What is instant funding in prop trading? Prop firms have become a popular choice among financial investors and traders today. However, to join this market, traders often have to pass the challenges set by prop firms. Fortunately, some companies now offer instant funding accounts, allowing traders to skip evaluations and access trading capital immediately. But exactly, what is instant funding? What are its characteristics and benefits? Today’s article by PF Insight will provide you with the most comprehensive overview. Let’s dive in!

What is instant funding?

Instant funding is a fast funding model where money is immediately transferred to your trading account after you register or request additional capital. Instant funding accounts are available on several online brokerage platforms that allow you to trade stocks, forex, crypto, and other assets. This enables traders to take advantage of new trading opportunities right away.

For example, instant funding lets you open positions instantly and react quickly to market opportunities, even if your account balance is low. This serves as an alternative to waiting for approvals or completing evaluation challenges.

However, traders should carefully consider the costs, withdrawal restrictions, and risk management guidelines before using instant funding options, as many firms impose relatively high fees or strict requirements.

Pros and cons of instant funding

Instant funding is becoming increasingly popular because it offers traders attractive conditions. However, like any funding model, it also has limitations. Below are the main pros and cons of instant funding:

Pros:

- Immediate access to capital: No need to wait or pass any challenges. You can start trading right after purchasing the account.

- Fast market response: Allows you to react instantly to market movements — a crucial advantage for intraday or high-frequency traders.

- More flexibility: You can trade whenever opportunities arise without being limited by your current balance.

- Access anytime: Since funds are added instantly, you can trade even at night or on weekends when opportunities appear.

Cons:

- Higher upfront costs: Compared to regular funding, instant funding often involves higher activation or trading fees, reducing your overall profits.

- Reduced profit share: After deducting fees, traders receive a smaller portion of their profits.

- Strict limits: Many providers restrict how much you can withdraw within a certain timeframe or how much you can deposit via instant funding.

- Debt risk: Continuously using borrowed capital without profit can lead to accumulated debt over time.

Instant funding or a 2-step challenge?

Choosing between instant funding or a 2-step challenge depends on your trading experience and goals:

- For traders with proven strategies who are confident in their skills and want immediate access to capital – even with higher fees – instant funding is a great option.

- On the other hand, many traders still prefer 1-step or 2-step evaluations. These models may feel less restrictive and are often more affordable, making them ideal for new traders.

- Ultimately, the decision between instant funding or a 2-step challenge depends on your priorities. If speed and capital access matter most, instant funding is the better choice. But if you prefer stable drawdown limits and lower costs, the evaluation route might suit you better.

How to choose an instant funding provider

To find the best instant funding provider, traders should evaluate the following factors:

- Profit distribution method: Understand whether payouts are fair for all traders or if higher-performing traders receive better terms.

- Realistic profit targets: Choose a firm that sets achievable goals without pushing traders into excessive risk.

- Risk management: Ensure the company provides strong guidelines and tools to help you trade safely in volatile markets.

- Technology quality: The trading platform, data access, and execution speed should enable seamless and quick trades.

- Research resources: Access to training materials and market insights can help improve your strategy and decision-making.

- Support availability: Reliable customer and mentor support help you grow and solve issues efficiently.

- Reputation: Always choose providers with transparency, ethics, and positive trader feedback.

What is instant funding? Top 3 best instant funding providers for traders

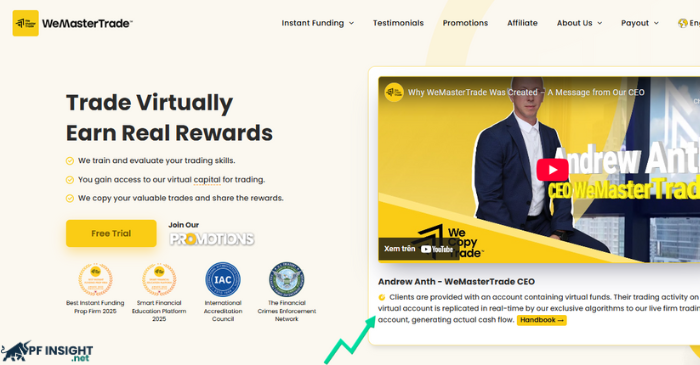

WeCopyTrade (WCT)

WeCopyTrade is an outstanding copy trading platform that offers traders instant funding options. This program is ideal for experienced traders seeking to boost profits quickly or those who prefer to skip evaluations and start trading live accounts immediately.

Key features include:

- No challenges

- No evaluation

- Quick funding

- No time limits

- No volume restrictions

- Unlimited news trading

- Daily withdrawals

- Access to stocks, forex, gold, crypto, and more

- 60% profit share

The 5%ers

The 5%ers is one of the most reputable instant funding options for forex traders.

Highlights:

- No demo or evaluation period – traders start trading live accounts instantly.

- A 50/50 profit split, distributed monthly.

- Two account types offering different risk/reward balances.

- Leverage up to 1:30, maximizing trading potential.

FTUK

FTUK is another excellent instant funding provider, offering appealing benefits such as:

- Up to 80% profit share once traders reach milestones.

- The ability to scale accounts by 400% with each achievement.

- Up to $17 million in potential funding across multiple accounts.

- Traders can hold trades as long as they like and withdraw profits after the second level.

- Leverage up to 1:100, enhancing market exposure.

- An 8% stop-out threshold that limits traders’ downside risk.

Conclusion

In 2025, the trend of instant funding in prop trading is opening up new opportunities for traders seeking fast access to capital without complex evaluations. Many traders still ask what is instant funding and whether it truly offers an advantage. Understanding what is instant funding helps traders see how it can accelerate their journey to trading live accounts. Don’t forget to visit our website for more expert insights and updates on prop trading!