In financial markets, price does not always move in a clear trend. Many periods are defined by sideways price movement, where prices fluctuate within a limited range and make directional predictions difficult, especially for beginners. In such conditions, strategies that rely heavily on trend identification often struggle to perform consistently. This is why the grid trading strategy is frequently discussed in the context of sideways markets, as it does not depend on forecasting direction. Instead, it attempts to profit from repeated price fluctuations within a defined range.

- Profit taking strategy – How to know the right time to lock in your gains?

- Unlock the power of breakout strategy for Prop Firm challenge and maximize your wins

- Types of arbitrage strategies every trader should know

What is the grid trading strategy

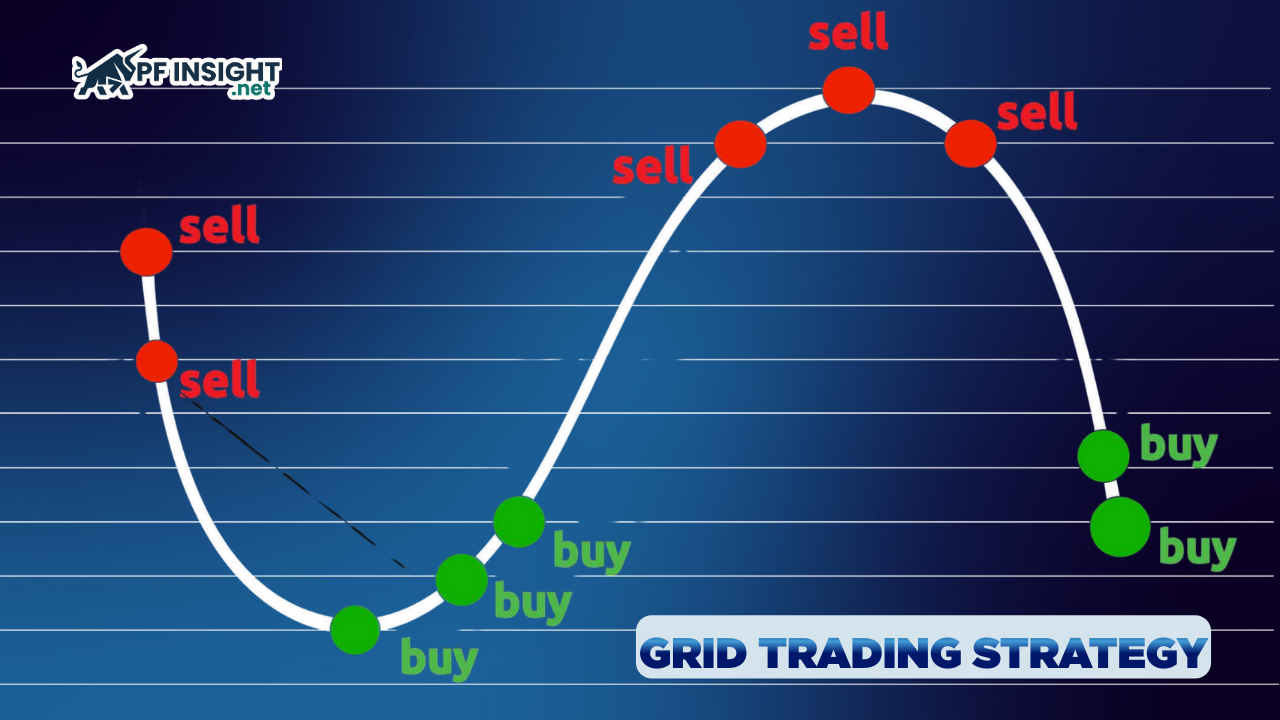

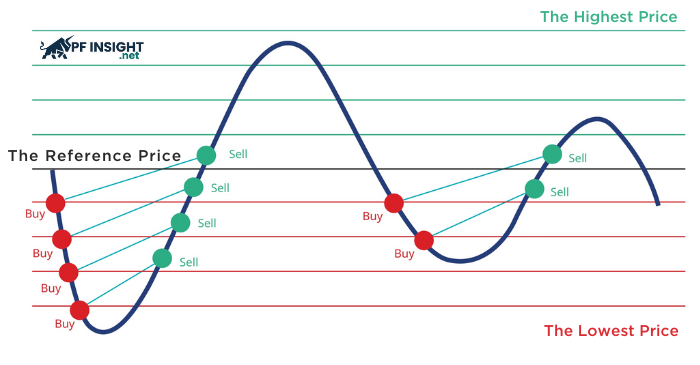

A grid trading strategy is a trading method in which a trader pre-places multiple buy and sell orders at different price levels, forming a grid-like structure around the current price area. Instead of entering a single position and waiting for the price to move in one specific direction, this strategy breaks the trade into multiple smaller parts, each corresponding to a price level within a defined range.

The core of a grid trading strategy lies in taking advantage of price fluctuations. When price falls to a lower grid level, a buy order is triggered. When the price rises to the next grid level, a sell order is executed. This process can repeat many times as long as the price continues to fluctuate within the predefined range, without requiring the trader to predict whether the market will move up or down.

Orders in grid trading are usually placed at equal price intervals, known as grid spacing. This spacing determines trading frequency and the expected profit per trade. A tighter grid results in more frequent trades but smaller profit per execution, while a wider grid reduces trading frequency and requires larger price movements to generate profit.

At a basic level, a grid trading strategy is designed to perform best when the market lacks a clear trend. Because it does not rely on forecasting price direction, this approach is often considered suitable for newer traders who are becoming familiar with sideways market conditions.

Why sideways markets create opportunities for grid trading

Sideways markets are periods when the market lacks a clear trend, but that does not mean trading opportunities are absent. On the contrary, the following characteristics of range-bound markets create favorable conditions for a grid trading strategy.

- Price repeatedly fluctuates within a defined range: Sideways markets often form relatively stable upper and lower price boundaries, where price frequently reverses instead of moving in a sustained direction.

- Highs and lows form around familiar levels: When price repeatedly tests similar areas, a grid trading strategy can take advantage of this repetitive behavior without needing to forecast a trend.

- Volatility is sufficient to trigger multiple grid orders: Sideways markets typically show moderate volatility, allowing price to reach multiple buy and sell levels within the grid without breaking the overall trading structure.

- False breakouts occur frequently: Unstable breakouts tend to create noise for trend-following strategies, while grid trading can continue operating effectively within the established price range.

- No reliance on predicting market direction: A grid trading strategy focuses on reacting to actual price movement rather than trying to predict whether the market will rise or fall.

Because of these characteristics, sideways markets are often considered the most suitable environment for a grid trading strategy to perform effectively, especially on short- to medium-term timeframes.

How the grid trading strategy attempts to profit

Instead of searching for a single trade in the “right direction,” a grid trading strategy aims to generate profits through multiple small trades executed repeatedly within a defined price range. This mechanism can be understood through the following basic steps.

- Defining a trading price range: The trader sets upper and lower boundaries of a sideways range where price is expected to continue fluctuating for a certain period.

- Dividing the price range into fixed order levels: These price levels form a grid, with buy orders placed below a reference price and sell orders placed above it.

- Automatically triggering orders as price moves: When price falls to a level within the grid, a buy order is executed. When the price rises to the next level, the corresponding sell order is triggered.

- Capturing profits from each small price swing: Each cycle of buying low and selling high within the grid generates a small profit, rather than relying on a single large price movement.

- Repeat the process as long as the price remains within the range: The strategy continues to operate effectively while the market stays sideways, allowing many small trades to accumulate into an overall result.

This approach reflects the core nature of a grid trading strategy, which focuses on exploiting repetitive price movements rather than attempting to predict the future direction of the market.

Key risks beginners should understand

For many beginner traders, grid trading strategies are often seen as a “safe” approach because they do not require predicting market direction. However, this very approach carries risks that beginners tend to underestimate if they only focus on favorable sideways market conditions.

Grid trading only works well when the market maintains a sideways structure

The entire logic of the strategy is based on the assumption that price will continue to move back and forth within a familiar range. When the market breaks out of this range and starts forming a strong trend, grid orders are no longer closed as expected, causing losing positions to accumulate rapidly.

Multiple small trades can create a false sense of safety

Each grid order usually carries relatively small risk, but when many positions are opened at the same time, the total account exposure can be much larger than beginners initially realize.

Drawdowns often come before profits

In practice, a grid trading strategy can experience prolonged drawdowns before sell orders are fully triggered. This requires a high level of patience and discipline. Without it, traders may close positions too early or disrupt the grid structure before the right moment.

Capital management matters more than the strategy idea itself

Grid spacing, position size per order, and total allocated capital determine the real level of risk. A poorly designed grid can make the strategy fragile, even if the market remains sideways.

Psychological factors are often underestimated

Monitoring many open positions at once, especially during periods of increased volatility, can create significant psychological pressure. For beginners, a lack of experience in emotional control often leads to premature intervention or inconsistent decision-making.

Conclusion

The grid trading strategy is designed to take advantage of repetitive price fluctuations in sideways markets, where predicting trends is often ineffective. By breaking trades into multiple buy and sell orders arranged in a grid structure, this strategy aims to generate profits from small price movements within a defined range. For beginners, the grid trading strategy should be viewed as a conditional trading tool that requires a clear understanding of risk and proper capital management before being applied.

We wish traders success in finding suitable trading approaches, and invite you to follow our articles at Pfinsight.net