Swing trading strategies are the core of the swing trading method, a trading approach that focuses on capturing short and medium term price movements. Instead of seeking minute-by-minute profits like day trading, swing trading targets broader market moves and typically holds positions for several days to several weeks.

In this article, PF Insight provides a deeper look into how swing trading works, the strategies traders commonly apply, how to set an optimal risk to reward ratio, and the common mistakes that cause traders to lose balance between risk and profit.

- Position trading how long term strategies help traders reduce noise

- Avoid these 7 common mistakes in prop trading to maximize your profits

- Asymmetric trading how to maximize profit potential with controlled risk

What is swing trading?

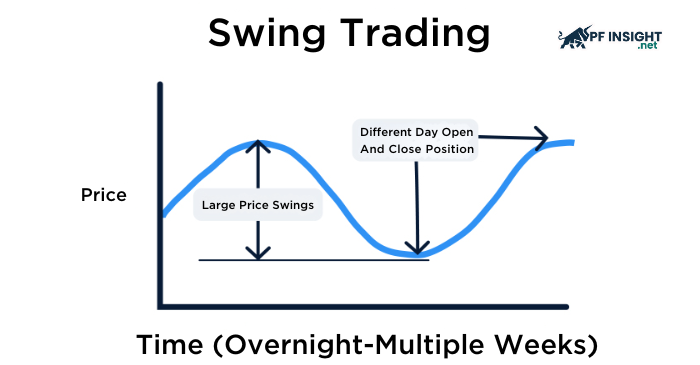

Swing trading is a trading method that aims to capture profits from short and medium term price movements. Instead of trying to catch every small intraday move like day traders, swing traders focus on larger market swings. They typically identify key support or resistance zones, wait for a pullback to complete, and then open a position when the primary trend shows signs of resuming.

The major difference between swing trading and day trading lies in position holding time. While day traders close all positions by the end of the day, swing traders can hold trades across multiple sessions, sometimes from several days to several weeks. This approach allows them to capture broader market swings without having to monitor the market constantly.

Key points:

- Swing trading focuses on price movements lasting from a few days to a few weeks.

- Technical tools such as RSI, MACD, and moving averages are commonly used to determine entry and exit points.

- Most swing traders are individual traders rather than institutional investors.

Understanding swing trading

Market prices rarely move in a straight line. Instead, they fluctuate continuously as the market approaches new price levels. In an uptrend, prices form a series of higher highs and higher lows, while in a downtrend they create lower highs and lower lows. These fluctuations reflect market sentiment and are driven by the ongoing buying and selling activity of traders and investors.

The foundation of swing trading is to capitalize on these natural price swings. To do this, traders use technical analysis to identify market cycles and price patterns that signal potential reversals or trend continuations. Commonly used tools include:

- Moving averages

- Momentum indicators such as RSI and MACD

- Support and resistance zones formed by price action

Swing traders often look to enter trades around key support or resistance levels, and many only trade once reversal signs begin to appear clearly. They also set specific profit targets and typically exit before the swing completes.

Because swing trading revolves around reversal points, assessing the risk to reward ratio of each trade becomes especially important. Traders must define the entry, exit, and stop loss levels before taking a position to ensure that risk remains controlled.

For example, a strategy with a moderate win rate generally requires a minimum risk to reward ratio of 1:3 to maintain long term profitability. Conversely, if a trade offers potential profit that is lower than the risk taken, traders should avoid it or adjust the strategy.

In other words, swing trading sits between day trading and position trading, shorter than long-term investing based on fundamentals but without the constant monitoring required in intraday trading.

Swing Trading Strategies

Trend pullbacks

Trading pullbacks within a strong trend is one of the most common swing trading strategies. When a new trend forms, some traders look for buying opportunities at the 8-day moving average, while others wait for a deeper retracement toward the 20-day moving average for a safer entry zone. The goal of this strategy is to catch the end of the pullback and follow the main trend as it continues.

Support and resistance trading

Financial assets often react multiple times at key support or resistance zones. Traders who identify these levels can set precise entry and exit points, anticipating a bounce from support or a reversal when price reaches resistance. This strategy works well in both sideways markets and during corrective phases within a larger trend.

Breakout trading

When price consolidates or contracts within a narrow range, a breakout becomes a strong signal for the potential start of a new trend. When price breaks above resistance or falls below support, traders enter positions to capture the strong momentum that often follows. This strategy is particularly effective with highly volatile assets.

Fibonacci retracement

After a significant price move, the market often retraces part of the move before continuing in the main trend. Fibonacci levels such as 23.6 percent, 38.2 percent, 61.8 percent, and 161.8 percent help identify zones with high reversal potential. When Fibonacci levels align with moving averages, support or resistance zones, or chart patterns, the reversal signal becomes more reliable.

Chart patterns

Price patterns such as head and shoulders, double tops and double bottoms, flags, and pennants are used by swing traders to identify potential reversals or trend continuations. These patterns usually have a clear invalidation point, which helps traders manage risk effectively by knowing exactly when a trade is no longer valid.

How to set an optimal risk to reward ratio for each trading style

Since swing trading focuses on market reversal points, setting a reasonable risk to reward ratio for each trade becomes especially important. Each swing strategy has its own way of placing stop losses and defining profit targets, but the general principle is that traders must clearly determine the RR before entering a position to ensure that risk is always controlled.

The role of risk to reward in swing trading

Unlike trend traders, who may hold positions throughout an extended trend, swing traders usually aim to capture only a portion of the price movement. This requires them to define precisely:

- Where the entry will be

- Where the stop loss will be placed

- Where the profit target will be set

The RR ratio therefore becomes the foundation that determines the effectiveness of the entire strategy.

Setting RR based on each type of swing trade

Trend pullbacks:

- Stop losses are typically placed below the most recent pullback low.

- Profit targets aim for the nearest recent high or the next resistance zone.

- Common RR: 1:2 or 1:3 depending on the strength of the trend.

Support and resistance trading:

- Stop losses are based on the breakout of the support or resistance zone.

- Targets are set at the opposite reversal zone within the trading range.

- RR depends on the width of the range, often starting from 1:2.

Breakout trading:

- Stop losses are placed below the breakout point or at the retest area.

- Profit targets tend to be larger because trends often strengthen after a breakout.

- RR can expand significantly, sometimes reaching 1:3 or 1:4.

Fibonacci retracement:

- Stop losses are set below or above the broken Fibonacci level.

- Targets aim for the continuation of the main trend.

- RR varies depending on the depth of the retracement.

General criteria for a reasonable RR

Some traders refuse to take trades if they do not offer a minimum RR of 1:2 or 1:3. For example:

- If the risk is 1 USD, a reasonable expected profit should be 3 USD.

- In contrast, risking 1 USD to gain only 0.75 USD is rarely effective unless the strategy has an extremely high win rate.

In swing trading, the combination of precise entries, tight stop losses, and appropriate targets helps improve RR quality and minimize risk.

Common mistakes that disrupt the balance between risk and reward

Establishing a reasonable risk to reward ratio is only the first step. Many swing traders still struggle to maintain this balance because of several common mistakes. These errors not only affect individual trades but also reduce the overall effectiveness of a swing trading strategy.

Setting stop losses too tight or too wide

A stop loss that is too tight makes a trade vulnerable to being stopped out before price moves in the intended direction. On the other hand, placing a stop loss too wide increases risk and breaks the original RR structure.

Effective swing traders always place stop losses based on market structure, price patterns, or clear support and resistance levels.

Overestimating profit targets

Many traders set profit targets too far from what price action can realistically achieve. High RR ratios may look attractive, but if a target has no technical basis, the probability of reaching it is low.

Swing traders should set profit targets based on:

- The nearest resistance zone

- The previous swing high or low

- Key Fibonacci levels or swing structure

Trading in choppy market conditions

When the market is moving sideways or lacks a clear trend, the probability of false signals increases sharply. Attempting to trade during these periods often breaks RR expectations because market direction is uncertain. Experienced swing traders typically avoid trading when the market has no clear structure.

Failing to define entry and exit points clearly

Some trades fail because traders enter too early, exit too late, or change their plan mid-trade. This disrupts the RR balance and leads to unnecessary losses.

To maintain discipline, traders need to plan every trade before entering the market.

Entering trades without confirmation

Not waiting for confirmation often leads to catching the wrong bottom or top. Experienced swing traders usually require two to three confluence factors, such as:

- RSI divergence

- MACD shifting direction

- Price touching a strong support or resistance zone

Letting emotions influence decisions

Fear, hope, or greed can cause traders to widen stop losses, move targets, enter late, or exit earlier than planned.

This lack of discipline is a major reason why strategies with good RR potential still result in losses.

Conclusion

Swing trading takes advantage of the market’s natural price swings to capture profits over a time frame of several days to several weeks. By understanding how the market forms highs and lows, using technical analysis to identify reversal points, and applying the appropriate swing trading strategies, traders can capture high-probability price movements.

Update financial trading articles at Trading Basics.