profit can reach up to $500, ensuring stable income from intraday price fluctuations.

30 pips a day trading strategy

The 30 PIP per day strategy helps traders capitalize on highly volatile currency pairs such as GBP/JPY, AUD/JPY, GBP/AUD, or GBP/NZD. The 5-minute timeframe is ideal, as it provides clear reversal signals, helping to identify precise entry and exit points.

The 30-pip-per-day strategy uses the EMA 10 and EMA 26 to determine market direction. When the EMA 10 crosses the EMA 26, it signals an entry. Understanding what a pip is helps traders identify potential profits from small price movements in a currency pair, while also assessing market sentiment when the price begins to move according to the EMA signals.

Traders can enter trades at high or low prices as soon as the market creates a short-term correction, taking advantage of the price range to generate profit. This strategy is only applicable during corrections, because the price will self-correct according to the main trend, helping to confirm the direction and maximize the chances of success in the trade.

- Open a sell order when the market is in a downtrend, with the EMA 10 crossing the EMA 26 from above and the price continuing to fall.

- Open a buy order when the market is in an uptrend, with the EMA 10 crossing the EMA 26 from below and the price continuing to move upwards.

- Place a stop loss approximately 20 pips above the entry price of the sell order to manage risk.

- Set your take profit approximately 40 pips below the sell price to ensure you profit from the trade.

Conclude

Understanding what is a pip is essential for anyone aiming to become a successful Forex trader. According to PF Insight, knowing what a pip is allows traders to gauge price movements, evaluate risks, and set realistic profit targets, ultimately enhancing decision-making and fostering sustainable trading strategies.