The martingale strategy is one of the most well-known approaches in both gambling and financial trading. Its mechanism of doubling the position size after each loss creates the illusion of a simple, easy-to-apply system that delivers an almost guaranteed win rate in the early stages. This is why many traders mistakenly believe that martingale can help them generate quick profits without needing a complex strategy.

However, when the market moves against the position or extends into a prolonged trend, martingale can wipe out an account in just a few trades, regardless of the trader’s experience. This is also the reason most traders fail with the martingale strategy, especially in forex, crypto, and other highly volatile markets.

Pfinsight.net will break down how the martingale strategy actually works, why so many traders lose money with it, the hidden risks most people overlook, and real-world scenarios to help you determine whether this approach is suitable for your trading style.

- How to know the liquidity of a stock and why it matters for trading

- What trading models can teach you about market behavior?

- Funded trading: how traders get access to capital without using their own money

What is the martingale strategy?

The martingale strategy is a trading method built on a simple principle: every time you lose a trade, you double the position size on the next one with the expectation that a single winning trade will recover all previous losses and generate a small profit. This “sounds logical” approach makes martingale appealing to many beginners because it is simple, requires no complex analysis, and appears to deliver a very high win rate.

However, the exponential increase in position size is also the reason accounts blow up quickly when the market moves in the opposite direction for an extended period. The core mindset behind martingale is

- Losses do not matter

- A single winning trade will recover everything

- The probability of “losing indefinitely” is assumed to be low

For example, if you start with a $10 trade and lose, you double the next position to $20. If you lose again, you double it to $40, and so on, until you eventually win. Once the winning trade occurs, the profit offsets all previous losses, and you reset the position size back to the original $10.

How the martingale strategy works in trading

The martingale strategy operates on a core principle: whenever a trade loses, the trader doubles the position size on the next trade in order to recover all previous losses and earn a small profit once a winning trade appears. In trading, the mechanism works as follows:

The trader opens an initial position

Example:

Trade 1 = 0.10 lot

If the trade wins, the trader takes a small profit and starts a new cycle.

If it loses, the martingale sequence begins.

If the first trade loses, the trader doubles the position size

Trade 2 = 0.20 lot

If it loses again, the position size continues to double.

The doubling sequence continues until a winning trade occurs

Example of a seven-trade sequence: 0.10, 0.20, 0.40, 0.80, 1.60, 3.20, and 6.40 lots

With just one winning trade, the trader will:

- Recover the total loss accumulated from the previous six trades

- Add a small profit equal to the gain from the very first position

When a winning trade appears, the martingale cycle resets

The trader returns the position size to 0.10 lot and begins the process again.

Martingale is often used together with a “no stop loss” approach

If a stop loss is set too close, normal market noise can trigger losses quickly and accelerate the doubling sequence. Because of this, many martingale traders avoid using stop loss, or set extremely wide stop loss levels, or use hedging to hold positions. This makes the strategy highly vulnerable when the market enters a strong trend, causing losses to spiral out of control.

Why many traders fail with the martingale strategy

Although martingale initially gives the impression of being “impossible to lose”, most traders quickly fail when they try to apply it in real trading. The problem does not lie in the position-sizing formula itself but in the inherent instability of the market, the limitations of the trading account, and human psychology. When these factors come together, they turn martingale into a strategy with extremely high risk. Below is a detailed breakdown of the main reasons why martingale often leads to heavy losses:

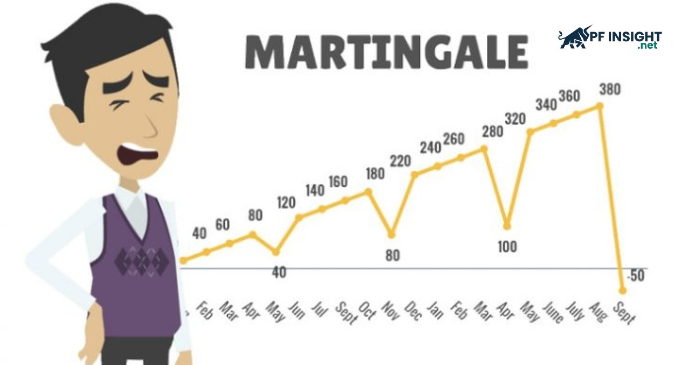

Losing streaks in real markets are much longer than expected

In theory, long losing streaks are considered rare. But in real market conditions, strong news events, extended trends, choppy sideways phases, and flash crashes can all cause 8 to 12 consecutive losing trades, far more than what most traders are mentally prepared for.

Martingale requires extremely large capital, which most traders do not have

Martingale is not suitable for small accounts. This strategy requires large capital, high free margin, the ability to tolerate deep drawdown, tight spreads, and minimal slippage. Even accounts with a few thousand dollars struggle if the market moves against them for several trades in a row. This is why martingale is a strategy many beginners think they can use, but in reality, they do not have the resources to use it safely.

Martingale performs poorly in strong trending markets

Martingale only works “reasonably well” when the market is sideways, has low volatility, is free from major news, and frequently reverses. But most forex, crypto, and index markets trend aggressively:

- EURUSD can run 100 to 200 pips in a single direction

- NAS100 can rally or fall for hours without pulling back

- XAUUSD often trends violently during Fed-related news

In these conditions, martingale almost always leads to margin calls, stop-outs, and uncontrolled drawdown. Traders lose not because the strategy is misused, but because the market environment is fundamentally incompatible with the method.

Psychological pressure increases exponentially

Martingale does not only magnify financial risk; it magnifies psychological stress. As losses double each time, traders experience self-doubt, panic, loss of control, and a desperate urge to recover, ignoring market analysis.

Martingale is almost impossible to use in prop firms

Martingale is almost impossible to use in a prop firm environment because its very nature goes against every risk-management requirement these companies enforce. Most prop firms prohibit martingale, ban grid trading, restrict EA usage, monitor lot size increases, enforce strict daily drawdown limits, and require traders to maintain consistent performance throughout each evaluation stage. Martingale, on the other hand, generates extremely deep drawdown, causes sudden spikes in lot size, leads to uncontrolled risk, and creates a completely unbalanced risk-to-reward profile. Even when it is not explicitly banned, this strategy is nearly incapable of passing limits such as a 4 to 5 percent daily drawdown or an 8 to 10 percent maximum drawdown, because only three or four losing trades in a row are enough to wipe out the entire account.

There is no clear stopping point, which is the most dangerous issue

Even more dangerous, martingale is a strategy with no clear stopping point. It creates the illusion that “one more trade” will recover everything, but in reality the trader never knows how long the market can move against the position, how many doubling steps will be required, or how much capital is needed to survive an extreme adverse cycle. Without a defined cutoff point, the only possible ending for a martingale sequence is a blown account. A strategy whose default outcome is a complete loss of capital cannot be considered sustainable, especially in a tightly regulated, risk-controlled environment like a prop firm.

Real-world use cases

The martingale strategy is typically applied in certain trading situations, mostly by traders who want to recover losses quickly or capture small but frequent profits in low-volatility markets. Below are the most common scenarios where martingale is used:

Range-bound markets

When price moves repeatedly between support and resistance, some traders apply martingale to continuously average down or average up and take profit when the market returns to the equilibrium zone.

This approach only works as long as the market does not break out strongly from the range.

Scalping on lower timeframes

Some scalpers use martingale to recover losses quickly during low-volatility periods, such as the Asian session.

Advantage: fast take-profit with small price movements.

Disadvantage: a single large candle can break the entire doubling sequence.

Grid trading with automated EAs

Many trading robots use a martingale-based grid system that opens multiple positions in layers.

The idea is that price will eventually return to the mean and close the cluster of trades in profit.

The drawback is that grids perform well in sideways markets but blow accounts easily when a strong trend forms.

Trading during quiet market sessions

Some traders use martingale during:

- The Asian session in forex

- Periods before major news releases

- Late-night hours in crypto with low liquidity

Although volatility is lower, an unexpected move can still cause the doubling sequence to spiral out of control.

“Safer” martingale variations

Some experienced traders use modified versions of martingale, such as

- Increasing position size gradually (1.2x or 1.5x instead of 2x)

- Limiting the maximum number of doubling steps

- Applying it only at strong reversal zones

These variations reduce risk but still carry the same structural weakness: a strong trending market can invalidate the entire system.

Safer alternatives traders can use

The martingale strategy can generate quick profits in favorable market conditions, but its risks are far too high to sustain over the long term. Instead of increasing position size exponentially after losses, traders can apply safer position management techniques and more robust trading strategies. Below are several alternatives that reduce risk while improving consistency.

Fixed fractional position sizing

Instead of doubling after each loss, traders risk only a fixed percentage of their account on every trade, such as 1 or 2 percent. This is the position-sizing method used by most professional traders. Key advantages include:

- No sudden spikes in drawdown

- Easy to manage across all market conditions

- Fully compliant with prop firm rules

Controlled dollar-cost averaging (smart DCA)

This is a safer version of averaging, where traders increase position size only slightly and only at key price levels supported by technical analysis. It still carries risk but is more suitable for sideways markets or pullback structures. Unlike martingale, this approach:

- Does not double positions

- Adds trades only when probability is high

- Always uses a clear stop loss

Scaling in with the trend

Instead of increasing position size while in a losing streak like a martingale, many professional traders only add to a position when the market is already moving in the predicted direction. For example, the first trade is profitable, the price breaks an important level, and the trader adds a second position with a smaller level of risk. This approach allows them to maximize profits during strong trends, reduce overall drawdown, and limit psychological pressure while trading. It is also a common technique among swing traders and trend-following index traders in major US markets.

Planned hedge trading

Hedging can be used to reduce risk when the market moves against a position, but it must follow a clear process:

- Open a hedge position to temporarily lock in losses

- Wait for market confirmation

- Unwind the hedge in stages

When executed correctly, hedging can control risk better than martingale, although it still requires experience.

Using stop loss and trailing stop properly

The biggest danger of martingale comes from not using a stop loss.

By applying a well-defined stop loss, traders can eliminate most of the risk associated with martingale. It is an essential risk management tool for anyone who wants long-term consistency. A trailing stop helps:

- Secure profits when the market moves in your favor

- Limit risk when the market reverses

- Prevent deep drawdowns

Trading only high-probability setups

Instead of trying to recover losses with high-risk methods like martingale, traders should focus on building a high-probability strategy based on the core principles of market structure. This includes identifying clear supply and demand zones, monitoring strong support and resistance levels, recognizing clean price action patterns such as breakouts, retests, or pullbacks, and using confirmation signals from technical indicators. When you trade with a system that has a well-defined edge, there is no need for martingale to boost profits, because the accuracy and consistency of the strategy itself will generate sustainable growth.

Using mean reversion strategies with risk limits

In range-bound markets, traders can apply mean reversion strategies, but only with:

- A strict limit on the number of entries

- Fixed position sizes

- Clear stop losses

- Logical entry zones

Conclusion

Martingale strategy may look simple and effective in the short term, but its core mechanism carries exponential risk that most traders cannot control. The strategy can work in range-bound or low-volatility markets, but it almost always fails when the market enters a strong trend, reacts to unexpected news, or reaches margin limits.

To trade sustainably, traders need to focus on proper risk management, build high-probability strategies, and use safer alternatives instead of relying on martingale. Understanding how martingale works, the risks behind it, and the available alternatives is essential for protecting your account and growing steadily over the long term.

Read more of our related articles in Trading Basics.