Finding profitable opportunities and managing risks are key elements of proprietary trading. Position sizing calculator, one of the best supporting tools, allows traders to determine the optimal position size to improve performance. This article by PF Insight will analyze in detail how Position sizing Calculator for Prop Firm works and the benefits. Let’s find out.

What is a Position sizing Calculator?

Position Sizing Calculator is a tool that allows traders to calculate position size (lots) based on their risk level, available capital, and stop loss distance. Simply put, instead of placing orders based on emotions, traders use this tool to ensure that each trade only risks a small portion of their account.

Why use Position sizing Calculator for Prop Firm?

Traders should use the Position sizing Calculator for Prop Firm for the following reasons:

- Effective risk management: This tool allows to accurately determine the order volume based on the set risk level, thereby minimizing losses and preventing too much capital from being put into a single transaction. Ensuring sustainability in the trading process and protecting account safety, this is considered a smart capital management technique.

- Optimizing profits: You can minimize the risk of underperformance and increase overall profits by properly allocating capital to each trade. This strategy lays the foundation for long-term profits while helping your portfolio maintain stability and balance.

- Maintain stability: By minimizing impulsive, emotional trading, the Position Sizing Calculator for Prop Firm helps traders maintain a methodical and disciplined trading style, which enhances the stability and efficiency of the investment process.

- Capital protection: Each trade should have a maximum risk level set to help protect the account from significant losses. The entire capital will not be affected by a single losing trade, allowing the trader to continue pursuing their financial goals and participate in long-term market activity.

- Strategy based: Position sizing Calculator for Prop Firm automatically determines and adjusts position size based on the level of risk you are willing to take, regardless of whether your trading style is conservative or aggressive. This ensures that your position size is always aligned with your personal style, helping you maintain efficiency and discipline in investing.

- Save time: Calculating position size manually is often laborious and prone to errors. Position sizing Calculator makes this process quicker and easier while still ensuring accuracy.

- Increased confidence: When you understand the level of risk and potential profit before placing an order, you can make more confident and informed decisions. This not only helps traders stay calm but also strengthens their psychology, preventing emotional trading.

How Position sizing Calculator works

The Position Sizing Calculator for Prop Firm is not a magic tool, it just works based on sound mathematical formulas. It uses the data you enter to calculate the appropriate position size, allowing you to manage your risk and trade with discipline.

Main parameters (Input)

Position sizing Calculator for Prop Firm works based on the following factors:

- Account Currency: Account currency includes USD, EUR, VND,..

- Account Balance: Total capital as of the current date or initial capital in the Prop Firm challenge.

- Risk Percentage: The maximum percentage usually 1% or 2% of your entire account that you are willing to risk on a single trade.

- Stop Loss Distance: The difference (in points or pip value) between the entry price and the stop loss price.

- Instrument: Metal, stock, futures contract or currency pair. The value of a pip or point of an instrument can vary depending on the trading instrument you choose.

Formula for calculating transaction volume (Lot Size)

Step 1: Calculate the maximum risk amount

First, the Position sizing Calculator for Prop Firm will calculate the exact amount (in account currency) you are willing to risk per trade.

Risk Amount = Account Balance x Risk Percentage/100

For example: With a $50,000 account and a 2% risk level, the maximum risk amount for one order would be: $50,000 × 0.02 = $1,000.

Step 2: Calculate the pip/point value in the transaction

At this step, each pip or point changes depending on the trading instrument and the account base currency. To determine the exact position sizing calculator for Prop Firm will usually calculate it automatically or prompt you to enter the necessary information.

Value Per Pip/Point = Risk Amount / Stop Loss Distance (in pips/points)

For example, if you put $1,000 at risk and set a stop loss at 50 pips, your maximum loss per pip is $20 ($1,000/50 pips).

Step 3: Determine the order size

Based on the maximum value per pip/point determined in step 2, the tool will calculate the final figure using the current exchange rate and standard contract size rules (1 standard lot equals 100,000 units in Forex).

Lot Size= (Value Per Pip/Point x Exchange Rate) / (Contract Size×Pip/Point Value Factor)

For example: You know that you must enter a trade with exactly 2.00 to ensure that if the trade fails, you will lose exactly $1,000 (or 2% of your account).

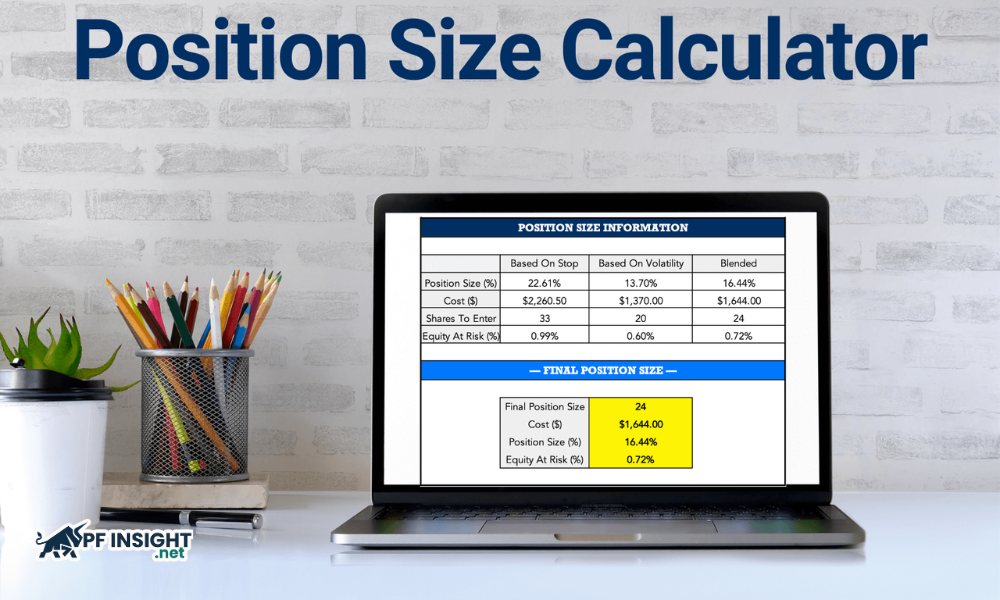

Top Position sizing Calculator for Prop traders

The choice of Position Sizing Calculator for Prop Firm is usually determined by the type of asset you trade (Forex, Futures, Stocks, Cryptocurrencies), the trading platform (MT4/MT5) and the level of complexity of risk management you require. Below are 5 tools that are frequently used by Prop Firm traders.

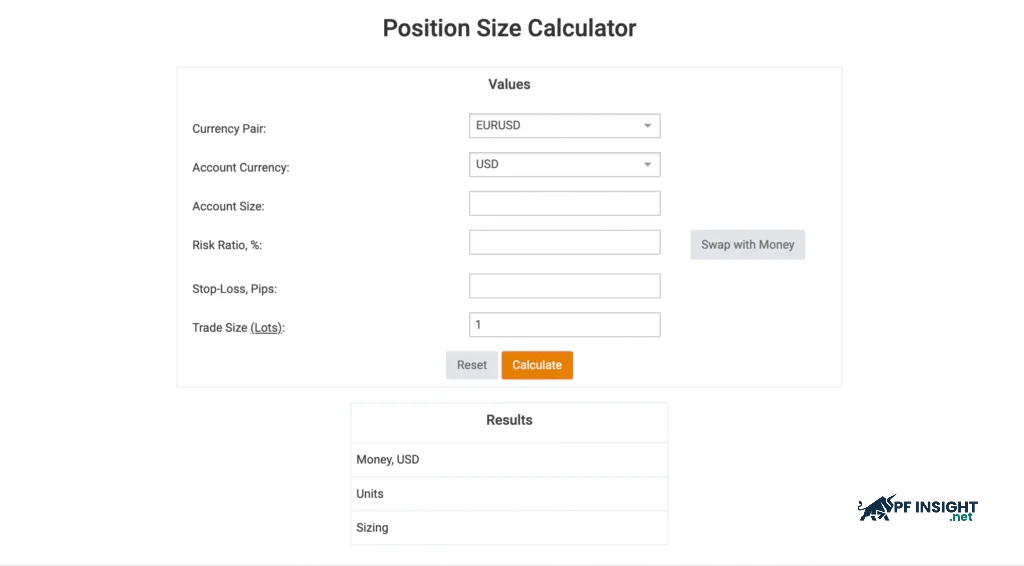

Babypips Calculator

BabyPips is known as one of the most useful Position sizing Calculators for Prop Firm tools for traders. Featuring a simple, easy-to-understand and beginner-friendly educational style, BabyPips’ position sizing tool follows the same philosophy: intuitive, easy-to-use and suitable for those who are just starting to learn trading.

BabyPips Key Features:

- Provide tool explanation, instructions for use.

- Simple, intuitive user interface.

- Prioritize important information about currency pairs, stop loss orders, risk ratios and account size.

- Suitable for performing quick calculations.

CashbackForex

CashbackForex offers a comprehensive and flexible volume calculator. Users can enter details such as leverage and pip value for each product. This makes it suitable for both novice and experienced traders.

CashbackForex Key Features:

- Supports a wide range of trading instruments with the ability to determine precise trading volumes.

- Allows to personalize details: pip value, rate and leverage.

- Intuitive interface that is easy to use for both new and experienced traders.

- Support multiple account currencies.

- Ideal for quick and thorough analysis before placing an order.

TradingView Add-ons

As a Position sizing Calculator for Prop Firm, TradingView add-ons have become a popular choice, providing outstanding convenience to users:

- Built-in chart integration: Allows you to view entry points, stop losses and take profits without switching apps.

- Helps traders determine lot size instantly: On TradingView, you can input your account balance and risk ratio using a number of indicators or drawing tools. The tool will automatically determine the number of shares, contracts, or lot size you should trade after placing a stop loss order. This completely eliminates manual calculations and ensures that your cash risk is always within the allowed limits.

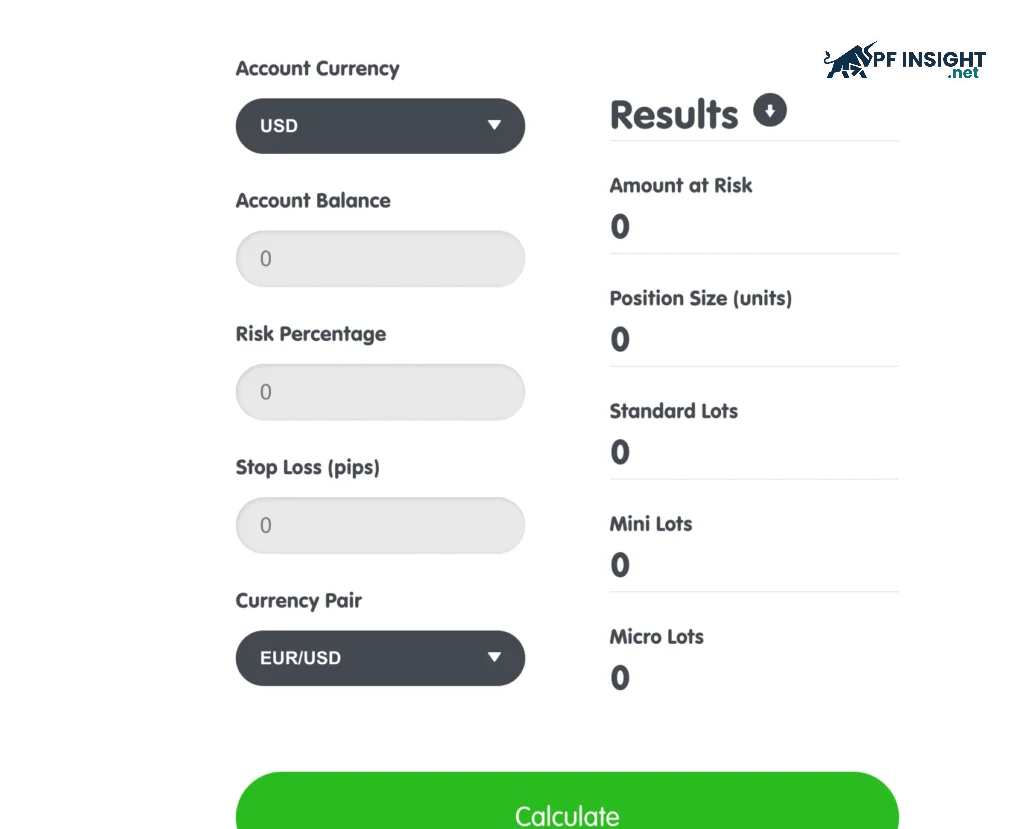

Myfxbook

Myfxbook is the Position Sizing Calculator for Prop Firm, which helps traders determine the appropriate trading volume. This tool helps traders optimize their strategies and make more accurate decisions for each trade by combining factors such as account currency, desired risk ratio, stop loss level and trading trend.

Myfxbook Key Features:

- User-friendly interface, easy to use, suitable for all levels of traders.

- Allows entering trading trends, stop loss level, risk ratio and account currency.

- The exact position volume is automatically calculated in just a few seconds.

- Offers a wide range of trading instruments and currency pairs.

- Support effective capital and risk management, prevent over-trading

- Compatible with mobile devices

EA/Indicator on MT4 – MT5

The automatic Position sizing Calculator for Prop Firm (EA/Indicator) is an indispensable solution for traders using MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

- Many indicators automatically calculate the volume when placing orders: Expert Advisors (EAs) or specialized indicators will be integrated directly into the trading platform. When you drag Stop Loss lines on the chart, the tool will immediately display the optimal Lot Volume to limit the risk based on the percentage you specified.

- Simplify calculations: Position sizing calculator for Prop Firm not only calculates position size, but some tools also allow you to place orders using the calculated position size with just one click or keyboard shortcut. This allows traders to react quickly to market changes, minimize errors due to emotions or hasty calculations, and improve trading discipline and performance.

Notes when using Position sizing Calculator in Prop Firm

Even with an ideal trading strategy, losses can still occur if you do not manage your capital effectively. With the help of Position Sizing Calculator for Prop Firm, you can preserve your account and maintain capital management discipline.

Maintain capital and limit the risk of “burning your account”

The key to effective risk management is to keep your maximum loss per trade between 1% and 2% of your total capital. For Prop Firm traders, the Position Sizing Calculator is crucial: It instantly converts the percentage limit into the exact position size (lots, contracts, or shares). This way, even if the market goes against you, you can be sure that you will never lose more than your allowed risk.

The Position sizing Calculator for Prop Firm will automatically calculate the ideal position size after you place a Stop Loss order based on key technical levels. This size is set to ensure that your loss will never exceed 1% of your total capital. Thanks to this protection, you can maintain your market risk exposure even if your account experiences a long losing streak (e.g. 10 trades) and still retain 90% of your capital.

Compliance with regulationsSponsored by Prop Firm

Hedge fund companies typically apply extremely strict risk management rules:

- Daily Drawdown: Usually limited to 5% of capital.

- Maximum Drawdown: Usually limited to 10% of total capital.

For each trade, traders can adhere to a pre-determined risk level of 1%−2% using the Position Sizing Calculator for Prop Firm. This is an important strategy to avoid hitting the 5% Daily Drawdown threshold after a short losing streak. This tool acts as a safeguard, ensuring adherence to the Prop Firm’s strict rules, helping you overcome challenges and maintain your funding account without “breaking the rules”.

Control your mind, trade without emotions

You will eliminate the impact of emotions after using Position sizing Calculator for Prop Firm. This tool helps you avoid irrationally reducing the trading volume due to fear or overtrading due to greed. Thanks to this, all trading actions are performed based on mathematical logic and in accordance with the established plan, strengthening trading discipline.

Conclude

Choosing the Position sizing Calculator for Prop Firm depends on your personal trading platform and habits. Whether you prefer the simplicity of an online tool or look for the automation features of MT4/MT5, these tools are key to professional risk management. Make position sizing a mandatory rule before every trade – this is a solid foundation for more disciplined and confident trading at Prop Firm.