The financial market operates continuously, and the price of the same asset can differ between exchanges or regions. This imperfection in pricing has created opportunities for one of the oldest and least risky trading strategies: the arbitrage strategy, also known as the price difference trading strategy.

In today’s article, Pfinsight.net will help you explore the most common types of arbitrage strategies every trader should know, how they work, the supporting tools, and the potential risks to watch out for.

- Top 5+ prop trading strategies to maximize your funded account in 2025

- 5 Must-know quantitative trading strategies for consistent profits

- What is hedging? A complete guide for traders and investors

What is arbitrage in trading?

Arbitrage is based on a very simple principle: buy where the price is lower and sell where it is higher, taking advantage of temporary differences between markets. However, behind this seemingly simple idea lies a complex system involving execution speed, fees, liquidity, and quick decision-making.

Arbitrage is a trading strategy that exploits price discrepancies of the same asset across two or more markets. The goal of traders applying the arbitrage strategy is to buy where the price is lower and simultaneously sell where it is higher, profiting from the difference without needing to predict the market’s direction.

For example, if the EUR/USD pair is trading at 1.1000 on Exchange A but at 1.1005 on Exchange B, a trader can buy from Exchange A and sell on Exchange B to earn a profit of 0.0005 per unit. Although the difference seems small, when executed with large volume or through automated systems, it can generate significant profit.

Arbitrage is often considered a low-risk strategy because traders are not betting on market direction but rather exploiting temporary inconsistencies in pricing. However, in practice, successful arbitrage execution depends on three key factors:

- Execution speed: Prices can change within milliseconds, so traders need platforms and tools that can execute orders extremely fast.

- Transaction costs: Spreads, withdrawals, and commission fees can reduce or even eliminate profits.

- Liquidity and technical risk: The market may lack sufficient volume to fill orders, or system delays of just a few milliseconds can erase an arbitrage opportunity.

Therefore, arbitrage is not entirely “risk-free” as it is often described. But when implemented correctly, it remains one of the most stable and logically sound strategies in modern financial trading.

Top types of arbitrage strategies every trader should know

Arbitrage strategy does not come in just one form. Depending on the asset class, market, and instruments they trade, traders really employ a variety of arbitrage strategies. The five most popular forms of arbitrage strategy are listed below and should be understood by all traders.

Spatial arbitrage (two-market arbitrage strategy)

This is the most basic and easy-to-understand form of arbitrage strategy. Traders look for price differences of the same asset between two exchanges or geographic locations.

Example: If gold is trading at $2,000/oz in New York but $2,010/oz in London, a trader can buy in New York and sell in London to earn a $10 profit per ounce.

Spatial arbitrage strategy requires fast execution speed and the ability to transfer assets or place orders instantly, as these price gaps usually last only for a few seconds.

Triangular arbitrage (currency pair arbitrage strategy)

This arbitrage strategy is common in the Forex market, where the exchange rates among three currency pairs are not perfectly aligned. Traders exploit the price discrepancy between the pairs to generate profit.

Example: If the exchange rates of EUR/USD, USD/JPY, and EUR/JPY are slightly misaligned, a trader can circulate capital among the three pairs to capture a small, low-risk profit.

The triangular arbitrage strategy is typically executed by automated trading algorithms, as it requires rapid calculations and order execution.

Statistical arbitrage

Unlike the previous two types, the statistical arbitrage strategy relies on mathematical models and historical data to identify relationships between assets. When an asset’s price temporarily deviates from its predicted value, the system simultaneously opens long and short positions to profit from the statistical inefficiency.

This arbitrage strategy is often used by hedge funds and requires strong data analysis and programming skills to operate automated systems effectively.

Cross-market arbitrage

Cross-market arbitrage strategy takes advantage of price differences between derivative products and their underlying assets.

Example: The futures price of a stock may differ from its current spot price. A trader can buy the stock and sell the futures contract (or vice versa) to profit when the prices converge.

This arbitrage strategy is widely used in stock, commodity, and index markets, requiring deep understanding of contract mechanics and expiration timing.

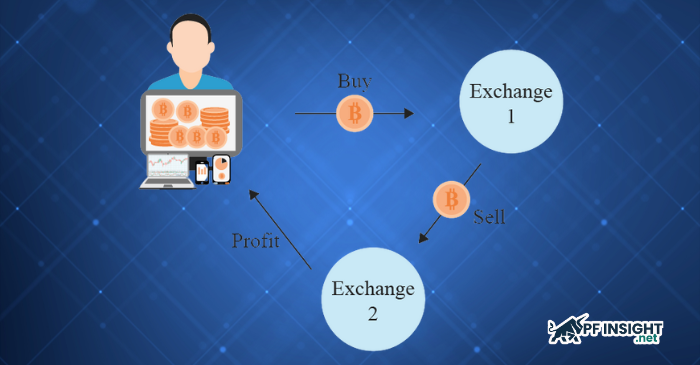

Crypto arbitrage (exchange arbitrage)

The cryptocurrency market, which operates 24/7 and lacks centralized regulation, presents the most abundant arbitrage strategy opportunities.

Example: Bitcoin might trade at $50,000 on Binance but $50,150 on Kraken. A trader can buy on the cheaper exchange and sell on the higher one.

However, this arbitrage strategy demands tight control over transaction fees, transfer time, and blockchain network stability, as these factors can significantly impact profitability.

Tools and platforms that support arbitrage trading

To execute an arbitrage strategy successfully, identifying opportunities is only half of the process. The other half lies in executing trades quickly and accurately, something most traders today achieve through specialized tools and platforms. Below are the most common types of tools that help traders optimize their arbitrage strategy and improve efficiency in exploiting price discrepancies:

Arbitrage scanners and price trackers

These are the foundational tools that help traders detect price differences between exchanges or markets. They collect real-time data from multiple sources and display pairs with significant discrepancies.

Examples:

- Cryptohopper or Bitsgap for crypto arbitrage strategy

- ArbiTool for forex and commodities

These tools save time for traders, but they require stable connections and continuously updated data to avoid inaccuracies that could affect profits.

Automated arbitrage bots

Arbitrage bots allow systems to automatically buy and sell once an opportunity is detected. These bots are especially effective in crypto and forex arbitrage strategies, where execution speed is measured in milliseconds.

Platforms such as HaasOnline, 3Commas, or MetaTrader 5 Expert Advisors (EAs) allow traders to program automated strategies with built-in risk management and optimized trading frequency.

However, bots only perform effectively when properly configured and operating in high-liquidity environments, as small discrepancies can disappear within seconds.

Multi-exchange trading platforms

These platforms enable traders to execute trades across multiple exchanges simultaneously, reducing latency in order execution. Instead of logging into separate exchanges, traders can place buy and sell orders directly from a unified dashboard.

Examples:

- Kryll.io or Coinigy for crypto arbitrage strategy

- cTrader or MetaTrader 5 for forex and CFDs

With integrated APIs, these platforms offer speed and precision, critical factors for successful arbitrage trading.

Data analytics and backtesting tools

For statistical arbitrage strategy, historical data is the key foundation. Traders can use tools such as Python Pandas, MATLAB, or specialized platforms like QuantConnect to backtest models and identify potential arbitrage opportunities.

Data analytics helps traders understand the relationship between asset values and assess the long-term sustainability of an arbitrage strategy.

Risks and limitations of arbitrage trading

Although an arbitrage strategy is often considered a low-risk trading approach, in reality, no strategy is completely risk-free. Price discrepancies usually exist only for a short time and can be affected by various technical or market factors. Below are some key risks and limitations that traders should keep in mind when applying an arbitrage strategy.

Slippage and execution delay

In arbitrage, time is everything. If there’s a delay between spotting an opportunity and executing the trade, the price difference can disappear. This is known as slippage, and it can turn a small profit into a loss.

Factors such as internet speed, API latency, or exchange congestion can cause slippage, especially in crypto or forex markets, where volatility is high and price movements happen in milliseconds.

Transaction fees and hidden costs

An arbitrage strategy is only profitable when the gain exceeds total transaction costs. However, many new traders overlook small but important expenses like withdrawal fees, conversion charges, or spreads.

When accumulated, these costs can easily surpass the potential profit margin. That’s why calculating real costs before executing any arbitrage trade is absolutely essential.

Low market liquidity

If the market lacks liquidity, executing large-volume trades becomes difficult. An asset may show a large price gap but might not have enough trading volume on both sides to fill orders efficiently.

This issue is particularly common in crypto arbitrage or exotic forex pairs.

In low-liquidity environments, traders risk getting “stuck” in open positions, missing out on opportunities, or even incurring losses.

System and technology risk

Most modern arbitrage strategies rely heavily on automated software or API-based systems. This means that any technical malfunction, such as disconnection, misfired orders, or server downtime, can lead to financial losses.

Therefore, testing your system thoroughly, having a backup plan, and setting clear risk limits should always come before live deployment.

Legal and regulatory risks

Some jurisdictions have strict rules regarding the exploitation of price discrepancies, especially within traditional financial markets. While most forms of arbitrage are legal, traders should always verify the regulatory compliance of their operations, particularly when engaging in cross-border or crypto arbitrage.

Conclusion

There are many types of arbitrage strategies, from basic ones like spatial arbitrage to more complex forms such as statistical arbitrage. Each type offers unique opportunities but also demands different levels of knowledge, technology, and execution speed.

Arbitrage remains one of the few trading strategies that has stood the test of time. Even though technology and markets have evolved, its core principle has never changed: taking advantage of pricing inefficiencies to generate controlled profits.

Explore more articles on financial trading and market strategies in the Knowledge Hub section!