The trend following strategy has long been one of the foundational trading approaches, not because it promises quick profits, but because it emphasizes consistency in the trading process. In market conditions that are constantly changing and difficult to predict, many traders continue to choose trend following as a clearly structured approach. Rather than attempting to predict market tops and bottoms, this method focuses on following the direction of price movement. This mindset is what makes trend following strategy a long-term choice for many traders. Join Pfinsight.net as we take a deeper look at trend following strategy.

- Unlock the power of breakout strategy for Prop Firm challenge and maximize your wins

- Types of pullback – How to identify and trade each one

- Martingale strategy for trading how it works and why many traders fail

What is a trend following strategy

A trend following strategy is a trading approach that focuses on identifying and following the primary market trend, rather than attempting to predict short-term reversal points. The emphasis of this strategy is not on buying at the bottom or selling at the top, but on participating in the market once a trend has formed and been confirmed.

Unlike speculative approaches, trend following strategy operates based on clear and repeatable rules. Traders act only when the market shows a sufficiently strong trend and accept that not every trade will be profitable. Instead, the strategy aims to maintain a consistent process and capture major trends over time.

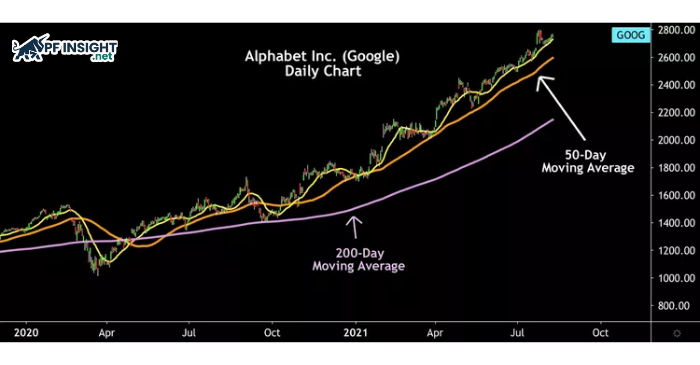

In practice, trend following is commonly built around simple but effective tools such as moving averages, breakout levels, or momentum indicators. These tools help traders filter out short-term price noise and focus on the dominant direction of price, forming the foundation for many long-term trading systems and systematic trading.

When a trend is confirmed through such rules, the key factor determining trading performance is no longer the accuracy of individual trades, but the ability to maintain consistency in executing the strategy over time.

Why consistency matters more than accuracy in trading

In trading, many traders focus too heavily on predicting the market correctly, believing that a high win rate will guarantee long-term profitability. In reality, accuracy is not the decisive factor for sustainable success. A strategy can win fewer trades and still be profitable, as long as it is executed consistently.

To better understand this difference, it can be viewed as follows:

- Accuracy in trading refers to correctly predicting the price direction of each individual trade.

- Consistency in trading is the ability to follow the same trading process over hundreds of trades, regardless of short-term results.

- A trader with high accuracy but poor consistency often breaks discipline after a few losing trades.

- In contrast, a trader with strong consistency can accept many small losses in exchange for long-term edge.

Consistency goes beyond entry timing. It also includes risk management, exit discipline, and emotional control. When traders constantly change their approach because of a few disappointing results, the statistical edge of a strategy is quickly eliminated. By contrast, consistently executing a stable framework allows cumulative results to work over time.

This is the core strength of trend following strategy:

- The strategy accepts a relatively low win rate.

- It prioritizes cutting losses quickly when the market moves against the trend.

- It focuses on holding positions longer when major trends emerge.

- Profits come from a small number of large winning trades that offset many small losses.

In the long run, trading is not a game of exceptional predictions, but a matter of expectancy and execution discipline. It is consistency in approach, not the accuracy of individual trades, that enables traders to survive and grow sustainably in the market.

How trend following strategy adapts across market conditions

One reason trend following strategy maintains consistency is its ability to adapt to different market conditions, rather than only performing well in ideal environments. This approach does not attempt to control the market, but instead adjusts its response based on actual price behavior.

How trend following responds to different market conditions:

- When the market shows a clear trend: Trend following performs most effectively. Traders can hold positions longer to capture large price moves, where a small number of winning trades generate most of the profits.

- When the market consolidates or moves sideways within a trend: Consolidation phases are treated as natural pauses rather than reversal signals. The strategy accepts small losses or continues to hold positions as long as the trend structure remains intact.

- When the market becomes highly volatile: Trend following does not react emotionally to every price swing. Traders may reduce position size, widen stop losses, or wait patiently for clearer signals while maintaining the same trend-based logic.

What remains unchanged across all market conditions:

- No attempt to predict tops or bottoms

- Risk management is always prioritized

- Strict adherence to entry and exit rules

- Consistency is valued above short-term profits

This stability in mindset and execution allows trend following strategy to adapt across market cycles without losing its long-term edge.

Common misconceptions about trend following

Although it has been widely used and has existed in the markets for a long time, trend following strategy is still often misunderstood, especially by traders who are new to this approach. The misconceptions below cause many people to underestimate the true effectiveness of trend following.

Trend following enters trades too late

One of the most common misunderstandings is the belief that trend following always enters trades late and misses most of the profit. In reality, this strategy deliberately enters after a trend has been confirmed in exchange for a lower probability of being wrong. The goal is not to capture the entire move from the very beginning, but to participate in the safest portion of the price movement.

Trend following has a low win rate, so it is ineffective

Trend following typically has a relatively low win rate, which can easily discourage many traders. However, the effectiveness of a strategy is not measured by win rate, but by long-term expectancy. In trend following, a small number of large winning trades can offset many small losses, as long as the trader maintains discipline.

Trend following only works in ideal market conditions

Many believe that trend following is only suitable when the market shows a clear and smooth trend. In practice, the strategy is designed to survive through difficult trading periods. Even though it may experience losses in ranging or highly volatile markets, trend following aims to preserve capital and remain ready to capitalize on major trends when they emerge.

Trend following is a simple strategy that requires no skill

The simplicity of the tools used in trend following often leads traders to underestimate it. However, the most challenging aspect of this strategy does not lie in indicators or patterns, but in the ability to follow rules consistently and control psychology. Accepting a series of small losses and patiently waiting for a major trend requires far more discipline than it may appear on the surface.

Conclusion

A trend following strategy is not an approach that promises quick profits, but one that focuses on discipline and consistency in trading. This strategy works effectively because of its ability to adapt to different market conditions, rather than relying on short-term predictions. Instead of seeking perfect accuracy, trend following prioritizes a repeatable process and strict risk management. Over time, the edge of the strategy comes from a small number of major trends that compensate for many small losing trades. This long-term mindset and stability in execution are what continue to make trend following strategy trusted and widely applied by traders.

We wish readers effective trading, strong discipline, and sustainable results on their trading journey.