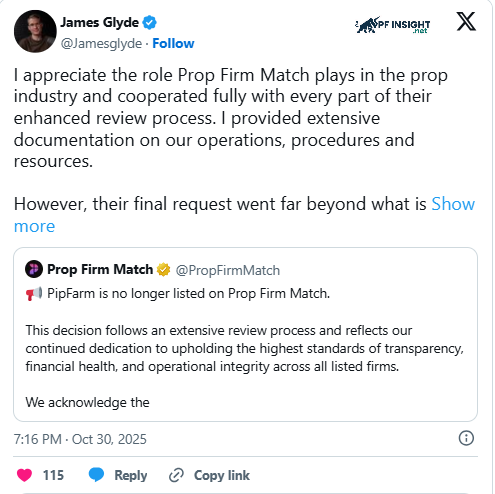

PipFarm’s recent withdrawal from Prop Firm Match has raised questions about potential conflicts between some proprietary trading companies and the rating platform. According to Prop Firm Match, PipFarm’s removal was the result of a “rigorous review process.” Meanwhile, PipFarm CEO James Glyde said the rating platform had made “unreasonable” demands that were unacceptable.

Addressing compliance shortfalls in Prop Firms

Prop Firm Match, an independent (unofficially regulated) aggregator, is known for its ratings of funding firms. Their ratings are based on detailed analysis and genuine feedback from the community, which helps to increase the credibility of prop firms in the market.

Prop Firm Match records over 1.2 million monthly visits globally, with India topping the user base, accounting for around 10% of the total, according to SimilarWeb.

The platform was created to address the lack of transparency in the prop trading industry. Unlike review sites that often leave out important details, Prop Firm Match focuses on this area in depth, thereby enhancing the reputation and reliability of prop companies.

It’s not uncommon for prop firms to be removed from Prop Firm Match. The platform has previously delisted companies like True Forex Funds, The Funded Trader, Bespoke Funding Program, Funded Engineer, and others. Most of these companies have had serious operational issues or have ceased operations altogether.

However, PipFarm seems to be different from those other companies, despite the negative reviews on social media.

Is the bar being set too high?

James Glyde said PipFarm had provided Prop Firm Match with detailed data on its operations, processes, and resources. However, the ratings site still required additional formal commitments and legal guarantees from PipFarm.

The final requirements from Prop Firm Match are beyond stringent, even higher than the standards set by regulators for shareholders when licensing banks or brokers, PipFarm’s CEO said.

“People advised me to refuse, and based on my principles, I decided not to comply with that request,” he shared.

FinanceMagnates.com contacted Martin Jensen, CEO of Prop Firm Match, about PipFarm. He declined to share details, only stating that all listed companies are required to adhere to strict standards. Prop Firm Match closely monitors its partners to ensure they meet the requirements and maintain transparency and integrity in their business practices.

Rather than act like other agencies, Mr. Jensen stated: “It is better to be criticized for being too meticulous than to miss a risk. We have to be absolutely certain about the companies we refer to. Therefore, all necessary data must be provided, and each request must be properly justified to ensure the standards and credibility of the entire process.”

Glyde told FinanceMagnates.com that in the 30 days before the delisting, his platform generated around $12,000 in revenue, most of which came from existing clients using coupons to make arbitrage trades. Additionally, the survey found that 60% of proprietary traders had to work with multiple companies, while 40% also faced psychological pressure and challenges in maintaining trading efficiency.

“MetaQuotes plays an important role in improving the efficiency of proprietary trading,” according to the survey, 70% of traders want professional supervision.

“The risk in proprietary trading is a big challenge and very difficult to control,” said PipFarm CEO.

Another prop company said Prop Firm Match had helped them attract significant traffic during major promotions, but the company representative admitted that nearly 50% of this traffic was not quality.

The brokerage firm said the platform would rate each offer to be more prominently displayed in its payment system. However, the brokerage rejected the request due to security concerns and did not want to disclose sensitive financial data.

Jensen, on the other hand, insists his platform does not require such data access. He says it only offers an API connection option that allows companies to publicly disclose information about time and value spent without sharing user data.

There are currently around 10 listed companies using this feature, with several others completing the onboarding process. This is a step towards increased transparency, part of a number of projects we are implementing to benefit both traders and reputable businesses. Participating companies are confident in publishing data because payout results are verified by an independent third party.

About PipFarm

PipFarm, founded by James Glyde, offers flexible funding packages from $2,500 to $300,000, with a maximum expansion roadmap of $1.5 million. The platform allows traders to earn attractive profit sharing rates of up to 95%, start the challenge from just $40, and withdraw profits bi-weekly.

PipFarm supports news trading, applies a 3% daily maximum loss and a 9% total loss limit. Traders can take advantage of the XP system to improve profit sharing ratios and reduce commission fees as the trade progresses.

The cTrader platform supports trading of cryptocurrencies and many other financial instruments. Users can pay via Visa, Skrill or Binance Pay, with processing and payout cycles occurring every 14 days.

For more information about Prop Firm, visit our website regularly!