Execution speed and spread costs are two of the most critical factors in Forex trading; they can directly determine a trader’s profitability. That’s why more and more professional traders are turning to ECN brokers, platforms that connect directly to the interbank market, offering low spreads, ultra-fast execution, and maximum transparency.

Unlike market maker brokers, an ECN (Electronic Communication Network) acts as a bridge between traders and top-tier liquidity providers worldwide. This means you receive real market pricing, free from quote manipulation, and experience minimal slippage, even during high-volatility periods.

In this article, PF Insight will explain how ECN brokers work, what key factors to consider when choosing one, and introduce the Top 5 best ECN brokers of 2025, ideal for traders seeking low spreads and fast execution.

- Top prop firms 2025: best funded accounts & rules you need to know

- Top 5 remote Prop Trading Firms for 2025 – The best platforms for funded traders

- Discover the best Prop Firms for Forex traders (2025 edition)

What is an ECN broker, and how does it work?

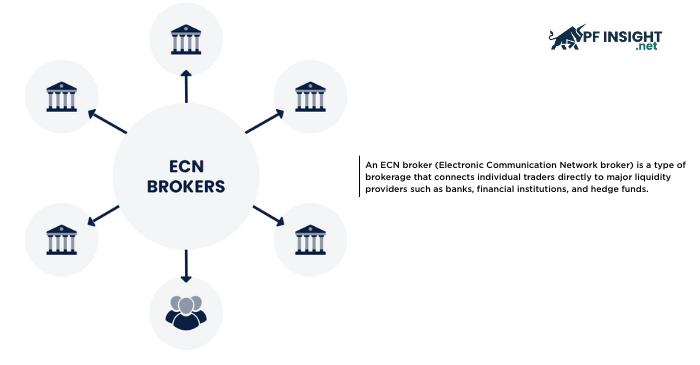

An ECN broker (Electronic Communication Network broker) is a type of brokerage that connects individual traders directly to major liquidity providers such as banks, financial institutions, and hedge funds.

Instead of acting as a market maker or manipulating prices, an ECN broker serves purely as a bridge, routing buy and sell orders transparently and ensuring that trades are executed at the best available market prices with high-speed execution.

Here’s how the ECN mechanism works: The ECN system automatically looks for a matched counterparty throughout its worldwide liquidity network when you place a buy or sell transaction. For instance, if you want to buy EUR/USD at 1.08500, the ECN will instantly match your order with a seller offering that price (or better) without the broker interfering or re-quoting.

Key advantages of ECN brokers:

- Transparent pricing: All execution prices reflect real market supply and demand.

- Ultra-fast execution: Servers are typically located near major liquidity hubs like London, New York, or Tokyo, minimizing latency.

- Low spreads: Since there’s no dealing desk or markup spread, traders get raw market spreads directly.

ECN brokers never trade against their clients, which removes conflicts of interest and creates a fair, impartial trading environment that is perfect for both professionals and scalpers. This is in contrast to STP (Straight Through Processing) or market maker models.

ECN brokers typically charge a fixed commission per trade instead of earning from widened spreads. This model allows traders to calculate costs more accurately and fine-tune their strategies, an essential advantage for high-frequency traders, such as scalpers and day traders.

Another key benefit of ECN trading is anonymous execution. Liquidity providers do not know who is placing the order, ensuring a completely neutral and transparent trading environment. Prices are determined purely by real market supply and demand, unaffected by the trader’s account size, order volume, or trading style.

Key criteria for ranking the best ECN brokers

Each ECN broker is unique in terms of costs, trading conditions, and execution speed. To identify the best ECN brokers of 2025, PF Insight evaluated and ranked them based on five core criteria that every trader should consider before opening an account:

Low and consistent spreads

Spread is the most fundamental trading cost.

A good ECN broker should offer near-zero spreads under normal market conditions and avoid excessive widening during high volatility or news events.

- Low spreads help scalpers and day traders maximize profits.

- Consistent spreads improve the accuracy of automated strategies (EAs).

Execution speed

Speed is the lifeblood of ECN trading.

A top-tier ECN broker should execute orders in under 50 milliseconds to minimize slippage and ensure true market fills.

- Fast execution ensures your orders match real interbank prices.

- Crucial for scalping and news trading strategies.

Regulation and trustworthiness

A reputable ECN broker must be regulated by top-tier financial authorities such as

- ASIC (Australia)

- FCA (United Kingdom)

- CySEC (Cyprus)

- FSA or DFSA (Middle East regions)

Regulation ensures transparency, fund safety, and protection against price manipulation or fraud.

Trading platforms and tools

A reliable ECN broker should support leading trading platforms like MT4, MT5, and cTrader, along with advanced features such as:

- VPS servers for ultra-fast trading

- API access or copy trading integration

- Custom indicators and advanced analytics tools

Customer service and technical support

In addition to offering favorable trading conditions, a reliable broker must also provide prompt, round-the-clock client service.

- Multi-language support

- Multiple contact channels: live chat, email, or hotline

- Fast and professional issue resolution

Top 5 best ECN brokers 2025 (detailed reviews)

Based on trading costs, execution speed, regulatory licenses, platform quality, and customer service, the Top 5 Best ECN Brokers 2025 have been determined after examining over 20 reliable ECN brokers globally. Here’s the detailed list:

IC Markets – Best overall ECN broker for low spreads

IC Markets remains the global benchmark for ECN trading thanks to its ultra-low spreads, execution speed under 30ms, and high transparency. It’s the top choice for scalpers, day traders, and anyone seeking a professional trading environment.

Key highlights:

- Average spread from 0.0 pip.

- Regulated by ASIC (Australia) and CySEC (Europe).

- Supports MT4, MT5, and cTrader.

- Offers Raw Spread Accounts with low commissions.

Pepperstone – Excellent for fast execution and scalping

Pepperstone stands out for its lightning-fast order execution and advanced technological infrastructure, making it perfect for scalping, news trading, and high-frequency strategies.

Key highlights:

- Average execution speed is less than 30ms.

- Spreads from 0.1 pip with low commissions.

- Platforms: MT4, MT5, TradingView, and cTrader.

- Regulated by FCA, ASIC, and BaFin.

FP Markets – Great balance between cost and reliability

FP Markets is a reputable ECN broker with competitive pricing and dependability. Both novice and seasoned traders will find it to be a solid choice.

Key highlights:

- Low spreads from 0.1 pip with competitive commissions.

- Regulated by ASIC (Australia) and FSCA (South Africa).

- Supports MetaTrader 4, MetaTrader 5, and the Iress Platform.

- Fast multilingual customer support, including Vietnamese.

Exness – Flexible leverage with tight spreads

Exness is popular among Asian traders for its flexible leverage, stable spreads, and instant deposit/withdrawal system.

Key highlights:

- Leverage up to 1:2000.

- Average spread 0.1–0.3 pip.

- Instant deposits & withdrawals 24/7.

- Regulated by FCA, CySEC, and FSCA.

Eightcap – Strong performance and competitive trading costs

Eightcap has grown rapidly as a true ECN broker offering excellent execution speed and low-cost trading, making it a favorite among EA users and algorithmic traders.

Key highlights:

- Spreads from 0.0 pip, low commission per lot.

- Regulated by ASIC (Australia) and SCB (Bahamas).

- Supports MT4, MT5, and API connectivity.

- Frequent trading promotions and bonuses.

ECN vs STP brokers – Which one is better in 2025?

When learning about different types of forex brokers, many traders often wonder about two popular options: ECN brokers and STP brokers. Both provide direct access to the market without a dealing desk (no dealing desk), but there are significant differences in how orders are processed, costs, and transparency.

Execution mechanism

ECN (Electronic Communication Network):

Connects traders directly with major liquidity providers such as banks or investment funds.

Each buy or sell order is automatically matched with the best available counter order in the real market.

STP (Straight Through Processing):

Trader orders are sent directly to the broker’s liquidity partners, but the broker may add a small “markup” to the spread to generate profit.

Although there is no price manipulation, the final price you receive may be slightly higher than that of ECN.

Trading costs

ECN brokers: usually have ultra-low spreads (close to 0 pip) but charge a separate commission for each trade.

STP brokers: usually have no commission but slightly higher spreads.

Example: An EUR/USD order on an ECN broker may have a spread of 0.0 pip + $7 commission per lot, while on an STP broker it may be 1.0 pip with no fee.

Speed and transparency

ECN: faster, prices reflect the real market directly, anonymous execution, and no conflict of interest between the trader and the broker.

STP: still fast, but may be slower by a few milliseconds; the level of transparency depends on the broker’s list of liquidity providers.

Suitable for whom?

| Broker type | Suitable for | Reason |

| ECN brokers | Scalpers, day traders, professional traders | Low spreads, high speed, full transparency |

| STP brokers | New traders, swing traders | Easy to use, no commission concerns, clear cost structure |

Conclusion

Choosing a reliable ECN broker is one of the most important steps for traders who value transparency, speed, and low trading costs.

In 2025, factors like tight spreads, fast execution, and strong regulation remain the key pillars that define a top-performing ECN environment.

Among all the options available, IC Markets and Pepperstone continue to stand out as the best ECN brokers 2025, offering ultra-low spreads, stable execution, and strong regulatory oversight. Meanwhile, FP Markets, Exness, and Eightcap also deliver excellent trading conditions and are worth considering depending on your strategy and experience level.

Follow Best Firms to stay updated with the latest information.