Wall Street Funded (WSF) recently announced significant improvements to its platform, marking an important step in its journey of innovation and modernization. According to the company, the upgrades began rolling out over the weekend, focusing on improving technical infrastructure, enhancing system performance, and refreshing the brand image. These changes are aimed at providing a smoother, safer, and more optimized trading environment for global investors.

Wall Street Funded changes MT5 server name: WSF Markets-Server

Wall Street Funded’s MetaTrader 5 (MT5) server will officially be renamed to WSF Markets-Server. Once the transition is complete, traders will need to log in again via the new server to continue trading. Importantly, the URL to access the WSFunded dashboard will remain the same, ensuring stability, avoiding disruptions, and maintaining a familiar experience for existing users.

To enhance flexibility and convenience for users, the company has announced a series of new features that are coming soon. Specifically, through Wall Street Funded’s in-house broker – WSF Markets – traders will soon have access to tools such as direct deposits, professional copy trading services, along with advanced fund management options such as PAM/MAM accounts.

This addition promises to simplify operations and capital management, increase transparency, and enable traders to execute diversification and scaling strategies more efficiently.

In its latest announcement, Wall Street Funded asserted that the recent improvements are a testament to the company’s sustainable development strategy and constant innovation orientation. WSF’s goal is to build a comprehensive trading ecosystem that provides a professional, transparent and efficient environment for all levels of investors. Through this, the company hopes to help traders access modern tools, advanced technology and trading standards on par with leading financial institutions.

“These adjustments mark an important milestone in Wall Street Funded’s development journey, demonstrating our continued commitment to technological innovation and providing the trading community with a safer and more modern experience,” the announcement stressed.

Entering a new phase of development, Wall Street Funded recommends traders to regularly update information from official channels so as not to miss important upcoming announcements. This is also the beginning of a modern trading era, strongly supported by WSF Markets.

About Wall Street Funded

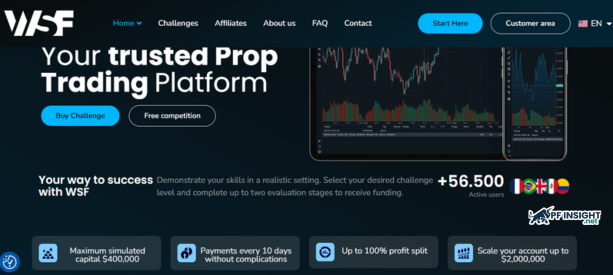

Wall Street Funded is a proprietary trading firm that offers flexible funding for traders looking to grow without using their own capital. The business offers a variety of options including single-stage, two-stage, and instant account funding, catering to the needs of both new and experienced traders.

Under the leadership of CEO Albert Suriol Navarro, Wall Street Funded has continued to expand its reach and assert its global position. The company’s headquarters are located in the United Arab Emirates (UAE).

Wall Street Funded’s challenge fee structure is flexible, starting at just $49, making it easy for traders to access funding programs. Traders can receive up to 80% profit sharing, depending on account type and trading performance. Funding account sizes range from $5,000 to $100,000, making it suitable for a wide range of experience levels. Wall Street Funded also maintains a bi-weekly (10-day) payout cycle, providing transparency and convenience. Supported asset classes include Forex, indices, commodities, and cryptocurrencies, allowing traders to diversify their portfolios.

Some basic information about WSF company:

- Highly rated by users on Trustpilot with an impressive score of 4.7/5

- Offers 7 funding programs to suit different trading styles

- Supports 5 modern trading platforms, optimized for both beginners and professionals

- User-friendly, intuitive control panel for efficient account management

- Diverse product portfolio: Forex, commodities, indices and cryptocurrencies

- Financial leverage up to 1:50, providing higher profit opportunities

- No trading time limit, allowing traders to freely implement long-term strategies

- Suitable for both EA trading and manual trading based on personal analysis

- Flexible scaling program, allowing traders to receive capital up to 1 million USD.

For more information about Prop Firm, visit our website regularly!