Smart Money Concepts is an analytical method focused on the trading behavior of large financial institutions – the “players” capable of leading market trends. Instead of following traditional indicators, Smart Money Concepts helps traders understand how large sums of money create liquidity, manipulate prices, and identify high-probability entry zones. This is a crucial mindset for those who want to trade like institutions.

- What is Mean Reversion trading? An effective Reversion strategy for traders

- VWAP trading strategy how traders use VWAP in intraday trading

- Pivot Points Trading strategy for support and resistance

What are Smart Money Concepts?

Smart Money Concepts (SMC) is a market approach based on the behavior of institutional investors and large funds. This method helps traders identify how large funds and financial institutions create liquidity, manipulate prices, and form trends.

By analyzing and tracking the behavior of smart money flows, the SMC method helps traders optimize entry points and manage risk.

The nature of how the SMC method works

The Smart Money Concept is considered a crucial foundation in modern technical analysis. This method focuses on studying how investment funds, financial institutions, and professional traders influence market fluctuations through their large-scale buying and selling activities.

According to Smart Money Concepts, market trends are largely driven by a group of investors with superior resources, often referred to as “smart money.” They possess clear advantages in capital, information, and analytical capabilities, allowing them to significantly influence price movements. This group includes professional investment funds, banks, and large financial institutions capable of directing money flows in the market.

SMC emphasizes that by identifying the patterns of smart money, market participants can track this money flow to make informed investment decisions, avoid impulsive trading, and limit unnecessary risks.

In reality, Smart Money Concepts (SMC) are not an accessible method for all investors. Accurately identifying the behavior of smart money requires experience, analytical skills, and considerable patience. Furthermore, Smart Money Concepts cannot completely eliminate risk and do not guarantee trading success under all market conditions.

Key terminology in the Smart Money Concepts method

To fully understand the SMC method, it’s first necessary to grasp the concepts and terminology frequently used in this trading approach.

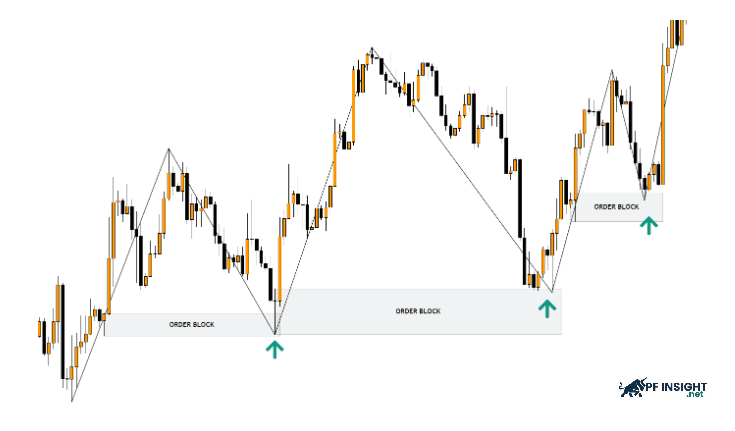

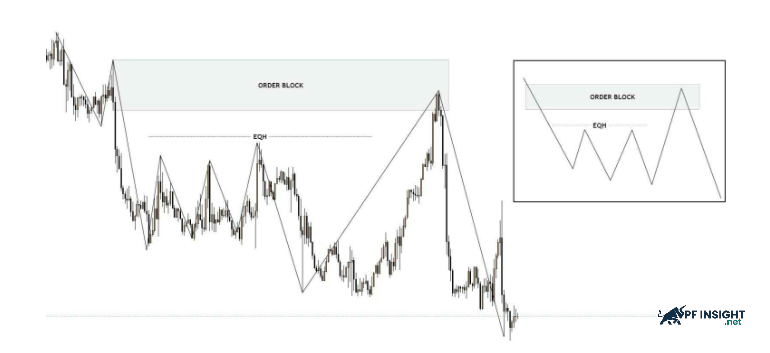

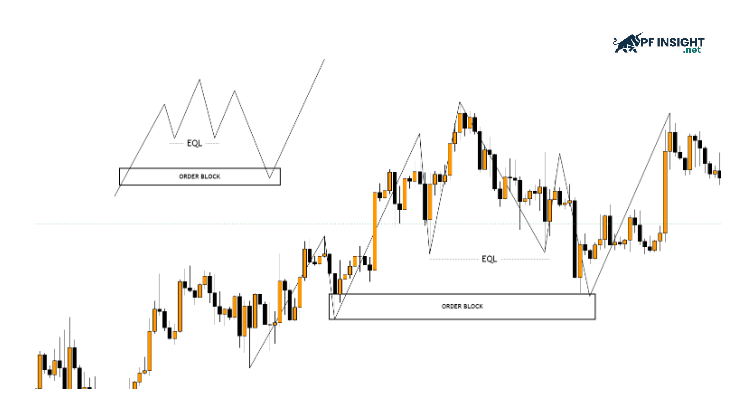

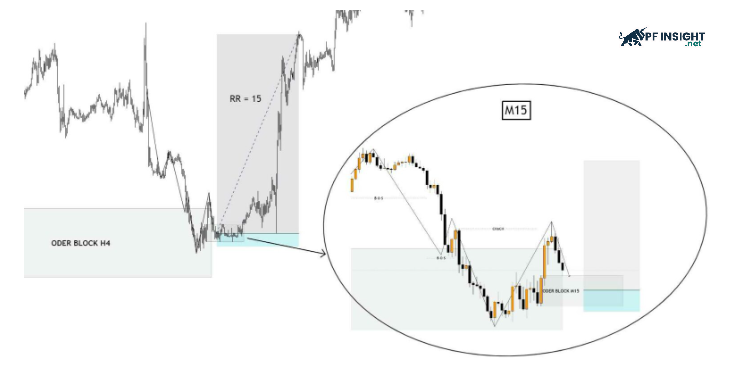

Order Block

Order Block is an important term in technical analysis, particularly popular in the Smart Money Concepts method. This concept refers to a price zone on a chart where unusually large trading volume occurs. Typically, an Order Block is identified by a strong bullish or bearish candlestick with a long body, marking a departure from that price zone. These movements reflect large-scale buying and selling activity from banks, investment funds, and large financial institutions.

Identifying and understanding Order Blocks helps traders analyze charts more effectively, thereby identifying price zones with strong participation from large institutions. These areas reflect potential buying or selling pressure, providing important clues about the future direction and dynamics of the market.

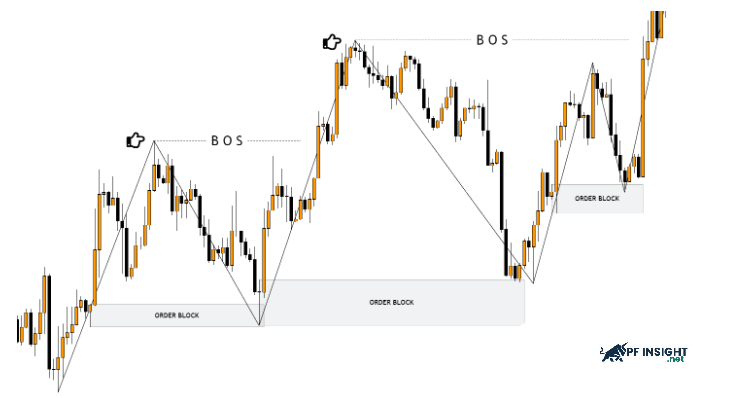

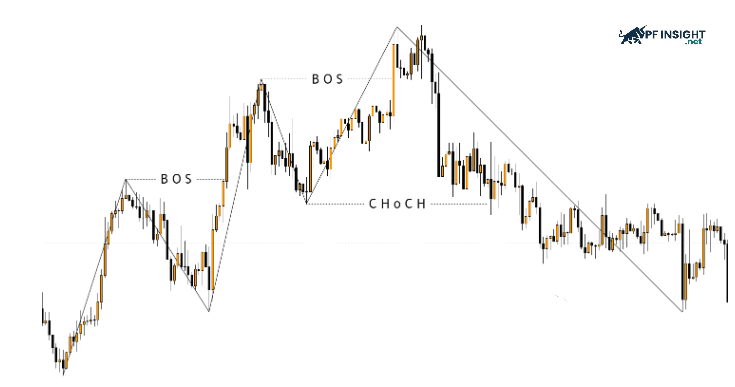

BOS (Break Of Structure)

Break of Structure (BOS) is a key concept in technical analysis, used to describe when the current price structure is broken. This phenomenon usually occurs when the price surpasses key support or resistance zones, indicating a significant change in market behavior and the potential for a new trend to form.

The appearance of the BOS indicates that the current price trend is no longer sustainable. A breakdown of this structure can mark a phase shift between an uptrend and a downtrend. Therefore, the BOS is often considered a crucial confirmation factor, helping traders identify entry points and adjust their trading strategies to suit the new market context.

CHoCH (Change Of Character)

In Smart Money Concepts, CHoCH is a signal reflecting a change in the characteristics of the price structure. Although similar to BOS, CHoCH is often used to identify trend transition phases. Conversely, BOS usually appears afterward to confirm that a new trend has been established and is continuing to develop.

Liquidity

Liquidity refers to the ease with which an asset can be bought or sold in the market. Highly liquid assets allow for quick transactions at low cost, while limiting the negative impact of price fluctuations during the order matching process.

Equal High – levels of equal highs: In many cases, the price will trigger the stop loss of sell orders around the supply zone, then react at the order block. Once the liquidity sweep is complete, the market’s downtrend continues.

Equal Low – levels of equal lows: In many cases, the price will trigger the stop loss of traders placing orders at the demand zone before reaching the order block. After the liquidity sweep, the market’s uptrend continues.

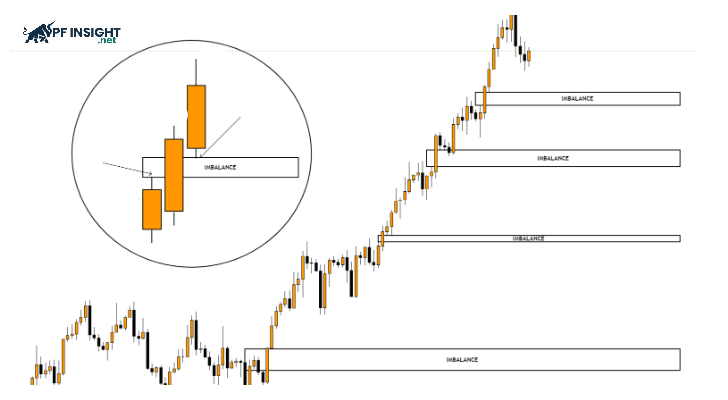

Imbalance

In Smart Money Concepts, an Imbalance represents a price area that has not been fully traded due to a strong discrepancy between buying and selling pressure. When the market stabilizes, the price often retraces to this zone to fill the remaining liquidity. For an uptrend, the Imbalance is identified based on the gap between the high of candle 1 and the low of candle 3; for a downtrend, the opposite principle applies.

Signs of Smart Money Concepts

Smart money activity always leaves distinctive signals in the market, though these aren’t always easy to recognize. Strong fluctuations, sudden increases in liquidity, and changes in momentum often reflect the involvement of large institutions. When traders understand and analyze these impacts, they can identify the direction of institutional money flows and develop trading strategies aligned with the main trend.

Step 1: Identify and evaluate market structure

Identifying the market context is the crucial first step in the Smart Money Concepts method. Traders need to observe the series of peaks and troughs to identify the main trend dominating prices. Additionally, events such as BOS, CHOCH, or shifts in market structure often provide clues about changes in institutional money flow behavior. When these signals appear, they can indicate the end of an old trend and the beginning of a new phase of movement.

Step 2: Identify key liquidity zones

In Smart Money Concepts, liquidity is often concentrated above price peaks and below price troughs. These areas contain numerous stop-loss orders, allowing large institutions to execute large volumes of trades. Identifying equal peaks, equal troughs, and clear support and resistance zones helps traders predict potential price breakouts before the market forms a new trend.

Step 3: Identify key Order Blocks

Observe the strong breakouts that occur after the consolidation phase, as this is a sign that smart money is entering the market. When the price returns to this area, the market usually reacts quickly and decisively because there are still unfulfilled orders. Prioritizing clear order blocks linked to the previous BOS will help increase confidence in trading.

Step 4: Confirm signals using volume and momentum

In Smart Money Concepts, volume plays a crucial role in confirming the behavior of large institutions. High volume during a breakout or when the price sweeps liquidity indicates that the market is being driven by institutional money, not simply noise from retail traders. If accompanied by strong candlesticks and a sudden surge in momentum, the trading signal becomes even more reliable.

Step 5: Analyze price behavior and movement

In the final step, traders should zoom in on the chart to observe the candlestick behavior in detail within the identified price zones. Reactions such as strong price rejections, filling of imbalance zones, or small BOSs indicate that institutions are defending their trading area. When these signals align with the structure on higher timeframes, it is highly likely that the movement is backed by large capital flows.

How to apply the Smart Money Concepts method in trading

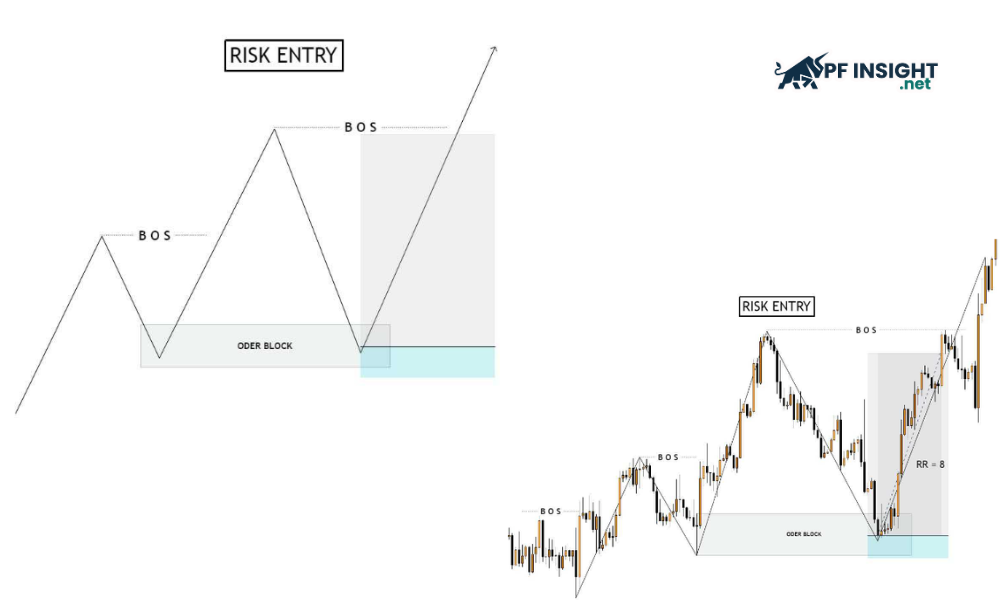

According to Smart Money Concepts, the two basic entry methods widely used are Risk Entry and Confirmation Entry, suitable for different trading styles and risk tolerance levels.

Risk entry

To apply Smart Money Concepts in trading and identify risk-entry entry points, traders need to sequentially perform several key analytical steps.

- Market supply and demand analysis: Combining technical and fundamental analysis to assess the state of supply and demand in the market. Focus on observing how large institutions and smart money participate, thereby understanding their impact on price fluctuations.

- Identifying risk and Entry points: Based on price structure analysis and money flow movements, identify entry points with appropriate risk levels. This process includes marking key support and resistance zones and identifying supply and demand imbalances in the market.

- Establishing risk management: Determine the appropriate risk/reward ratio for each trade based on your personal risk tolerance. Always use tools like stop loss and take profit to control losses and protect profits when the market moves in the right direction.

- Adhere to your trading plan: After clearly identifying your entry points and risk management strategy, execute the trade exactly as planned. Avoid letting emotions influence your decisions, even when the market experiences unexpected volatility.

For example: You can place orders directly on the main timeframe immediately after completing your analysis. For instance, if the main trading timeframe is H4, you can place an order right at the identified Order Block area without waiting for additional signals on a lower timeframe.

Confirmation entry

Confirmation entry differs in that it doesn’t immediately place an order, but requires an additional confirmation step on a smaller timeframe to reduce risk and increase the probability of success for each trade.

- Identifying confirmation signals: Apply technical indicators, price patterns, or candlestick patterns to test the validity of trading signals. Confirmation signals can come from reversal signals, price momentum, or fundamental factors affecting the market.

- Establish specific confirmation criteria: Clearly define the conditions that price must satisfy before entering a trade, such as a moving average reversal, a complete price pattern, or a breakout of a key support or resistance zone.

- Setting entry conditions: After receiving a clear confirmation signal, you place the order as planned and only activate the trade when the price actually meets all the specified conditions.

For example: If you are using the H4 timeframe to determine the overall trend, when the price returns to the Order Block area on H4, patiently wait for a clear reversal signal to appear on a lower timeframe such as M15. Only when this is confirmed should the trade be executed.

Is this method really suitable for traders?

Traders can utilize Smart Money Concepts as part of their trading strategy. However, like any analytical tool, SMC is not a perfect solution and does not guarantee immediate profits. The Smart Money Concepts method helps traders analyze the actions of large institutions in the market, enabling them to make intelligent trading decisions. But to master SMC, traders must have in-depth knowledge and practical experience to understand the signals and implement the strategy accurately.

Each trading method has its own advantages and disadvantages, and Smart Money Concepts are no exception. Traders need to carefully consider these before applying them to optimize trading efficiency.

Advantages of the SMC method

- Predicting the main trend: SMC helps traders identify the overall market trend by monitoring the behavior of market makers, thereby increasing the likelihood of success and minimizing risk.

- Understanding the organization’s workings: The Smart Money Concepts method provides detailed information about the trading behavior of market makers, helping investors grasp the key factors influencing price movements and make accurate decisions.

- Easy to apply for beginners: SMC does not require the use of complex technical analysis tools, making it suitable for new investors who want to understand how smart money flows in the market.

Disadvantages of the SMC method

- Not suitable for all markets: SMC is not suitable for all financial markets, especially new markets, those with low liquidity, or those with a limited number of participants.

- High level of experience required: The Smart Money Concepts method requires traders to have in-depth knowledge and experience in market analysis to make accurate and effective trading decisions.

- Based on the market maker hypothesis: SMC relies on the activity of “sharks” in the market, which makes the method vague and uncertain, posing risks to inexperienced investors.

Conclude

Smart Money Concepts (SMC) is a powerful method that helps traders understand the behavior of market makers and predict price movements. However, mastering it requires experience and in-depth analytical knowledge. Using SMC carefully will help optimize profits and reduce risks, see PF Insight for more details.