Stop loss strategy not only acts as a risk management tool but also helps traders form discipline in trading. However, placing orders too tight can cause you to miss important opportunities when the market reverses. In this article, PF Insight will guide you on how to set smart stop loss orders and share the secret to maintaining a stable mentality to follow the most effective trading plan.

- 5 Must-know quantitative trading strategies for consistent profits

- Best no evaluation Prop Firm offering direct funded accounts

- Prop Firm challenge mistakes every trader should avoid

What is a stop loss?

A stop loss order is a tool that automatically closes a position when the price reaches a predetermined threshold. The purpose of this order is to control risk and protect the account from adverse fluctuations, ensuring that losses do not exceed the acceptable level of the trading strategy.

When opening a buy position, traders often place a stop loss order at a price lower than the entry price to limit risk if the market falls. Conversely, for a sell position, the stop loss is set above the entry price to protect profits if the price suddenly moves in the opposite direction.

=>> Stop loss strategy helps traders avoid holding losing orders for too long, by automatically activating a position closing order when the price reaches a predetermined threshold, thereby preserving capital and maintaining discipline during trading.

Types of stop loss orders

Typically, traders use four main types of stop-loss orders to manage risk and protect their accounts from market volatility.

- Fixed stop loss: This order is set at a specific price at the beginning and stays in place until the market hits that level, automatically closing the order to limit losses.

- Trailing stop loss: An order that automatically adjusts in the favorable direction of the market price, helping to protect the profits already made while limiting the risk if the price reverses.

- Stop market order: Triggered when the price hits the set stop level, then converted to a market order, ensuring the trade is executed regardless of price changes.

- Stop limit order: A combination of a stop order and a limit order, allowing the trader to control exactly the price at which the order is executed, but has the potential to not be executed if the market moves too quickly.

Each type of stop-loss order offers its own advantages, suitable for different trading styles and goals, helping investors choose between safety, flexibility and the ability to control risks more effectively.

Why should you follow a stop loss strategy in trading?

Not placing a stop loss is like risking all your capital without a plan to protect it. This often comes from overconfidence, when the trader believes that the trend will soon reverse in their favor. Some people are driven by greed, waiting for the price to recover. Many people are even driven by emotions, believing that the market will “correct” according to their expectations, leading to increasingly large losses.

Therefore, following a stop loss strategy not only protects you from unwanted losses but also contributes to forming more disciplined and stable trading habits over time. Here are some of the outstanding benefits of maintaining a proper stop loss strategy:

- Limit the risk of losing capital: This is an important foundation for you to survive and develop long-term in the market. When capital is protected, you have the opportunity to learn, adjust your strategy and take advantage of new opportunities instead of being eliminated from the game early.

- Increase long-term profitability: Applying stop-loss orders helps limit losses in each transaction, thereby maintaining stable performance. By controlling risks well, traders can preserve capital, optimize the profit-to-loss ratio and achieve positive results in the long term.

- Emotional management: Stop loss strategy helps traders maintain a more stable mentality by eliminating the element of speculation and making decisions based on a predetermined plan, instead of reacting emotionally to market fluctuations.

- Enhanced strategy evaluation: Collecting accurate trading data helps you analyze performance, identify strengths and weaknesses in your system, and adjust your strategy for better performance in future trades.

- Maintain consistency: Stop loss strategy helps you develop strong confidence in your trading method, avoid impulsive decisions and create a habit of sticking to your plan in all market situations.

Instructions for building an effective stop loss strategy

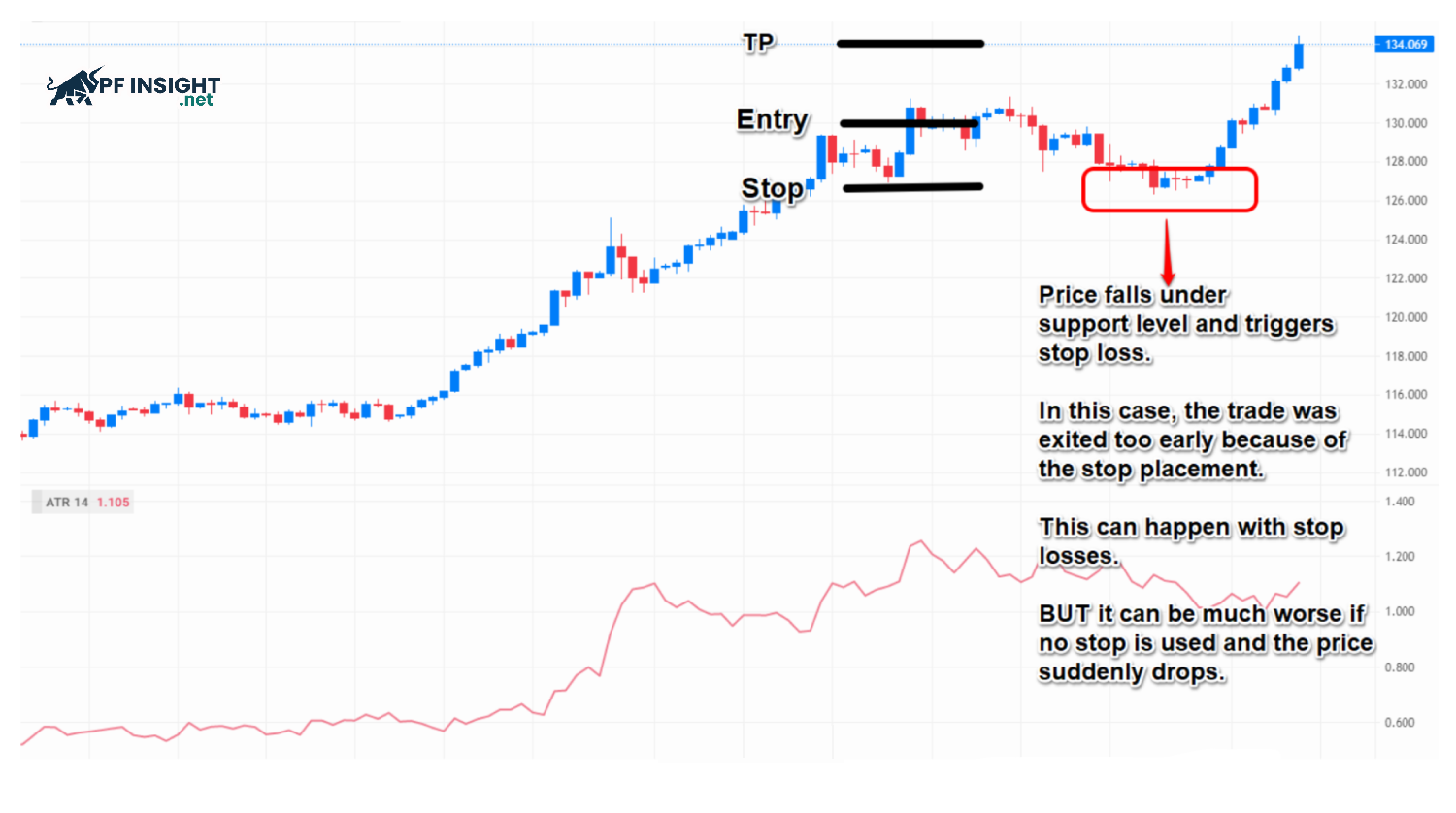

Not all stop loss strategies are created equal. Placing your stop loss too close can lead to repeated stop-losses, while placing it too far away can make risk management meaningless. Here’s a guide to help you determine the optimal stop loss location for each trade.

- Apply technical analysis: Identify key support and resistance levels on the chart. Placing stop-loss orders beyond these areas reduces the risk of getting stopped out due to short-term volatility and keeps your position safer within the main trend.

- Absolute stop limits: Instead of calculating as a percentage of the account, some traders choose to predefine a specific amount they are willing to risk per trade, making loss control clearer and more manageable.

- Market volatility: When the market has a large fluctuation range, it is advisable to place a wider stop loss order to avoid being wiped out early. Conversely, when the market is less volatile, a narrow stop loss helps to optimize risk and protect profits more effectively.

- Risk management principle: Limit your maximum loss per trade to 1–2% of your total capital. This approach helps you maintain your resilience after a losing streak and protects your account from large unforeseen losses.

- Review and optimize: If your stop loss strategy is constantly being triggered before the price moves in the predicted direction, it is a sign that the strategy or stop loss placement needs to be reviewed to better match the actual market volatility.

Common mistakes when traders apply stop loss orders

Even if you have a stop loss strategy in place, mistakes are inevitable. Many traders often place orders inappropriately or lack flexibility in the face of market fluctuations. Here are some common mistakes you should avoid to optimize the effectiveness of your stop loss strategy.

- Changing stop loss position: This is one of the most serious mistakes that traders often make during trading.

- Setting a stop loss too tight: Setting a stop loss too close to the entry price can cause the position to be closed prematurely due to small market fluctuations, missing out on the opportunity to benefit from the main trend that is forming.

- Not calculating the appropriate trading volume: This is a mistake that makes traders easily fall into a high-risk situation when betting too much capital on a single order, increasing the possibility of serious losses if the market goes against the predicted direction.

- Ignore the news factor: Important economic events or announcements can cause strong market volatility, leading to slippage and causing stop-loss orders to not be filled at the expected level, increasing the risk for the trader.

Top 5 stop loss strategies to help beginners manage risk better

An effective stop loss strategy needs to be adjusted according to each trader’s trading style, personal risk tolerance, and the specific market volatility at the time of the transaction. Below are 5 stop loss strategies commonly used by traders:

Volatility based strategy

Volatility-based stop loss strategies allow traders to flexibly adjust their stop loss positions according to price fluctuations. When the market is volatile, the stop loss order can be placed wider to avoid premature activation, whereas when the market is stable, the stop loss can be narrowed to optimize risk management and preserve profits.

For example, if the S&P 500 has only averaged about 20 points per day over the past 10 days, placing a stop-loss order beyond this range in a short-term trade could result in increased risk without significant reward.

One popular way to place a stop loss based on volatility is to use the Average True Range (ATR) indicator. This indicator measures the average price volatility over a given period of time. Based on the ATR value, traders can determine a reasonable stop loss location, which is usually just outside the normal range of the market.

Using volatility to determine stop loss placement can improve the effectiveness of trading strategies. However, it is important to remember that the ATR indicator reflects past volatility and is lagging, so it cannot accurately predict future volatility, but only helps traders adjust orders based on historical data.

Note: Remember that historical results do not guarantee future returns. Always trade with capital you are prepared to lose to avoid serious financial risk.

Risk-reward strategy

A risk-reward stop loss strategy compares the maximum loss you are willing to accept with the expected profit. Traders often use reference ratios such as 1:2 or 1:3, meaning that for every 1 part risked, the profit target is 2-3 parts. The 1:3 ratio is especially useful when the market is forming a clear and stable trend.

Another example is the 1:2 risk-reward ratio, which is often used when the market is in a narrow range or is in a period of high volatility. In this situation, the trader hopes that the price will move enough to bring in a profit commensurate with the level of risk accepted. However, no strategy can guarantee absolute success, as every trade contains the possibility of loss, which the trader must be prepared to face.

Each trader needs to determine the type of stop loss that suits their trading style and goals. There is no fixed formula for everyone, but choosing a reasonable risk-reward ratio helps optimize long-term results, limiting losses while still maintaining profit potential when the market moves in the right direction.

No matter how good your stop loss strategy is, every trade carries risk. Carefully evaluate your trades before deciding to enter and only use capital that you are willing to lose, to protect your finances and maintain your ability to trade long term.

Trading strategy with support/resistance

Using support and resistance levels is one of the classic and effective ways to apply a stop loss strategy. The basic idea is that when the price breaks through a support or resistance level, the original reason for entering the trade is no longer valid, signaling that the trade should be exited. This method is especially popular in swing trading, helping to clearly and logically determine the stop loss point, while protecting capital from unexpected market fluctuations.

The stop loss strategy based on support and resistance is a technical analysis method that helps identify important price levels. At these points, the price is likely to reverse or correct, from which traders can place reasonable stop losses to protect capital.

Support levels typically help limit price declines, while resistance levels prevent prices from rising too far. Therefore, placing a stop loss order just below support or above resistance can provide room for natural price fluctuations, giving the trade a chance to recover before the stop loss is triggered, while also reducing the risk of losing money early.

Support and resistance levels are often determined based on previous tops and bottoms, combined with technical tools such as moving averages (MA) or Fibonacci retracement levels to determine appropriate entry and stop loss points.

Confluence stop loss

The confluence stop loss strategy uses a combination of technical analysis tools to determine the exact location of the stop loss. These elements may include moving averages, support and resistance levels, previous highs and lows, Fibonacci retracements, trend lines and price channels, which increase confidence and reduce risk in the trade.

This stop loss strategy helps to improve stop loss order discipline and reduce the risk of being triggered by false signals, thereby protecting capital more effectively and optimizing trading results.

Example of placing stop loss strategy according to convergence point: Combining two technical indicators to determine stop loss placement, such as Bollinger Bands and signal levels from MACD, makes stop loss orders more accurate and reduces unnecessary risk.

- Bollinger Bands show price volatility through a central moving average and two bands above and below based on standard deviation.

- MACD (Moving Average Convergence Divergence) assesses the strength and direction of a trend and provides buy or sell signals by comparing short-term and long-term moving averages.

In this example, the trader is trading Bitcoin on the 5-minute chart. After identifying the bullish Tweezer bottom candlestick pattern, a Long Entry is made. The stop loss is placed at the point of convergence, which requires at least two confirmation indicators: The candle is below the Bollinger Bands and the MACD reaches its lowest level, ensuring that the stop loss is placed safely and appropriately.

Therefore, among the candles outside the Bollinger Bands, choose the candle with the lowest MACD value. A stop loss order is then placed just below this candle, marked with the purple line, effectively protecting the trade and optimizing the stop loss strategy.

The advantage of a convergence-based stop loss strategy is the ability to combine multiple indicators to determine a more accurate stop loss level, increasing the trader’s confidence. If you rely solely on Bollinger Bands, the stop loss order may be placed too close, easily triggered early and losing a profit opportunity.

A trailing stop loss

The trailing stop loss strategy is particularly effective when trading with trends. Traders take advantage of the trend’s early stages and hold their positions until the end of the trend appears, maximizing profits and minimizing losses.

Trend traders do not predict how long a trend will last and do not usually set a fixed take profit level. Instead, they use stop-loss orders to exit positions in time, even when the position is still profitable, to protect profits and limit risk.

In a stop loss strategy, a trailing stop order is set based on a fixed distance or percentage from the entry price. As the market moves in your favor, the order automatically adjusts with the price, protecting profits while still following the trend.

When the market turns, the stop loss order remains in place and will be triggered if the price moves in the opposite direction, protecting capital and profits. Some traders apply moving averages such as 50 DMA to place stop losses, helping the stop loss order adjust itself to the uptrend, optimizing risk management in the transaction.

Conclude

Stop loss strategy is an important tool to help traders manage risk and protect capital from unexpected market fluctuations. Applying a stop loss strategy not only helps limit losses but also builds discipline and consistency in trading.