The ATR indicator, short for Average True Range, is a technical indicator designed to measure market volatility rather than predict price direction. For beginners, understanding this distinction is critical. Many new traders focus on whether price will move up or down, while overlooking a more important question: how much the market is likely to move.

Volatility plays a central role in trading decisions, directly influencing position sizing, stop-loss placement, and overall risk management. A low-volatility market behaves very differently from one experiencing strong price swings, even if the broader trend appears similar. The ATR indicator helps traders quantify this factor by reflecting how active or quiet the market truly is.

This article will help you understand how the ATR indicator works, why volatility matters, and how beginners can use ATR for risk management rather than treating it as a buy or sell signal.

- Ichimoku cloud how it works in real trading

- RSI indicator common errors beginners often overlook

- Stochastic oscillator simple methods beginners can apply

What is the ATR Indicator

The ATR indicator is a volatility measurement tool developed by J. Welles Wilder Jr. Rather than indicating whether price is moving up or down, ATR focuses on the magnitude of price movements over a specific period.

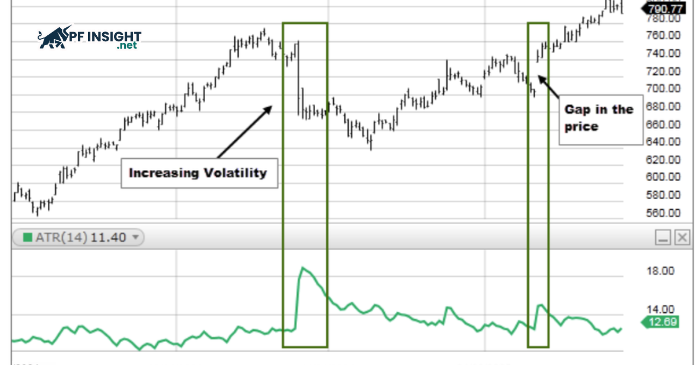

In essence, ATR reflects how “active” the market is. When ATR increases, it signals expanding volatility and wider price ranges. When ATR decreases, it indicates that the market is becoming quieter. This allows traders to assess whether current market conditions are suitable for trading.

Because ATR automatically adapts to the unique volatility characteristics of each market, it can be applied across different asset classes and timeframes. Whether trading stocks, forex, or cryptocurrencies, the ATR indicator helps traders evaluate volatility in an objective and consistent way, providing important context that price action alone may not clearly reveal.

How the ATR Indicator measures volatility

The ATR indicator helps traders understand market volatility by answering a simple question: how much does price typically move over a given period? Instead of focusing on whether price is rising or falling, ATR concentrates on the width of price fluctuations.

ATR is calculated based on the differences between key price levels in each trading session and compares them with the previous session. This approach allows ATR to capture both intraday movements and sudden changes that occur at market open, providing a more complete picture of volatility.

When ATR is low, the market is often moving sideways or lacking momentum, and small price movements are more likely to create noise. When ATR increases, it indicates that the market is entering a more active phase, where larger price movements occur more frequently.

For beginners, ATR can be seen as a measure of the market’s “breathing rhythm.” It helps adjust expectations, avoid placing stop losses too tightly in volatile conditions, and prevent overly aggressive trading when the market is quiet.

How traders use the ATR Indicator in trading

Traders commonly use the ATR indicator in the following ways:

- Assessing market conditions: ATR helps determine whether the market is experiencing low or high volatility, allowing traders to decide whether to trade more aggressively or take a more cautious approach.

- Identifying potential breakout phases: When ATR stays low for an extended period and then begins to rise, it often signals that volatility is expanding and the market may be preparing for a strong move.

- Filtering out noisy trading signals: In low-volatility environments, many technical signals tend to lose effectiveness. ATR helps traders avoid trading during these conditions.

- Adjusting expectations for price range: ATR provides a more realistic view of how far price is likely to move, helping traders avoid expectations that are too high or too low relative to current market conditions.

- Supporting trade management and risk management: By using ATR, traders can adjust entries, trade duration, and risk levels to better align with the current level of volatility.

Using the ATR Indicator for stop loss and exits

The ATR indicator is widely used to determine stop-loss and exit levels based on volatility rather than fixed price points. This approach helps traders manage risk more effectively across different market conditions.

Placing stop losses based on ATR

Traders often place stop losses at a multiple of the ATR value from the entry point, such as 1 or 2 ATR, so the stop level reflects the market’s natural price range.

Avoiding stop-outs caused by short-term volatility

When stop losses are set using ATR, price has enough room to fluctuate before reaching the stop level, reducing losses caused by market noise.

Using ATR for trailing stops

Stop losses can be adjusted in a favorable direction as price moves with the trend, based on the ATR value. This helps protect profits without requiring precise reversal predictions.

Adjusting exits according to volatility

When ATR changes significantly, traders can adjust their exit strategy to better match current market conditions.

Advantages and limitations of the ATR Indicator

Like any technical tool, the ATR indicator has clear strengths as well as limitations that need to be properly understood. Knowing both sides helps traders use ATR in a more effective and realistic way.

Advantages of the ATR indicator

- Measuring volatility in a clear and intuitive way: ATR allows traders to quickly see whether the market is quiet or highly volatile without complex analysis.

- Flexible across markets and timeframes: ATR can be applied to stocks, forex, cryptocurrencies, and multiple timeframes while maintaining consistent behavior.

- Supporting effective risk management: Using ATR to set stop losses and trailing stops helps ensure exit levels reflect actual market conditions rather than fixed price distances.

- Reducing emotional trading: When decisions are based on volatility, traders are less influenced by emotions caused by short-term price fluctuations.

Limitations of the ATR indicator

- Does not indicate price direction: ATR is not a buy or sell signal and cannot predict whether the market will move up or down.

- Has inherent lag: Because ATR is calculated from historical price data, it reacts more slowly to sudden market changes.

- Easily misused by beginners: Many new traders attempt to use ATR as a standalone entry signal, which often leads to context-free decisions.

- Requires combination with other tools: ATR is most effective when used alongside trend analysis, price action, or other technical indicators such as RSI or moving averages.

Conclusion

The ATR indicator helps traders understand market volatility rather than focusing solely on price direction. For beginners, ATR should be viewed as a tool that provides context, not as a standalone buy or sell signal. When used correctly, ATR supports proper stop-loss placement and risk management based on market conditions. Combining ATR with trend analysis and price action allows traders to trade with greater discipline and consistency.

Follow PF Insight to continue expanding your trading knowledge. In addition, the Technical Analysis section offers foundational articles to help beginners develop a proper technical analysis mindset.