The liquidity grab strategy is one of the key concepts within smart money concepts and is used to explain why the market frequently creates liquidity sweeps before moving in its true direction. For many new traders, these sweeps are often mistaken for real breakouts or reversal signals, leading to poorly timed entries and causing them to be pushed out of the market within seconds.

This article from Pfinsight.net will help beginners understand what a liquidity grab strategy is, how to identify an effective liquidity sweep, and simple methods that traders of all levels can use to mark liquidity zones.

- Stop loss strategy for new traders – From basics to advanced

- Scalping trading techniques tools that improve execution speed

- Anti Martingale strategy how this method helps traders grow profits safely

What is a liquidity grab strategy?

The liquidity grab strategy is a trading approach based on observing how the market attracts liquidity at locations where many pending orders or stop losses are clustered. This behavior is common within smart money concepts, where large institutions use available liquidity to facilitate a strong, directional price move.

In financial markets, liquidity often accumulates in familiar areas such as

- Recent highs and lows

- Clear support and resistance levels

- Zones that form recognizable price patterns

- Areas where the majority place their stop losses

When price approaches these areas, it often creates a brief move above a high or below a low to trigger pending orders. This is the phenomenon known as a liquidity grab. After liquidity is collected, price typically reverses or begins forming a new trend.

The liquidity grab strategy helps traders understand the mechanics behind false breakouts and avoid being misled by the market. This method not only reduces mistaken entries but also opens opportunities to trade from locations with more favorable risk-to-reward conditions.

How to spot a liquidity grab

To identify a liquidity grab, traders need to observe how price approaches liquidity zones and how candles react at the moment of the break. A liquidity grab usually happens quickly: price breaks an important level and immediately reverses, leaving a long wick that signals strong market rejection.

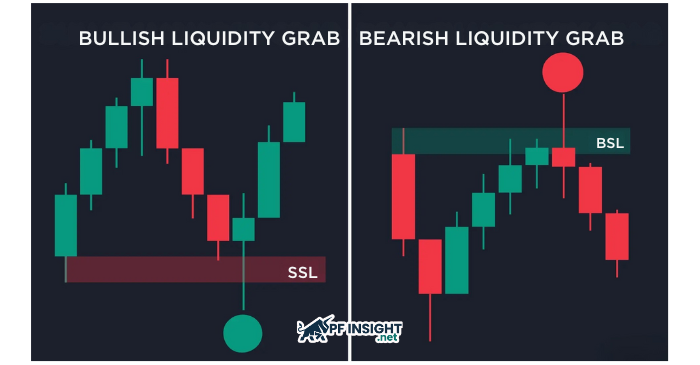

Bullish liquidity grab

A bullish liquidity grab occurs when price sweeps below sell-side liquidity (SSL), such as a previous low where many buy-side stop losses are placed.

Key signs include

- Price breaks the low but fails to hold below it

- The candle forms a long lower wick with a small body

- Price strongly reverses upward and closes above the swept area

This shows that selling pressure has been absorbed and liquidity has been collected. After the sweep, the market often reverses to the upside.

Bearish liquidity grab

A bearish liquidity grab occurs when price sweeps above buy-side liquidity (BSL), where many buy orders and sell-side stop losses are located.

Main characteristics:

- Price takes out the high but lacks continuation strength

- The candle leaves a long upper wick with a small body

- Price reverses downward and closes below the breakout level

This indicates that sellers used buy-side liquidity to enter with large volume, leading to a subsequent decline.

Common elements of an effective liquidity grab

Whether bullish or bearish, you will typically see three components:

- Fake breakout above a high or below a low

- Long wick signaling strong liquidity absorption

- Quick reversal immediately after the liquidity is triggered

When all three elements appear together, the probability is high that the market has just completed a liquidity grab and is preparing for a true directional move.

Simple methods beginners can apply to spot liquidity zones

For beginners, identifying liquidity zones does not need to be complicated. By understanding basic market behavior and applying a few simple techniques, you can easily spot areas where price is likely to create a liquidity grab. Here are the most effective and easy-to-apply methods.

Identify recent highs and lows

This is the foundational method. Liquidity often concentrates around:

- Short-term highs

- Short-term lows

The reason is that most traders place stop losses at these levels. When the price approaches them, the market tends to create a small break to trigger those orders before moving in the opposite direction.

Mark confluence zones where price has reacted multiple times

Liquidity zones often form in areas where price has:

- Touched repeatedly

- Been strongly rejected

- Formed common patterns such as double top, double bottom, or range

These areas attract both stop losses and pending orders, creating thick liquidity pools.

Observe long wicks at key areas

Long wicks signal liquidity absorption. When you see a long wick forming at a high or low, it is a strong indication that larger players are filling orders and a potential reversal may occur.

Use market structure to increase accuracy

Market structure is extremely useful for confirming whether an area truly contains liquidity. A simple rule for beginners:

- In an uptrend: liquidity typically sits below short-term lows

- In a downtrend: liquidity typically sits above short-term highs

When price breaks these levels but quickly returns, it is often a liquidity grab.

Mark areas where the crowd is easily trapped

Smart money often sweeps liquidity in locations where retail traders frequently make mistakes, such as

- Candle breakout attempts at range boundaries

- False trendline breaks

- Support/resistance levels that are briefly swept before reversing

- Stop-loss runs during news events

These are ideal entry locations for applying a liquidity grab strategy.

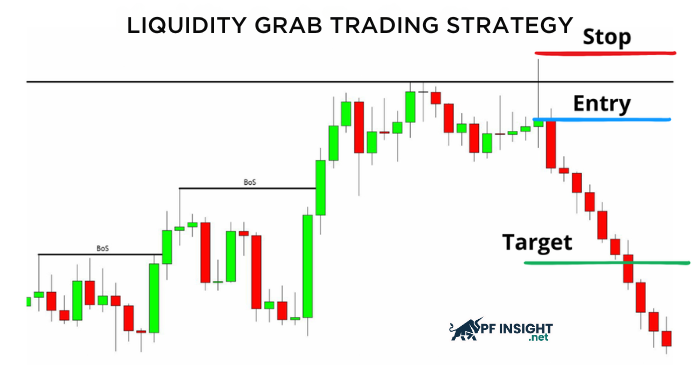

Common mistakes beginners make when trading liquidity grabs

The liquidity grab strategy offers a major advantage when traders understand how the market collects liquidity. However, most beginners frequently make mistakes because they misunderstand the concept or enter too early. Here are the most common errors and how to avoid them.

Confusing a liquidity grab with a real breakout

One of the biggest mistakes beginners make is assuming that a strong break signals the start of a new trend. In reality, most short-term breaks exist only to collect liquidity before reversing.

How to avoid it:

- Always wait for price to close back into the previous zone

- Do not enter a trade just because price breaks a high or a low

Entering too early before liquidity is collected

Many traders rush into a position as soon as the price touches a liquidity zone, causing them to be stopped out when the candle sweeps deeper.

How to avoid it:

- Wait for a clear rejection signal: long wick, small body, and a close back into the zone

- Do not guess how deep the sweep will go; react only when the market provides confirmation

Expecting every high or low to generate a liquidity grab

Not every high or low will be swept. Liquidity forms only in areas where the market has a reason to move.

How to avoid it:

- Combine liquidity analysis with market structure

- Prioritize confluence zones or areas where price has reacted multiple times

Ignoring momentum after the sweep

Even if a liquidity grab occurs, price can still move sideways or continue its previous trend if momentum is weak.

How to avoid it:

- Wait for an additional candle that shows clear direction

- Avoid trading when the market is weak or volatility is low

Using oversized positions during high volatility

Liquidity grabs occur in highly volatile conditions, increasing the chance of slippage or deep stop-loss spikes.

How to avoid it:

- Reduce position size

- Use wider stop losses based on market structure

Trading without a clear exit plan

Many beginners focus only on entries and fail to plan exits, causing them to take profit too early or hold trades too long.

How to avoid it:

- Set targets based on the next structural zone (supply or demand)

- Have rules to exit when the market loses momentum

Conclusion

The liquidity grab strategy helps traders understand why the market creates false breakouts and how liquidity is collected before the price makes its true move. By identifying high-liquidity zones, observing price reactions, and applying simple methods, beginners can avoid traps and enter trades at better locations. When combined with clear confirmations and proper risk management, this strategy becomes a useful tool for safer and more effective trading.

Learn more and optimize your trading performance by exploring the articles in Technical Analysis.