For experienced traders, choosing a prop firm with high leverage is often part of their strategy to scale up profits. However, not all prop firms are transparent about their leverage limits, risk management policies, or profit-sharing structures.

Understanding how leverage truly works and selecting the right funding company is therefore essential for maintaining consistent and sustainable trading performance.

In this guide, Pfinsight.net presents the Top 10 prop firms offering the highest leverage in 2025, highlighting each firm’s key rules, advantages, and the most important risk factors every trader should be aware of before joining.

- Best Prop Firms for swing traders offering high profit splits and low fees

- Top 5 remote Prop Trading Firms for 2025 – The best platforms for funded traders

- Prop Firms that support crypto trading with high payouts and funding options

What does high leverage mean in prop trading?

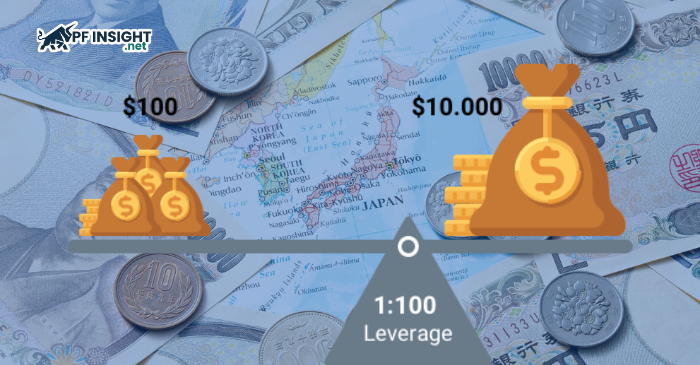

In prop trading, leverage allows traders to open positions much larger than the actual capital they have in their accounts. For example, with a leverage ratio of 1:100, a trader only needs $1,000 to control a trade worth $100,000. While this can amplify profits, it also magnifies losses if the market moves in the opposite direction.

At prop firms, leverage is often higher than that offered by traditional brokers because traders use funded capital provided by the firm. Some firms offer leverage of 1:50, while more “aggressive” ones may allow up to 1:200 or even 1:500. However, these firms typically enforce strict risk management rules, such as daily or overall drawdown limits, maximum position size, and holding time restrictions.

Example: With 1:100 leverage, a 1% adverse market move can wipe out the trader’s equity for that position, which explains why high leverage always requires strict discipline and risk control.

While high leverage can enhance profit potential, it shouldn’t be the only factor when choosing a prop firm. The best firms are those that combine reasonable leverage with transparent risk management rules, allowing traders to sustain performance and longevity in an ever-volatile market.

Top 10 prop firms offering the highest leverage in 2025

Leverage has become one of the most important factors traders consider when choosing a prop firm. While high leverage offers the potential for greater returns, it also amplifies the risks, which makes transparency and proper risk management critical.

Below is a list of the Top 10 prop firms with the highest leverage in 2025, carefully selected based on their leverage offerings, trading conditions, and overall reliability.

Quick Comparison Table (2025 Update)

| Prop Firm | Max Leverage | Profit Split | Challenge Type | Key Highlights |

|---|---|---|---|---|

| Alpha Funding | 1:400 | 90% | 2-Step | Flexible rules, fast payouts, low fees |

| WeMasterTrade | 1:200 | 90% | No Challenge | Instant funding, minimal restrictions |

| FTMO | 1:100 | 80% | 2-Step | Reputable, strict risk control |

| MyFundedFX | 1:200 | 85% | 1-Step | Simple challenge, consistent payout record |

| The Funded Trader | 1:200 | 90% | 2-Step | Strong community, multiple account sizes |

| Smart Prop Capital | 1:100 | 85% | Instant Funding | Low fees, fast scaling options |

| FundedNext | 1:200 | 90% | 2-Step | Transparent rules, high leverage options |

| True Forex Funds | 1:100 | 80% | 2-Step | EU regulation, reliable tracking tools |

| E8 Funding | 1:200 | 85% | 1-Step | Excellent analytics dashboard |

| Funded Engineer | 1:100 | 90% | Instant Account | Fair rules, instant payout system |

Detailed overview of each prop firm

Alpha Funding

- Maximum Leverage: 1:400

- Profit Split: Up to 90%

- Challenge Type: 2-Step Evaluation

- Highlights: Alpha Funding offers one of the highest leverage levels in the industry, ideal for aggressive traders. Their evaluation rules are flexible, allowing both short-term and swing strategies. The firm also has a reliable payout structure and low entry fees.

- Best for: Experienced traders looking to maximize short-term gains with disciplined risk control.

WeMasterTrade

- Maximum Leverage: 1:200

- Profit Split: 90%

- Challenge Type: No Challenge (Instant Funding)

- Highlights: WeMasterTrade is a fast-growing prop firm known for its low participation fees and flexible rules. Traders can access funding quickly through its zero-phase model, bypassing long evaluation processes.

- Best for: New traders or those who prefer immediate access to funded accounts.

FTMO

- Maximum Leverage: 1:100

- Profit Split: 80%

- Challenge Type: 2-Step Challenge

- Highlights: FTMO remains one of the most reputable prop firms globally. While its leverage is moderate, it prioritizes capital safety with clear risk rules and a solid payout history.

- Best for: Consistent traders who value structure and transparency.

MyFundedFX

- Maximum Leverage: 1:200

- Profit Split: 85%

- Challenge Type: 1-Step Challenge

- Highlights: Offers competitive leverage with a simplified evaluation process. Provides instant payout options after challenge completion.

- Best for: Traders seeking fast funding with minimal bureaucracy.

The Funded Trader

- Maximum Leverage: 1:200

- Profit Split: 90%

- Challenge Type: 2-Step

- Highlights: Combines high leverage with a strong community and flexible trading rules. Multiple account types for different strategies.

- Best for: Active traders who value social engagement and scaling potential.

Smart Prop Capital

- Maximum Leverage: 1:100

- Profit Split: 85%

- Challenge Type: Instant Funding

- Highlights: Known for low fees, instant payouts, and scalability options. Their dashboard offers real-time performance tracking for funded traders.

- Best for: Traders looking for simplicity and quick funding.

FundedNext

- Maximum Leverage: 1:200

- Profit Split: 90%

- Challenge Type: 2-Step

- Highlights: Transparent terms, flexible trading rules, and one of the best profit-sharing ratios.

- Best for: Traders who prioritize freedom in execution with high leverage options.

True Forex Funds

- Maximum Leverage: 1:100

- Profit Split: 80%

- Challenge Type: 2-Step

- Highlights: EU-regulated firm offering safety and trustworthiness with competitive conditions.

- Best for: Traders who prefer regulated prop firms with transparent policies.

E8 Funding

- Maximum Leverage: 1:200

- Profit Split: 85%

- Challenge Type: 1-Step

- Highlights: High leverage and a fast scaling model, supported by a powerful performance dashboard.

- Best for: Traders seeking advanced analytics and consistent payouts.

Funded Engineer

- Maximum Leverage: 1:100

- Profit Split: 90%

- Challenge Type: Instant Account

- Highlights: Offers fair rules, fast withdrawals, and solid customer support. Great balance between flexibility and accountability.

- Best for: Traders who value structure with easy payout access.

Risks of trading with high leverage

High leverage is one of the most frequent causes of prop trading failure, even though it can be an alluring characteristic for traders looking to maximize gains. When not managed properly, leverage can turn small market fluctuations into major losses often enough to breach a prop firm’s risk limits and lead to account termination.

Amplified volatility and rapid losses

High leverage magnifies both profits and losses. Even minor market movements can trigger significant equity swings. A trader using 1:200 leverage can lose 10% of their account from just a 0.05% unfavorable move. This volatility can lead to emotional reactions, impulsive trades, or violating firm drawdown limits.

Overconfidence and emotional bias

High leverage often gives traders a false sense of power – the illusion that larger trades mean higher skill or control. This can result in overtrading, revenge trading, or holding losing positions too long in hopes of a reversal.

Hidden firm restrictions

Many traders overlook the fine print in prop firm agreements. Some firms with very high leverage may also have restrictive rules: no holding over weekends, strict news trading bans, or tight daily loss limits, all of which can negate the benefits of high leverage.

Psychological pressure

When trading with leverage, even small drawdowns can feel amplified, leading to stress and poor decision-making. Prop firm traders often feel additional pressure knowing that repeated rule violations could cost them their funded account.

Conclusion

High leverage is a powerful tool in trading, especially in prop firms, where traders can amplify their profits without committing too much personal capital. However, it’s also a double-edged sword: a single mistake in risk management can wipe out a funded account in just a few trades.

When choosing a prop firm with high leverage, traders shouldn’t focus solely on the numbers like 1:100 or 1:500 but should instead evaluate the firm’s trading rules, drawdown limits, and risk policies as a whole. A transparent company with fair regulations and a reliable payout system is far more sustainable than one that attracts traders solely through high leverage.

Don’t forget to visit our website to stay updated with more useful information. Wishing traders success!